Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Predetermined overhead rate 2.5 You have recently been appointed as the cost accountant for Crane Hair Co. Ltd., a manufacturer of hair shampoo. Your first

Predetermined overhead rate 2.5

Predetermined overhead rate 2.5

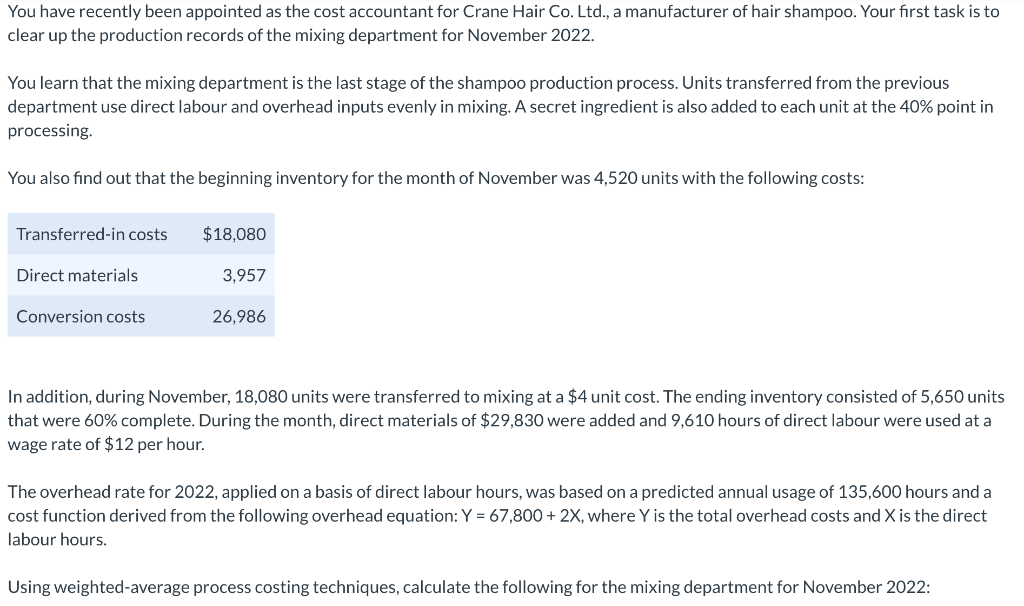

You have recently been appointed as the cost accountant for Crane Hair Co. Ltd., a manufacturer of hair shampoo. Your first task is to clear up the production records of the mixing department for November 2022. You learn that the mixing department is the last stage of the shampoo production process. Units transferred from the previous department use direct labour and overhead inputs evenly in mixing. A secret ingredient is also added to each unit at the 40% point in processing. You also find out that the beginning inventory for the month of November was 4,520 units with the following costs: In addition, during November, 18,080 units were transferred to mixing at a $4 unit cost. The ending inventory consisted of 5,650 units that were 60% complete. During the month, direct materials of $29,830 were added and 9,610 hours of direct labour were used at a wage rate of $12 per hour. The overhead rate for 2022, applied on a basis of direct labour hours, was based on a predicted annual usage of 135,600 hours and a cost function derived from the following overhead equation: Y=67,800+2X, where Y is the total overhead costs and X is the direct labour hours. Using weighted-average process costing techniques, calculate the following for the mixing department for November 2022 : The unit cost of items transferred to finished goods (Round answer to 4 decimal places, e.g. 52.7525.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started