Answered step by step

Verified Expert Solution

Question

1 Approved Answer

preferred shares are noncumulative, then 1. The preferred shareholders are entitled to current and arrears of dividends before common shareholders can receive divide 2. Cash

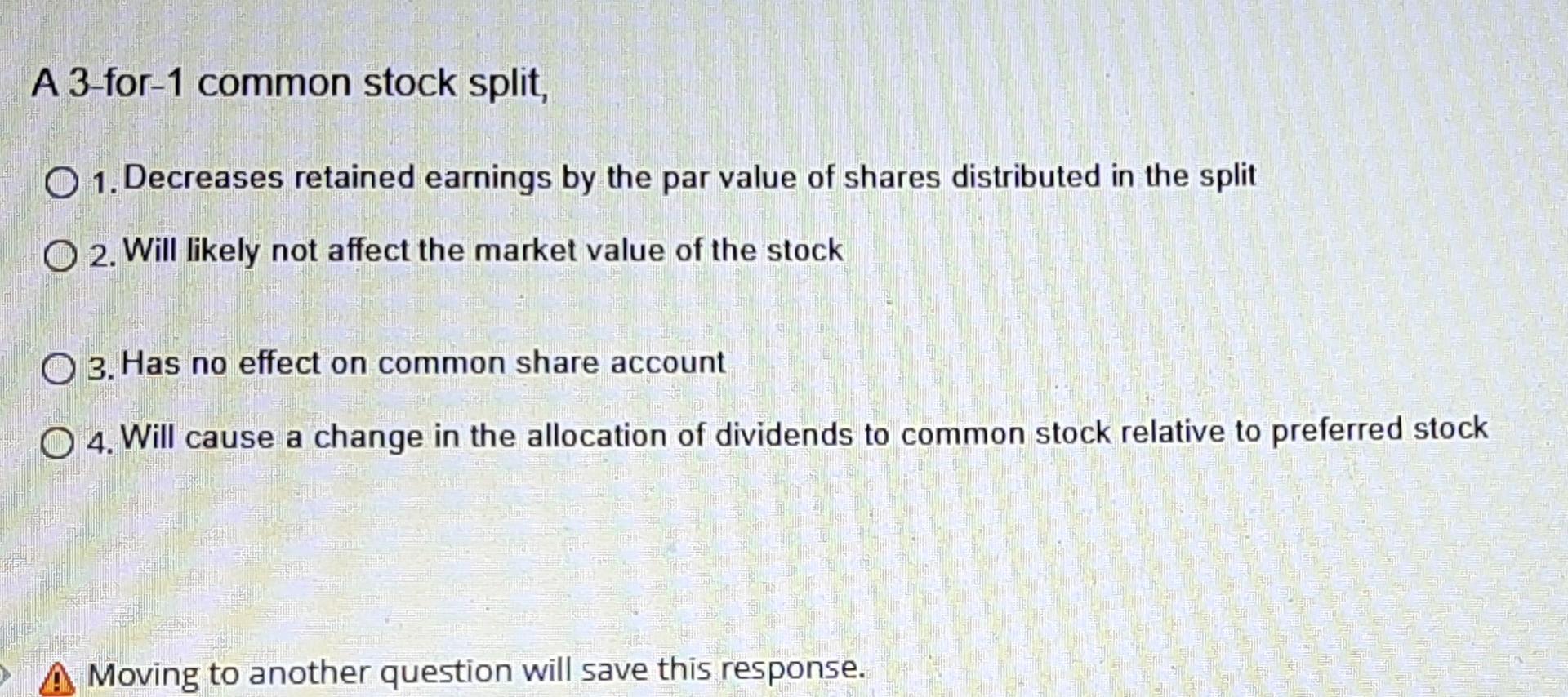

preferred shares are noncumulative, then 1. The preferred shareholders are entitled to current and arrears of dividends before common shareholders can receive divide 2. Cash dividends not declared in prior years are lost permanently. 3. The preferred shareholders are only entitled to a specific percent of the cash dividends, regardless of the amount declared 4. Prior years' cash dividends must be paid to the preferred shareholders before any dividends may be paid to the commons Moving to another question will save this response. Earnings per share is computed on the basis of O 1. A weighted average of the number of common shares outstanding during the year EBECH O 2. Aweighted average of the number of preferred and common shares outstanding during the year. 3. The number of common shares outstanding at the end of the year. O 4. The number of common and preferred shares outstanding at the end of the year. Em If preferred shares are callable, then O 1. The corporation may, at its option, purchase the preferred shares for a specified cash price. O 2. The preferred shareholder can turn the preferred shares in for a specified cash price. 3. The shareholders can exchange the preferred shares owned for common shares 04. There cannot be dividends in arrears. uestion 7 A Corporation that incurs a taxable loss is entitled to offset the loss as follows: a O 1. Carried back 7 years and forward 3 years O 2. Carried back 3 years and forward 20 years O 3. Carried back 3 years and forward 10 years O 4. Carried back 10 years and forward 3 years A 3-for-1 common stock split, O 1. Decreases retained earnings by the par value of shares distributed in the split O 2. Will likely not affect the market value of the stock O 3. Has no effect on common share account O 4. Will cause a change in the allocation of dividends to common stock relative to preferred stock Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started