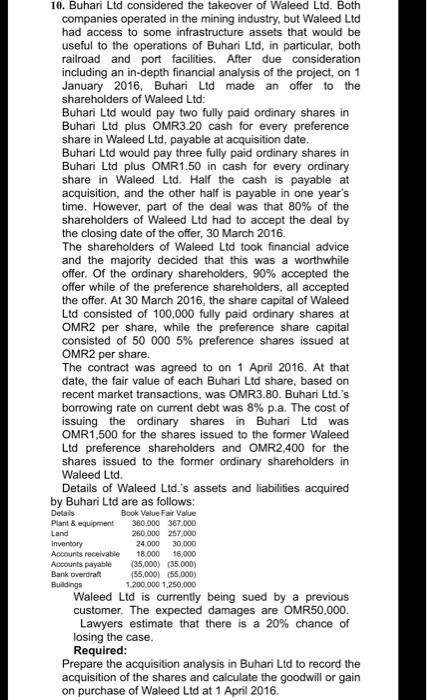

10. Buhari Ltd considered the takeover of Waleed Ltd. Both companies operated in the mining industry, but Waleed Ltd had access to some infrastructure assets that would be useful to the operations of Buhari Ltd, in particular, both railroad and port facilities. After due consideration including an in-depth financial analysis of the project, on 1 January 2016, Buhari Lid made an offer to the shareholders of Waleed Ltd: Buhari Ltd would pay two fully paid ordinary shares in Buhari Ltd plus OMR3.20 cash for every preference share in Waleed Ltd, payable at acquisition date. Buhari Ltd would pay three fully paid ordinary shares in Buhari Ltd plus OMR1.50 in cash for every ordinary share in Waleed Ltd. Half the cash is payable at acquisition, and the other half is payable in one year's time. However, part of the deal was that 80% of the shareholders of Waleed Ltd had to accept the deal by the closing date of the offer, 30 March 2016 The shareholders of Waleed Ltd took financial advice and the majority decided that this was a worthwhile offer. Of the ordinary shareholders, 90% accepted the offer while of the preference shareholders, all accepted the offer. At 30 March 2016, the share capital of Waleed Ltd consisted of 100,000 fully paid ordinary shares at OMR2 per share, while the preference share capital consisted of 50 000 5% preference shares issued at OMR2 per share. The contract was agreed to on 1 April 2016. At that date, the fair value of each Buhari Ltd share, based on recent market transactions, was OMR3.80. Buhari Ltd.'s borrowing rate on current debt was 8% p.a. The cost of issuing the ordinary shares in Buhari Ltd was OMR1,500 for the shares issued to the former Waleed Ltd preference shareholders and OMR2,400 for the shares issued to the former ordinary shareholders in Waleed Ltd. Details of Waleed Ltd.'s assets and liabilities acquired by Buhari Ltd are as follows: Details Book Value Fair Value Plant & equipment 360.000 367.000 Land 260.000 257.000 Inventory 24.000 30,000 Accounts receivable Accounts payable (35,000) (35,000) Bank overdraft (55,000) (55,000) Buildings 1.200.000 1.250,000 Waleed Ltd is currently being sued by a previous customer. The expected damages are OMR50,000. Lawyers estimate that there is a 20% chance of losing the case. Required: Prepare the acquisition analysis in Buhari Ltd to record the acquisition of the shares and calculate the goodwill or gain on purchase of Waleed Ltd at 1 April 2016 18.000 16.000