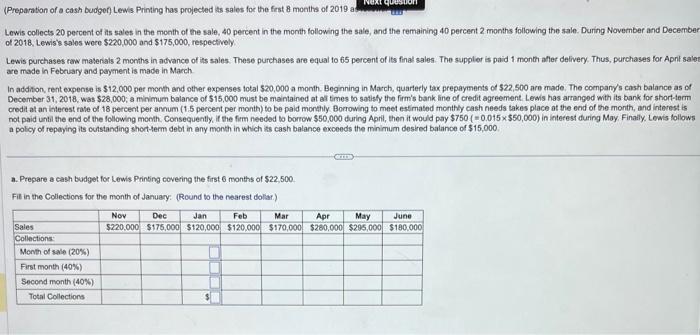

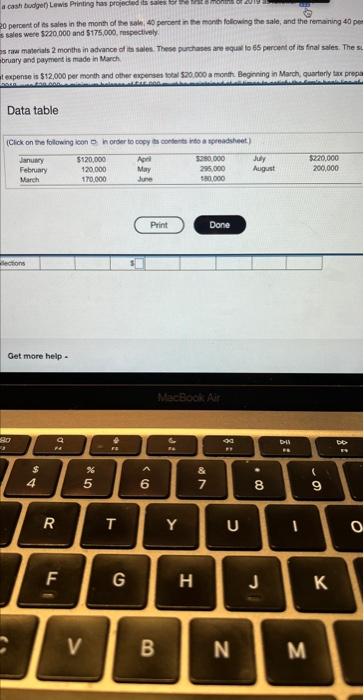

(Preparation of a cash budgen) Lewis Printing has projected ts sales foc the fist 8 months of 2019 a Lewis collects 20 percent of its sales in the month of the sale, 40 percent in the month following the sale, and the remaining 40 percent 2 months following the sale. During November and December of 2018, Lewis's sales were $220,000 and $175,000, respectively Lewis purchases raw materials 2 months in advance of its sales. These purchases are equal to 65 percent of its final sales. The suppler is paid 1 month afler delivery. Thus, purchases for Apnt sale are made in Febeuary and payment is made in March In addifion, rent expense is $12,000 per month end other expenses total $20,000 a month. Beginning in March, quarterly tax prepayments of $22,500 are made. The company's cash balance as of December 31,2018 , was $28,000; a minimum balance of $15,000 must be maintained at all times to satisty the firm's bank line of credit agreement. Lewis has arranged with its bank for short-term credit at an itilerest rate of 18 percent per ancum (1.5 percent per month) to be paid monthly. Borrowing to meet estimated monthy cash needs takes place at the end of the month, and interest is not paid until the end of the following moeth. Consequently, if the firm needed to borrow $50,000 during April, then it would pay $750(=0.015$50,000) in interest during May. Finally. Lexis follows a polcy of repeying its culstanding shortterm debt in any month in which is cash balance exceeds the minimum desired balance of $15,000. a. Prepare a cash budget for Lewis Printing covering the first 6 months of $22,500 Fit in the Coliections for the month of January. (Round to the nearest dolar.) 20 percect of is sales in the monti of the sale, 40 percert in the menth fellowing the sale, and the remaning 40 pe 5 sales were 5700,000 and 5175,000 , respectively. 5 riar mavecals 2 monthe in advance of it sales. These purchases are squa to 65 percent of its final sales. The 5 , bruary and paymert is made in March texpense is $12,000 per month and othec expenses hotal 520,000 a month. Begirning in March, quarterly tax prop: Data table