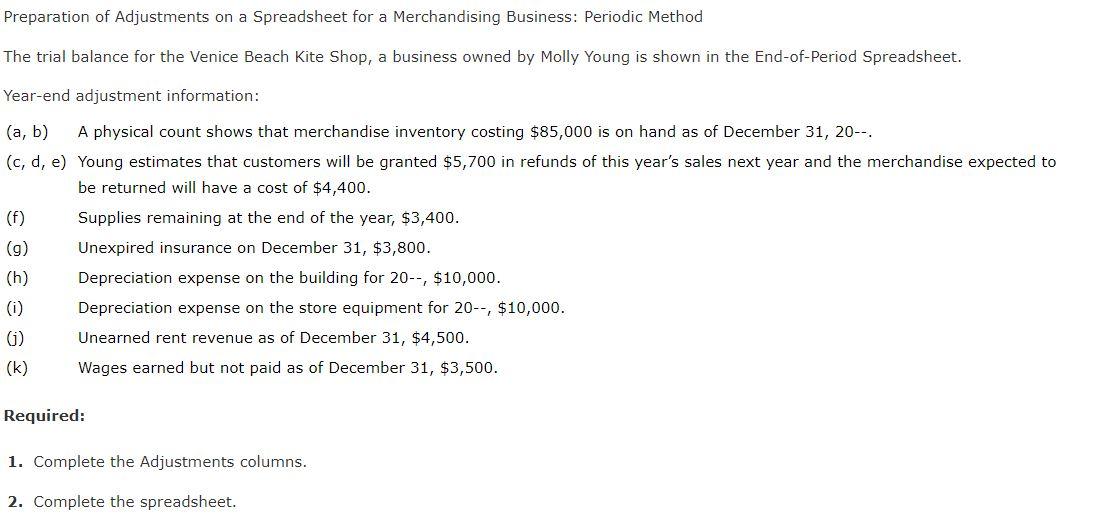

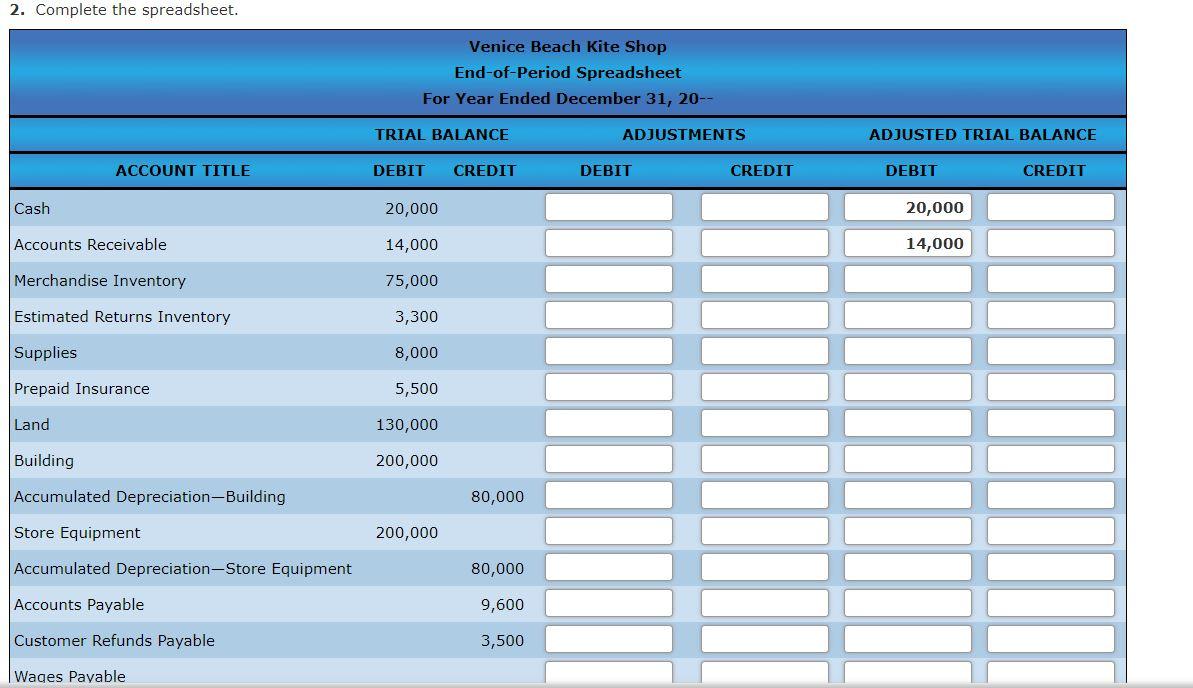

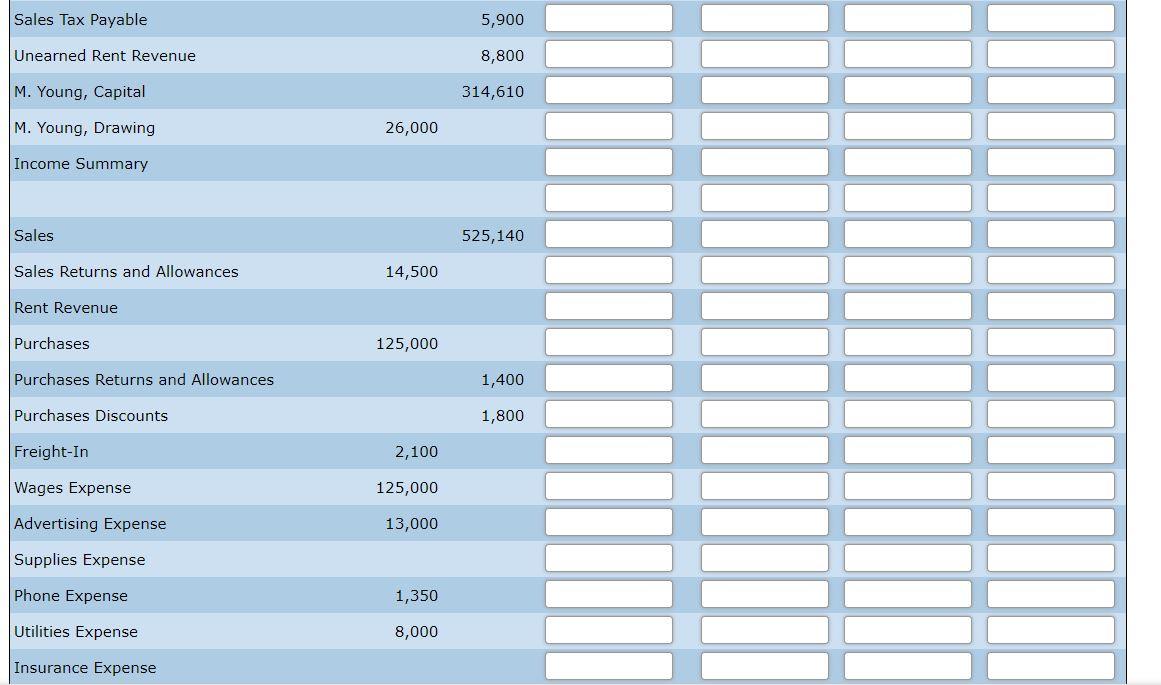

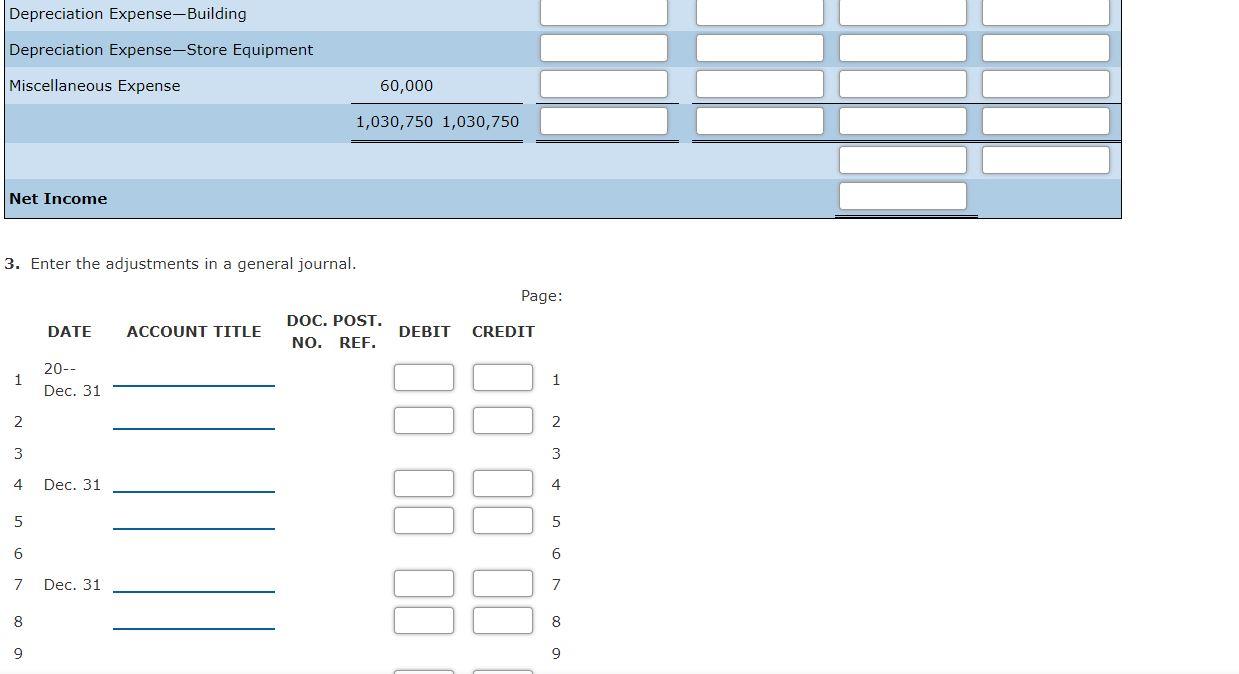

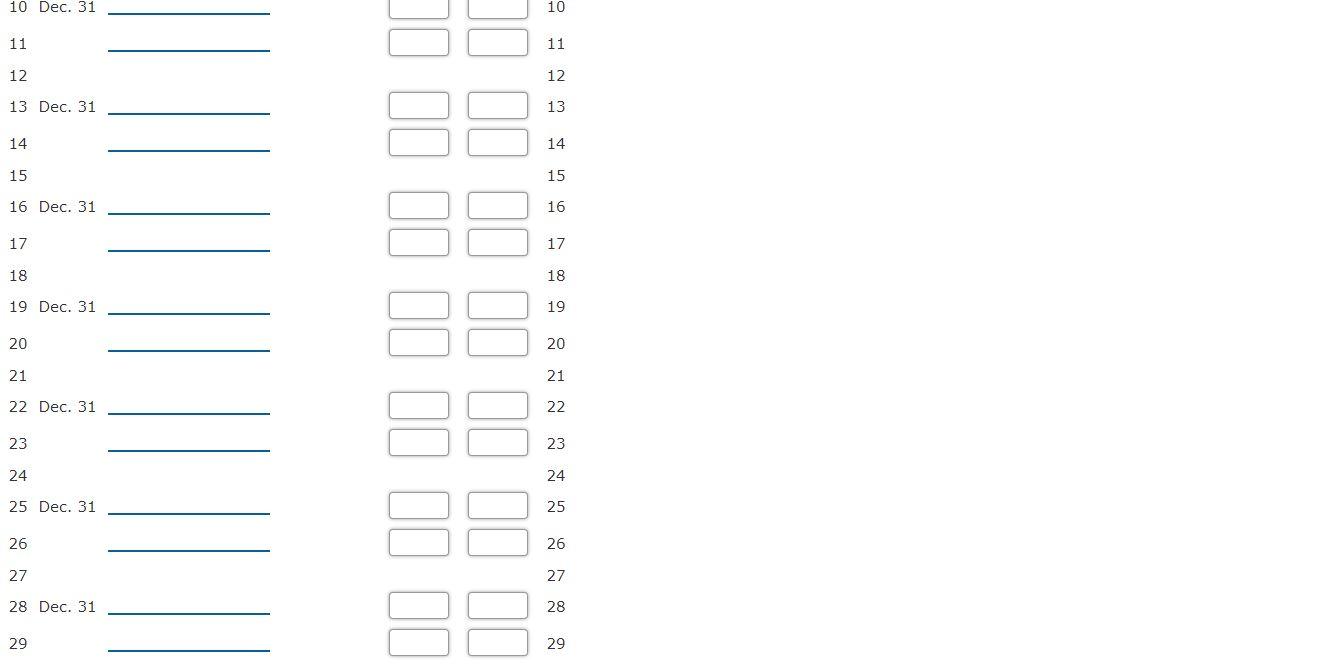

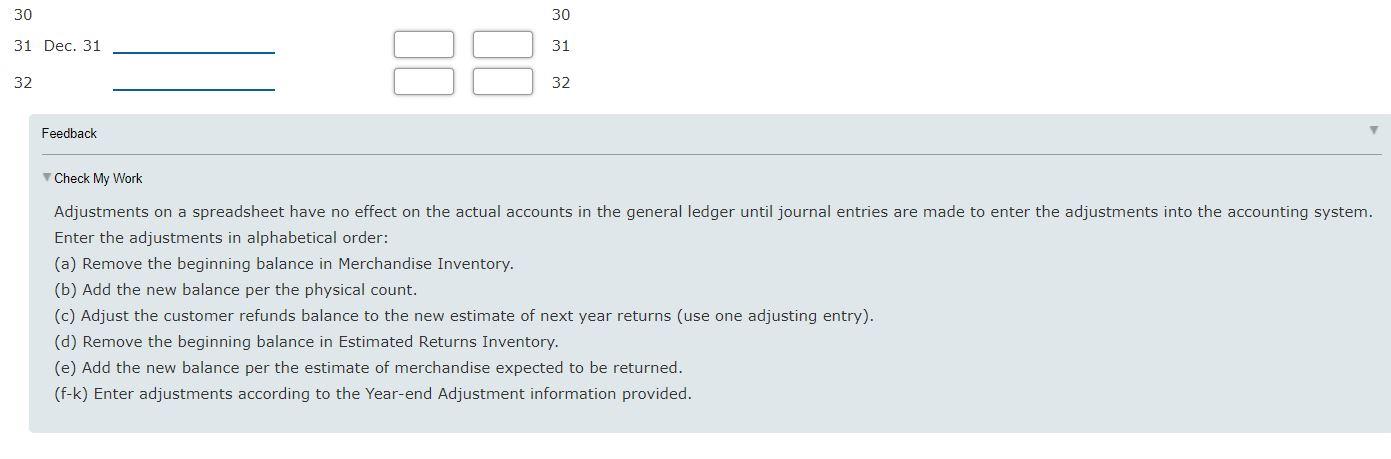

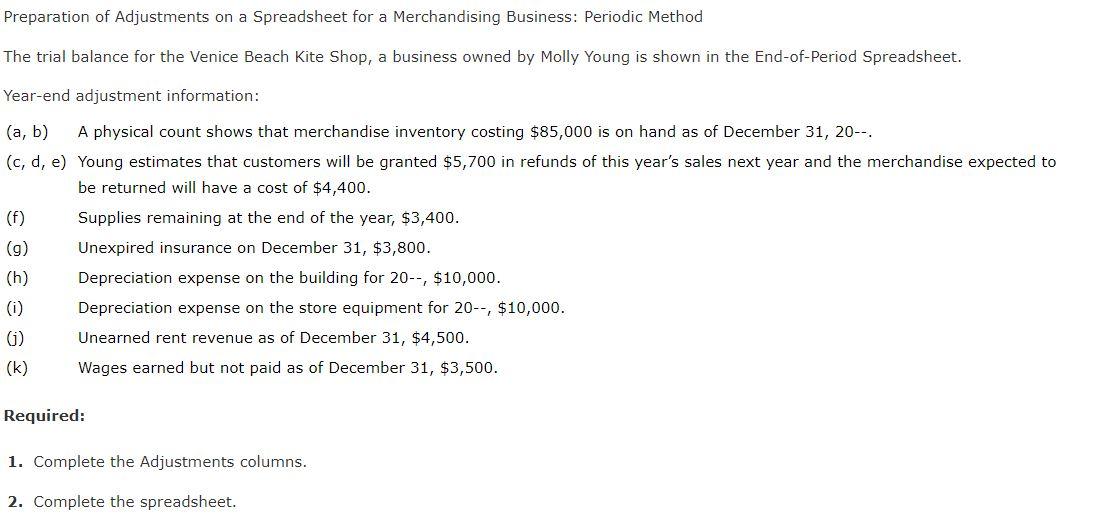

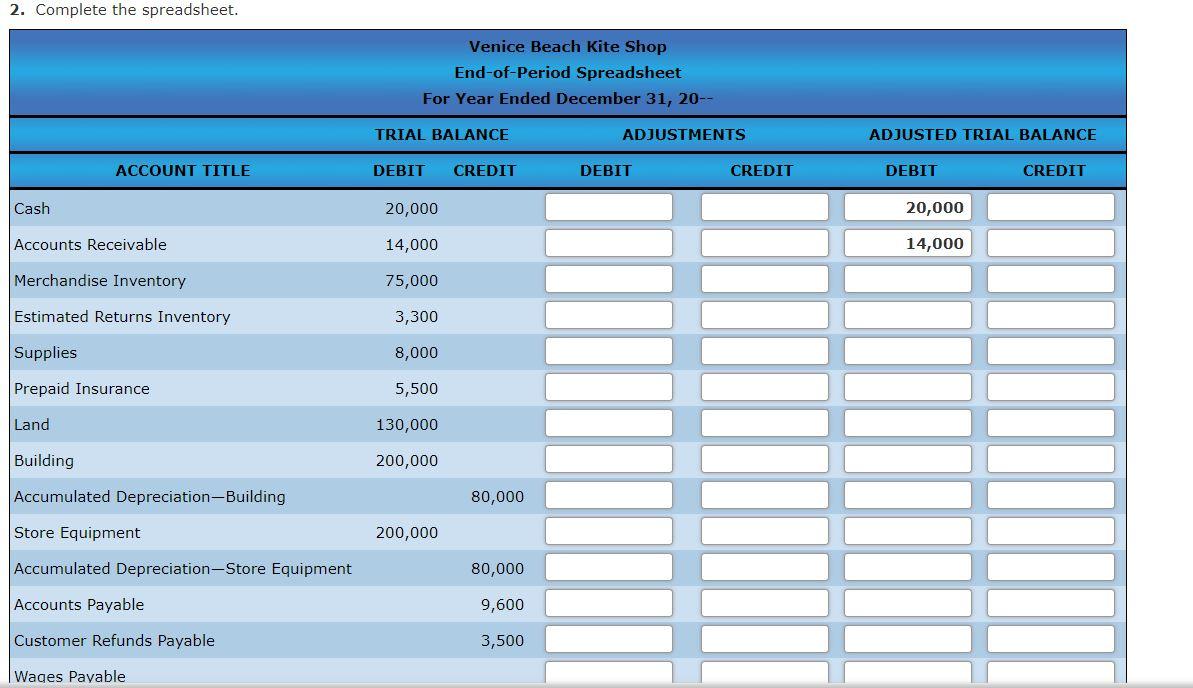

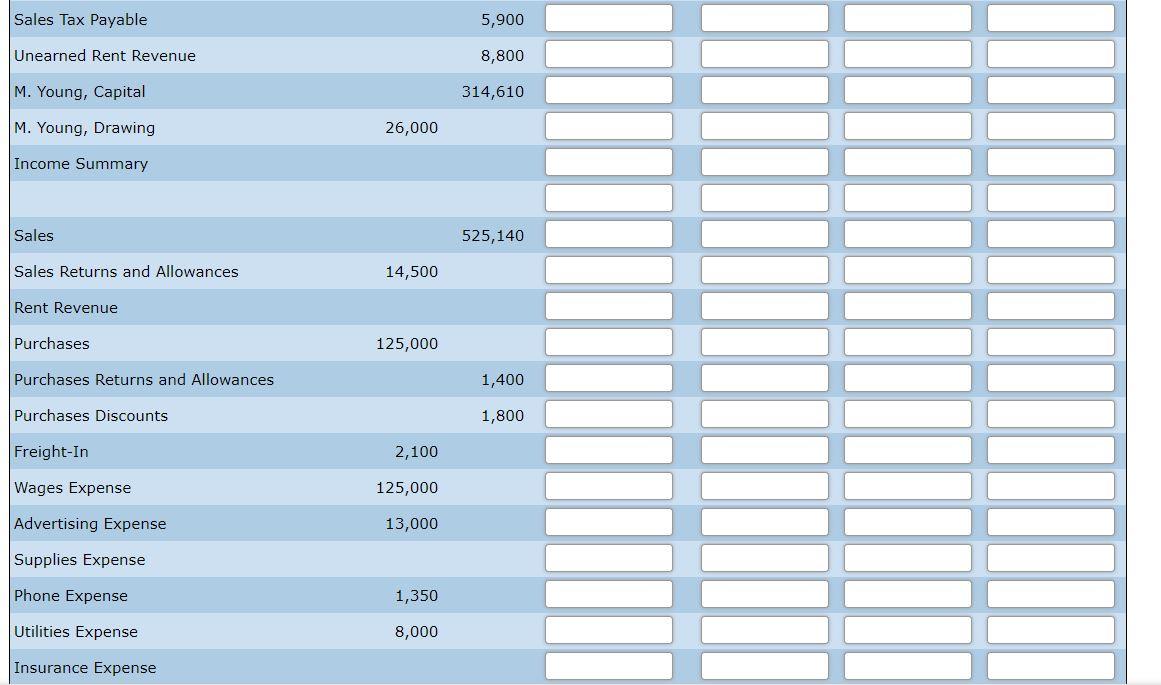

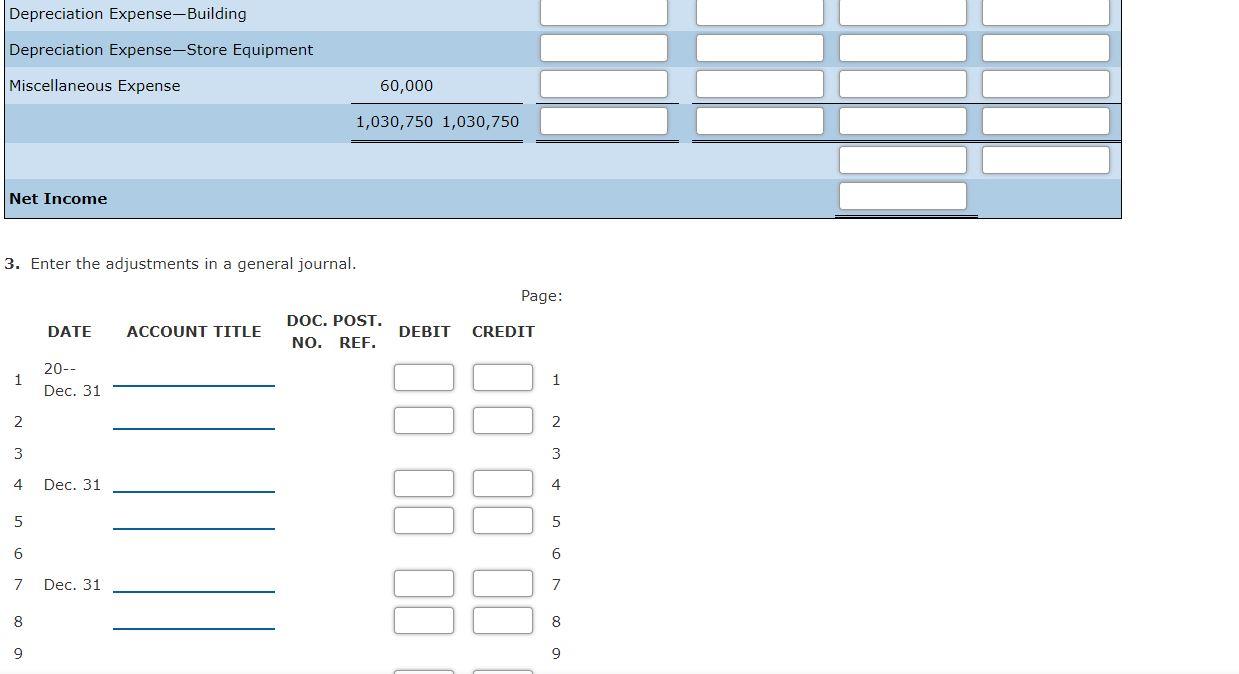

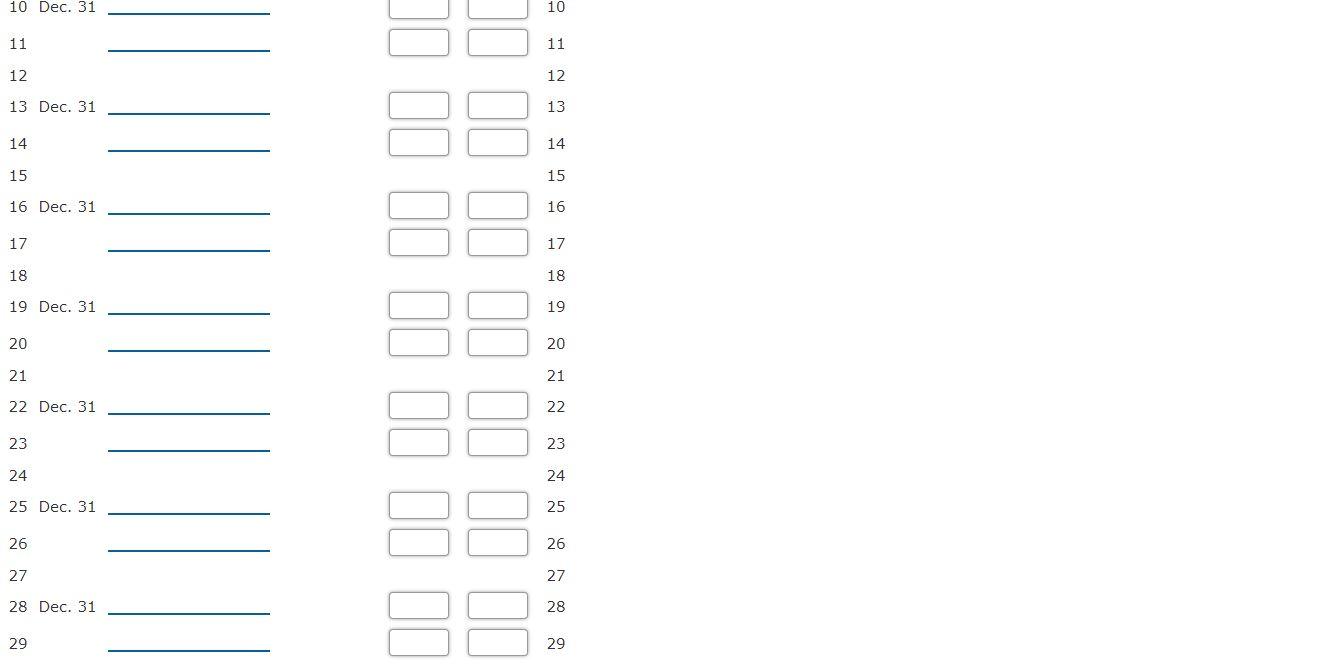

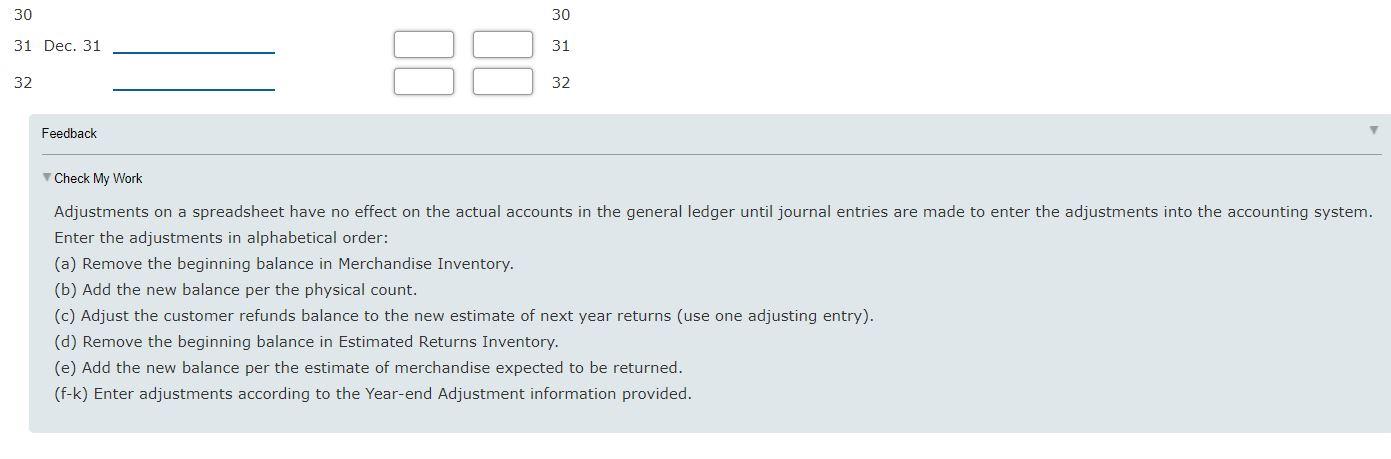

Preparation of Adjustments on a Spreadsheet for a Merchandising Business: Periodic Method The trial balance for the Venice Beach Kite Shop, a business owned by Molly Young is shown in the End-of-Period Spreadsheet. Year-end adjustment information: (a, b) A physical count shows that merchandise inventory costing $85,000 is on hand as of December 31, 20-- (c, d, e) Young estimates that customers will be granted $5,700 in refunds of this year's sales next year and the merchandise expected to be returned will have a cost of $4,400. Supplies remaining at the end of the year, $3,400. (9) Unexpired insurance on December 31, $3,800. (h) Depreciation expense on the building for 20--, $10,000. (0) Depreciation expense on the store equipment for 20--, $10,000. 6) Unearned rent revenue as of December 31, $4,500. (k) Wages earned but not paid as of December 31, $3,500. Required: 1. Complete the Adjustments columns. 2. Complete the spreadsheet. 2. Complete the spreadsheet. Venice Beach Kite Shop End-of-Period Spreadsheet For Year Ended December 31, 20-- TRIAL BALANCE ADJUSTMENTS ADJUSTED TRIAL BALANCE ACCOUNT TITLE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT Cash 20,000 20,000 Accounts Receivable 14,000 14,000 Merchandise Inventory 75,000 Estimated Returns Inventory 3,300 Supplies 8,000 Prepaid Insurance 5,500 Land 130,000 Building 200,000 Accumulated Depreciation-Building 80,000 Store Equipment 200,000 Accumulated Depreciation Store Equipment 80,000 Accounts Payable 9,600 Customer Refunds Payable 3,500 Wages Payable Sales Tax Payable 5,900 Unearned Rent Revenue 8,800 M. Young, Capital 314,610 M. Young, Drawing 26,000 Income Summary Sales 525,140 Sales Returns and Allowances 14,500 Rent Revenue Purchases 125,000 Purchases Returns and Allowances 1,400 Purchases Discounts 1,800 Freight-In 2,100 Wages Expense 125,000 Advertising Expense 13,000 Supplies Expense Phone Expense 1,350 Utilities Expense 8,000 Insurance Expense Depreciation Expense-Building Depreciation Expense-Store Equipment Miscellaneous Expense 60,000 1,030,750 1,030,750 Net Income 3. Enter the adjustments in a general journal. Page: DATE ACCOUNT TITLE DOC. POST. NO. REF. DEBIT CREDIT 1 20- Dec. 31 1 2 2 3 3 4 Dec. 31 4 II II II II II II 5 5 6 6 7 Dec. 31 7 8 8 9 9 0 0 11 Dec. 31 11 12 13 Dec. 31 12 II IL - 14 15 14 14 15 16 17 18 20 21 II II II II II II II II ll 3 30 30 31 Dec. 31 31 32 32 Feedback Check My Work Adjustments on a spreadsheet have no effect on the actual accounts in the general ledger until journal entries are made to enter the adjustments into the accounting system. Enter the adjustments in alphabetical order: (a) Remove the beginning balance in Merchandise Inventory. (b) Add the new balance per the physical count. (c) Adjust the customer refunds balance to the new estimate of next year returns (use one adjusting entry). (d) Remove the beginning balance in Estimated Returns Inventory. (e) Add the new balance per the estimate of merchandise expected to be returned. (f-k) Enter adjustments according to the Year-end Adjustment information provided