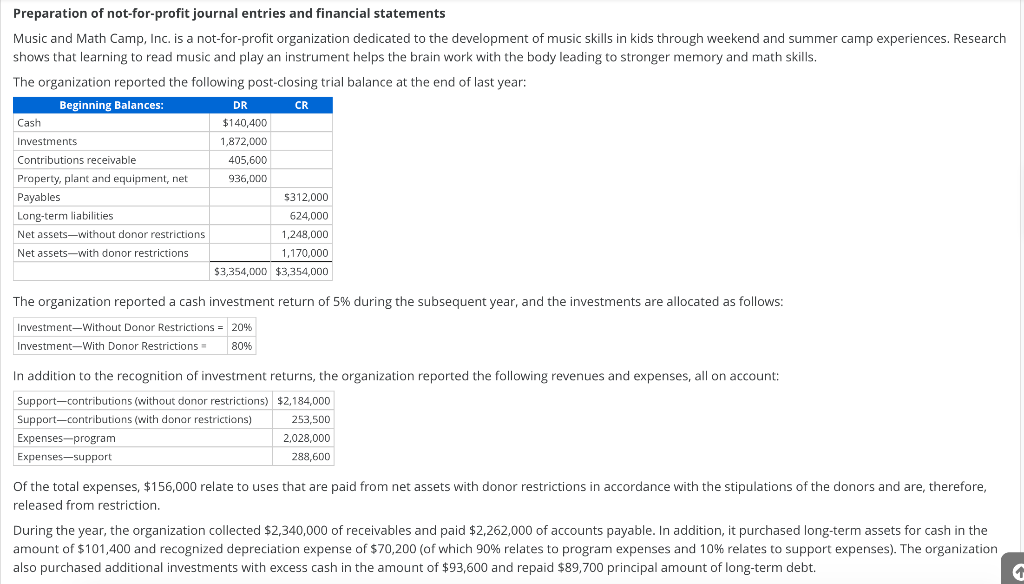

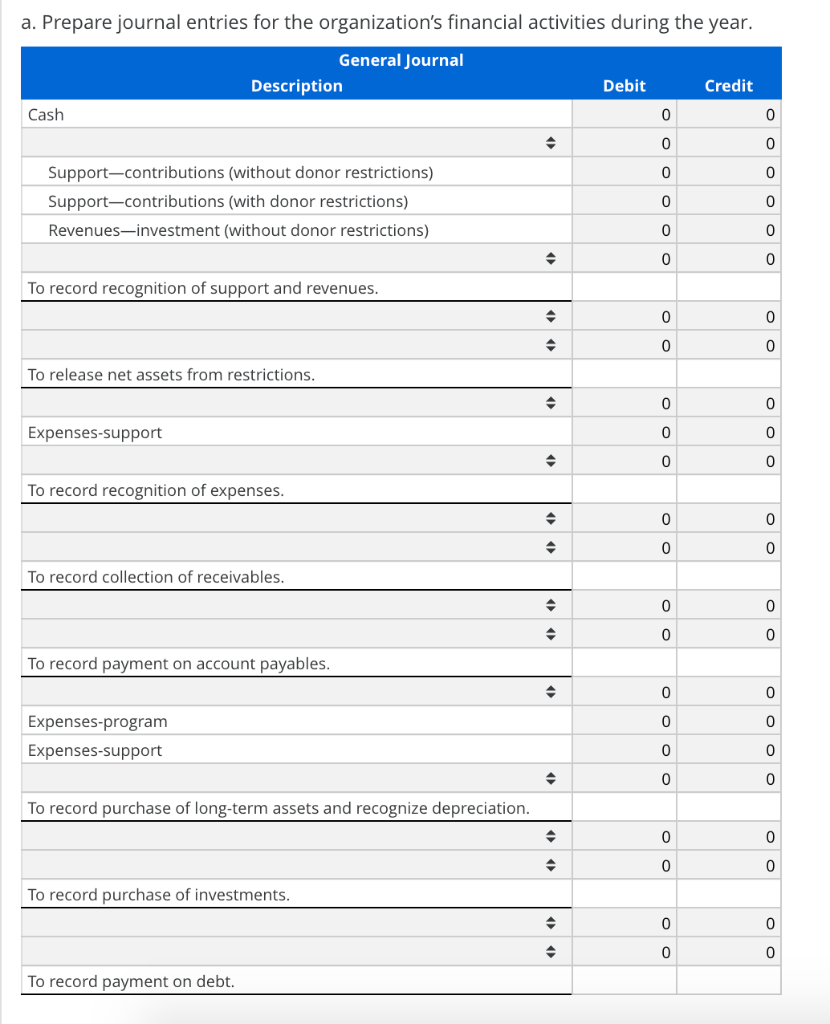

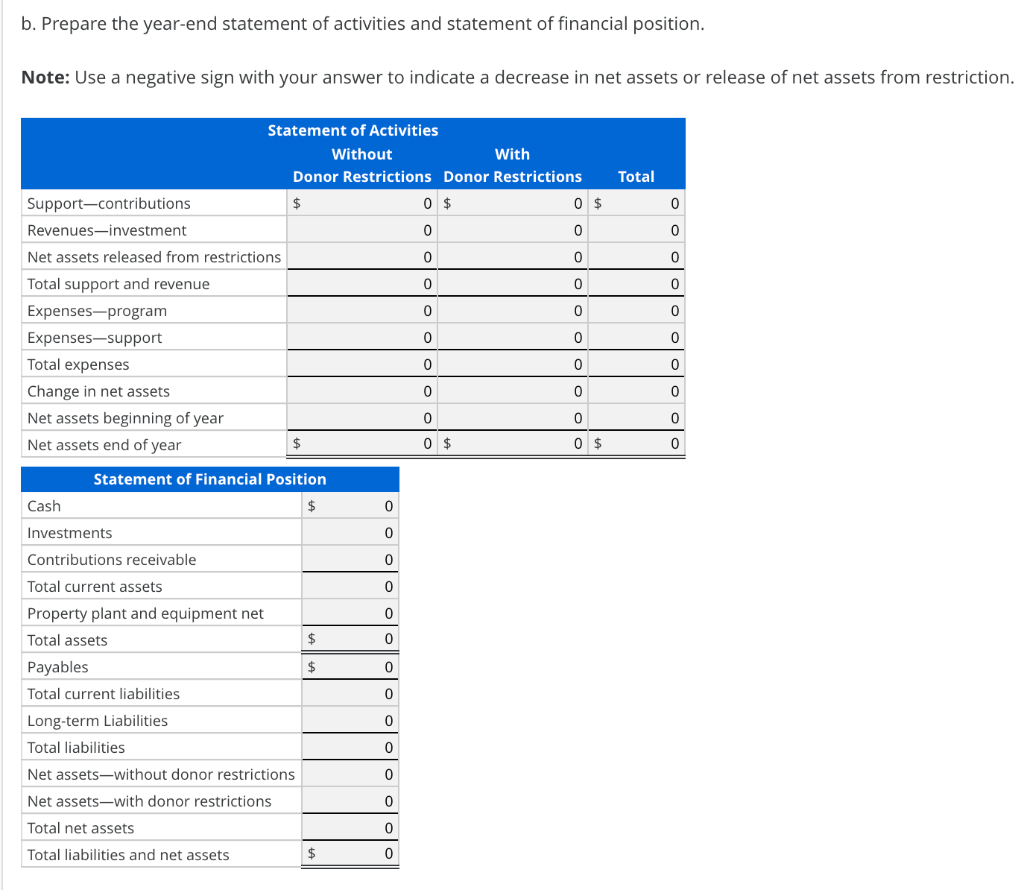

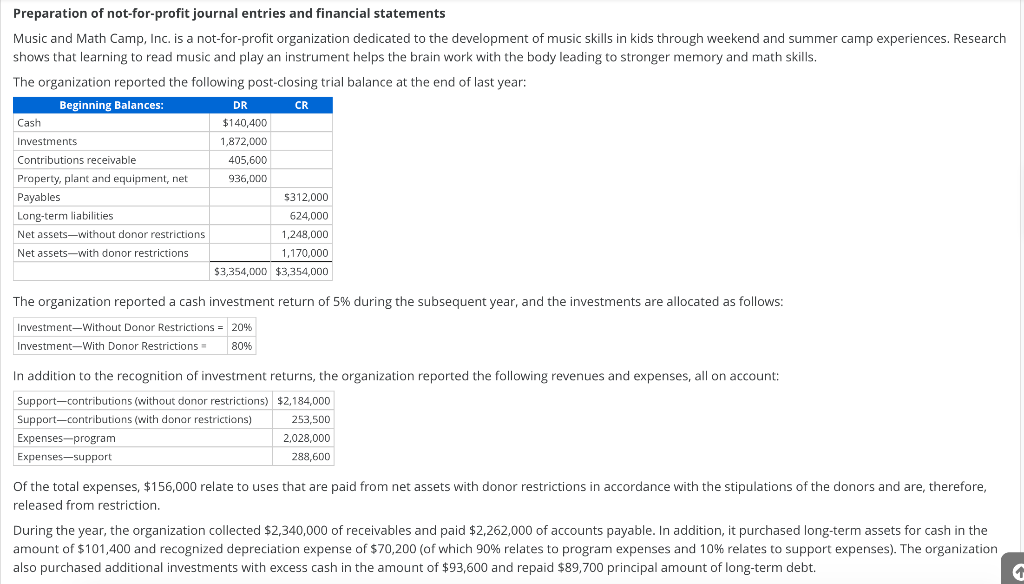

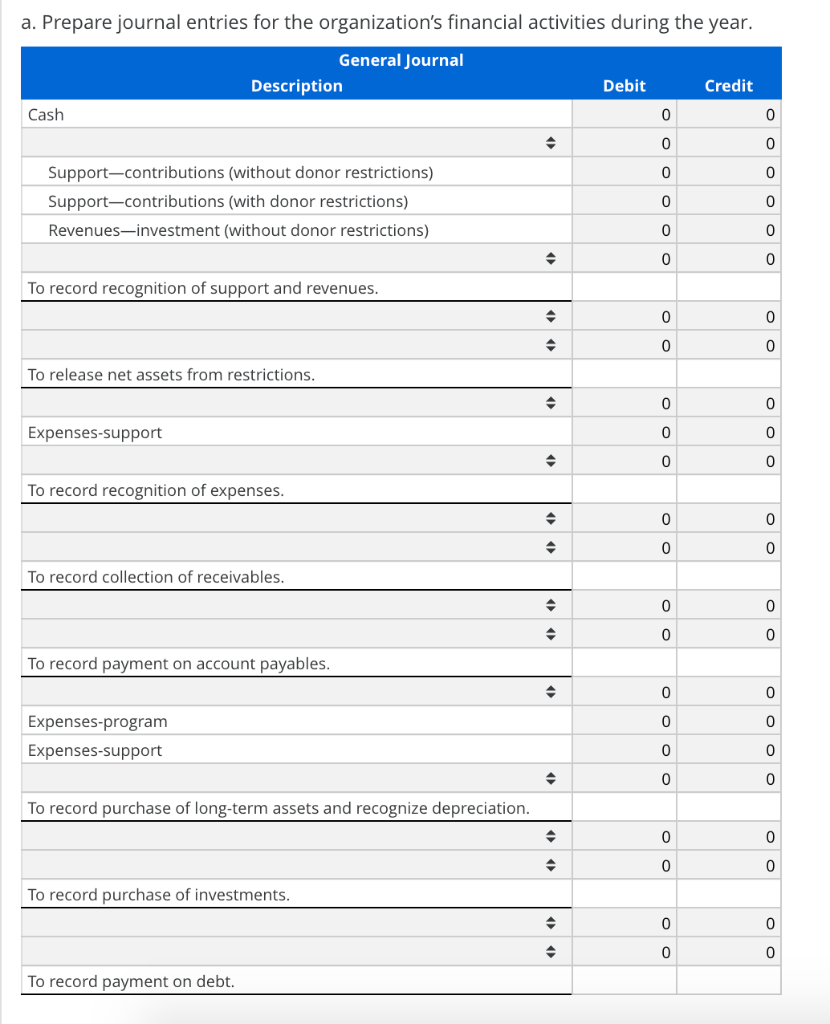

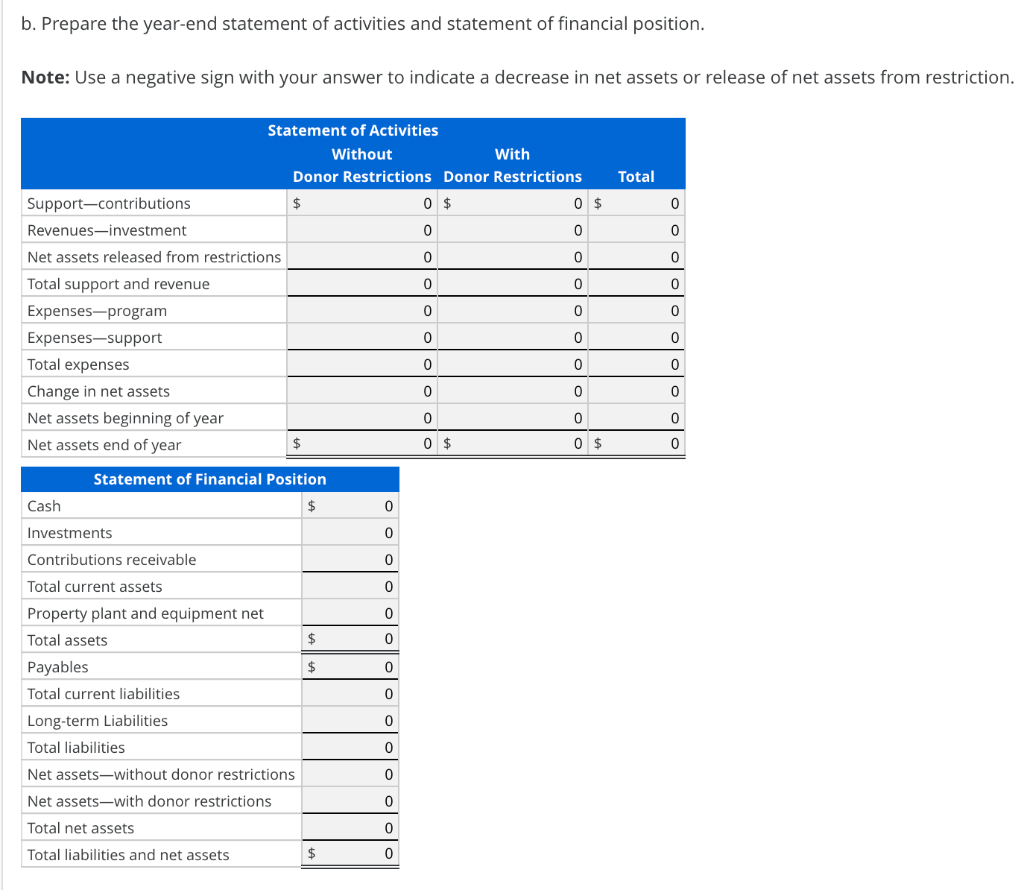

Preparation of not-for-profit journal entries and financial statements Music and Math Camp, Inc. is a not-for-profit organization dedicated to the development of music skills in kids through weekend and summer camp experiences. Research shows that learning to read music and play an instrument helps the brain work with the body leading to stronger memory and math skills. The organization reported the following post-closing trial balance at the end of last year: Beginning Balances: DR CR Cash $140,400 Investments 1,872,000 Contributions receivable 405,600 Property, plant and equipment, net 936,000 Payables 5312,000 Long-term liabilities 624,000 Net assets-without donor restrictions 1,248.000 Net assets-with donor restrictions 1,170,000 $3,354,000 $3,354,000 The organization reported a cash investment return of 5% during the subsequent year, and the investments are allocated as follows: Investment-Without Donor Restrictions = 20% Investment-With Donor Restrictions 80% In addition to the recognition of investment returns, the organization reported the following revenues and expenses, all on account: Support-contributions (without donor restrictions) $2,184,000 Support-contributions (with donar restrictions) 253,500 Expenses-program 2,028,000 Expenses-support 288,600 Of the total expenses, $156,000 relate to uses that are paid from net assets with donor restrictions in accordance with the stipulations of the donors and are, therefore, released from restriction. During the year, the organization collected $2,340,000 of receivables and paid $2,262,000 of accounts payable. In addition, it purchased long-term assets for cash in the amount of $101,400 and recognized depreciation expense of $70,200 (of which 90% relates to program expenses and 10% relates to support expenses). The organization also purchased additional investments with excess cash in the amount of $93,600 and repaid $89,700 principal amount of long-term debt. a. Prepare journal entries for the organization's financial activities during the year. General Journal Description Debit Credit Cash o od Support-contributions (without donor restrictions) Support-contributions (with donor restrictions) Revenues-investment (without donor restrictions) o o o o o o 0 0 0 To record recognition of support and revenues. 0 0 0 0 To release net assets from restrictions. 0 Expenses-support ooo 0 0 To record recognition of expenses. 0 o o 0 To record collection of receivables. 0 0 0 0 " To record payment on account payables. Expenses-program Expenses-support oooo Oo oo To record purchase of long-term assets and recognize depreciation. 0 o o 0 To record purchase of investments. 0 0 0 0 To record payment on debt. b. Prepare the year-end statement of activities and statement of financial position. Note: Use a negative sign with your answer to indicate a decrease in net assets or release of net assets from restriction. Total 0 0 0 Statement of Activities Without With Donor Restrictions Donor Restrictions Support-contributions 0 $ 0 $ Revenues-investment 0 0 Net assets released from restrictions 0 0 Total support and revenue 0 0 Expenses-program 0 0 Expenses-support 0 0 Total expenses 0 0 Change in net assets 0 0 Net assets beginning of year 0 0 Net assets end of year 0 $ 0 $ 0 0 0 0 0 0 0 Statement of Financial Position Cash $ 0 Investments 0 Contributions receivable 0 Total current assets 0 0 $ 0 $ 0 Property plant and equipment net Total assets Payables Total current liabilities Long-term Liabilities Total liabilities 0 0 0 0 0 Net assets-without donor restrictions Net assets-with donor restrictions Total net assets Total liabilities and net assets 0 $ 0