Question

Preparation of projected statement of income statement The above is the 2012 to 2014 income statement for the company. Consider there is a choice of

Preparation of projected statement of income statement

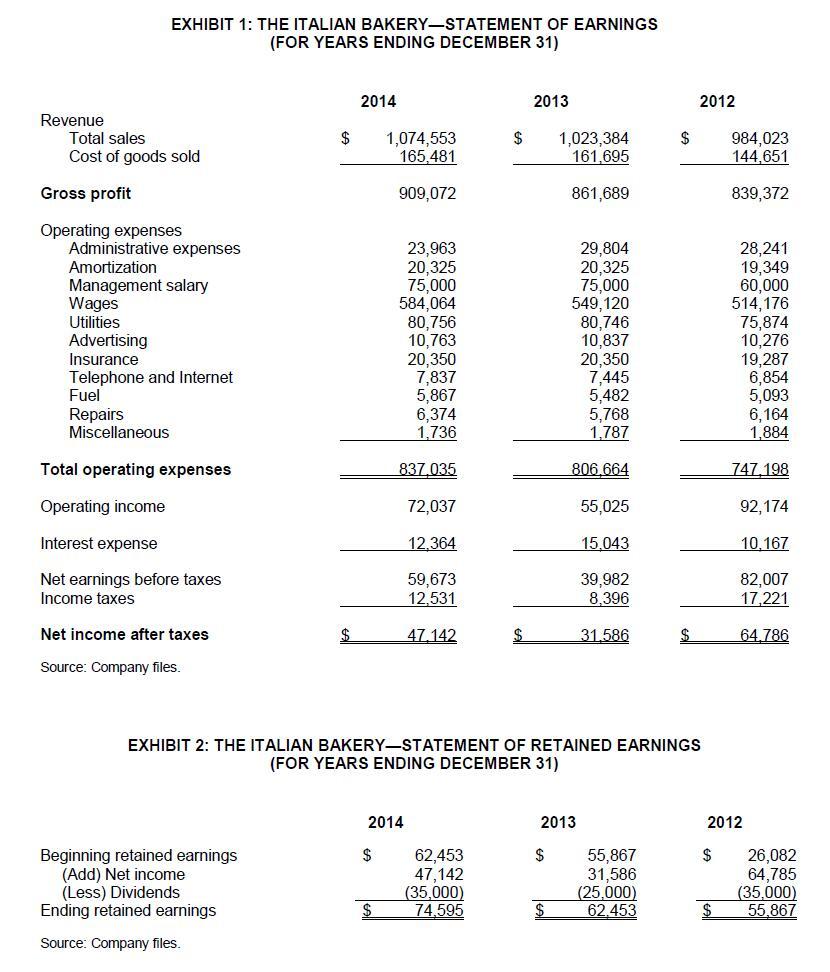

The above is the 2012 to 2014 income statement for the company. Consider there is a choice of expansion based on the below information, please draft the projected income statement for 2015 based on the below given information.

Expansion of Organic Gluten-Free Bread Line

The Bakery already had most of the equipment it needed to produce the organic gluten-free bread line; however, the business would need to spend $120,000 on additional equipment to avoid cross-contamination of the ingredientsstorage racks, and product-specific packaging supplies. This option would be financed entirely by a long-term loan from the CB. Additional warehouse space would be needed throughout the year to accommodate the increased production; the rental of storage space would cost $3,250 a month. The new line's sales were projected at $275,000 because of the product's premium prices. Existing bread sales were estimated to remain at the same dollar amount as the previous year. If this option were pursued, Liambotis would increase the amount of advertising to match that of the dessert goods line. Gluten-free bread included more expensive ingredients, so the cost of goods sold for the new product line would increase to 20 per cent of sales. An additional full-time baker would be hired to help with production and to ensure the Bakery produced enough of both product lines. No additional delivery truck drivers would be needed.

Revenue EXHIBIT 1: THE ITALIAN BAKERY-STATEMENT OF EARNINGS (FOR YEARS ENDING DECEMBER 31) 2014 2013 $ 1,074,553 165,481 1,023,384 161,695 909,072 861,689 23,963 29,804 20,325 20,325 75,000 75,000 584,064 549,120 80,756 80,746 10,763 10,837 20,350 20,350 7,837 7,445 5,867 5,482 6,374 5,768 1,736 1,787 837,035 806.664 72,037 55,025 12,364 15.043 59,673 39,982 12,531 8,396 $ 47.142 $ 31,586 $ EXHIBIT 2: THE ITALIAN BAKERY-STATEMENT OF RETAINED EARNINGS (FOR YEARS ENDING DECEMBER 31) 2014 2013 2012 62,453 47,142 (35,000) 74.595 55,867 31,586 (25,000) 62.453 Total sales Cost of goods sold Gross profit Operating expenses Administrative expenses Amortization Management salary Wages Utilities Advertising Insurance Telephone and Internet Fuel Repairs Miscellaneous Total operating expenses Operating income Interest expense Net earnings before taxes Income taxes Net income after taxes Source: Company files. Beginning retained earnings (Add) Net income (Less) Dividends Ending retained earnings Source: Company files. $ $ $ $ $ 2012 $ $ 984,023 144,651 839,372 28,241 19,349 60,000 514,176 75,874 10,276 19,287 6,854 5,093 6,164 1,884 747,198 92,174 10,167 82,007 17,221 64,786 26,082 64,785 (35,000) 55,867 Revenue EXHIBIT 1: THE ITALIAN BAKERY-STATEMENT OF EARNINGS (FOR YEARS ENDING DECEMBER 31) 2014 2013 $ 1,074,553 165,481 1,023,384 161,695 909,072 861,689 23,963 29,804 20,325 20,325 75,000 75,000 584,064 549,120 80,756 80,746 10,763 10,837 20,350 20,350 7,837 7,445 5,867 5,482 6,374 5,768 1,736 1,787 837,035 806.664 72,037 55,025 12,364 15.043 59,673 39,982 12,531 8,396 $ 47.142 $ 31,586 $ EXHIBIT 2: THE ITALIAN BAKERY-STATEMENT OF RETAINED EARNINGS (FOR YEARS ENDING DECEMBER 31) 2014 2013 2012 62,453 47,142 (35,000) 74.595 55,867 31,586 (25,000) 62.453 Total sales Cost of goods sold Gross profit Operating expenses Administrative expenses Amortization Management salary Wages Utilities Advertising Insurance Telephone and Internet Fuel Repairs Miscellaneous Total operating expenses Operating income Interest expense Net earnings before taxes Income taxes Net income after taxes Source: Company files. Beginning retained earnings (Add) Net income (Less) Dividends Ending retained earnings Source: Company files. $ $ $ $ $ 2012 $ $ 984,023 144,651 839,372 28,241 19,349 60,000 514,176 75,874 10,276 19,287 6,854 5,093 6,164 1,884 747,198 92,174 10,167 82,007 17,221 64,786 26,082 64,785 (35,000) 55,867Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started