Question

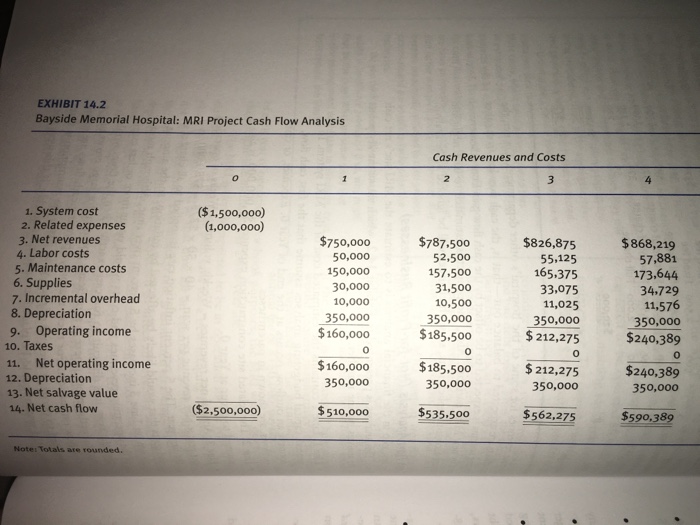

Prepare a 5 year cash flow analysis (see exhibit 14-2 for basic format. Mercadia Hospital, a not-for-profit entity, is preparing to build a satellite emergency

Prepare a 5 year cash flow analysis (see exhibit 14-2 for basic format.

Mercadia Hospital, a not-for-profit entity, is preparing to build a satellite emergency department on land it owns 10 miles from the hospital site. Based on a $50,000 planning study, Mercadia believes there is sufficient demand for the project.

The project will be built on land that Mercadia purchased for $150,000 but now has a market value of $500,000. Building and fixed equipment (average useful life of 20 years) will be $10,000,000 and major moveable equipment (average useful life of 5 years) will cost $5,000,000. We'll assume that these outflows occur at the end of Year 0.

Volume will ramp up over a three year period. In Year 1, visits are projected at 15,000 rising to 25,000 in Year 2 and then to 30,000 in Years 3-5. Payer mix is assumed to be 45% private pay, 25% Medicare, and 15% each for Medicaid and Uninsured. Private payers reimburse the hospital $1,400 per visit, Medicare pays $850, Medicaid $640 and uninsured patients average $550.

Salary expense will be $9,000,000 in Year 1, $10,000,000 in Year 2 and $12,000,000 in Years 3- 5. Fringe benefits are 25% of salaries. Supplies and other expenses (which include maintenance and overhead expenses) are a mix of fixed and variable costs. The fixed costs are estimated at $3,000,000 per year while the variable costs are $325 per visit.

Inflation, which has been about 2%, is assumed to affect revenues and expenses equally. The impact on the hospital's existing emergency room volume is expected to be negligible. Management believes that there will be a slight increase in accounts receivable that will be offset by an equal increase in accounts payable.

The projections will only go out to the end of Year 5.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started