prepare a balance sheet using LIFO method and the given adjusted trial balance

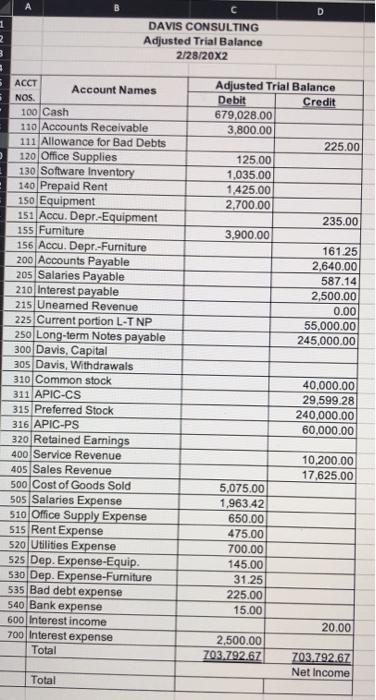

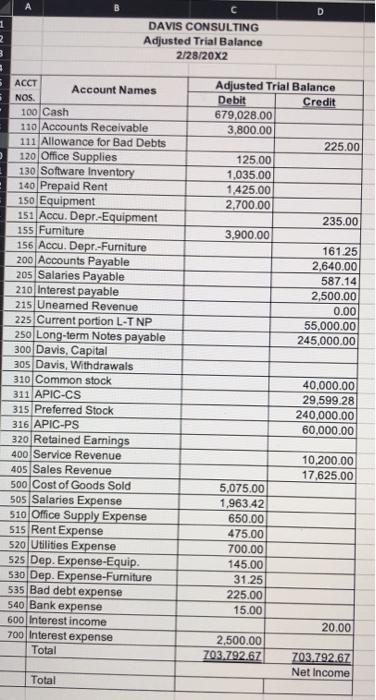

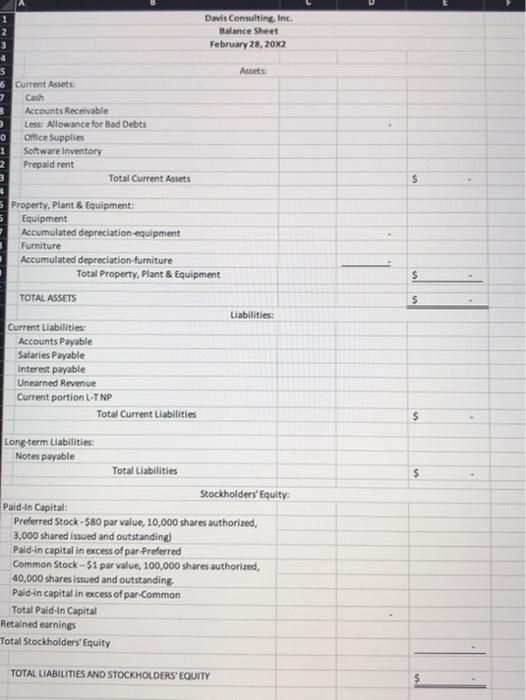

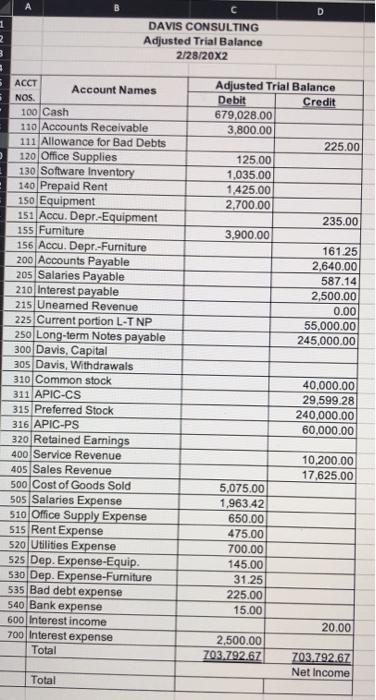

D 1 2 3 DAVIS CONSULTING Adjusted Trial Balance 2/28/20X2 Adjusted Trial Balance Debit Credit 679,028.00 3,800.00 225.00 125.00 1,035.00 1.425.00 2,700.00 235.00 3,900.00 161.25 2,640.00 587.14 2,500.00 0.00 55,000.00 245,000.00 ACCT Account Names NOS 100 Cash 110 Accounts Receivable 111 Allowance for Bad Debts 120 Office Supplies 130 Software Inventory 140 Prepaid Rent 150 Equipment 151 Accu. Depr.-Equipment 155 Furniture 156 Accu. Depr.-Furniture 200 Accounts Payable 205 Salaries Payable 210 Interest payable 215 Uneamed Revenue 225 Current portion L-TNP 250 Long-term Notes payable 300 Davis, Capital 305 Davis, Withdrawals 310 Common stock 311 APIC-CS 315 Preferred Stock 316 APIC-PS 320 Retained Earnings 400 Service Revenue 405 Sales Revenue 500 Cost of Goods Sold 505 Salaries Expense 510 Office Supply Expense 515 Rent Expense 520 Utilities Expense 525 Dep. Expense-Equip. 530 Dep. Expense-Furniture 535 Bad debt expense 540 Bank expense 600 Interest income 700 Interest expense Total 40,000.00 29,599.28 240,000.00 60,000.00 10,200.00 17,625.00 5,075.00 1,963.42 650.00 475.00 700.00 145.00 31.25 225.00 15.00 20.00 2,500.00 703.792.67 703 792.67 Net Income Total Davis Consulting, Inc. Balance Sheet February 28, 20X2 Assets 5 6 Current Assets 7 Cash 3 Accounts Receivable Less: Allowance for Bad Debts 0 Omce Supplies 1 Software Inventory 2 Prepaid rent 3 Total Current Assets $ Property, Plant & Equipment: Equipment Accumulated depreciation equipment Furniture Accumulated depreciation furniture Total Property, Plant & Equipment TOTAL ASSETS $ 5 Liabilities: Current Liabilities: Accounts Payable Salaries Payable Interest payable Unearned Revenue Current portion L-INP Total Current Liabilities $ Long-term Liabilities: Notes payable Total Liabilities $ Stockholders' Equity Paid to Capital: Preferred Stock-$80 par value, 10,000 shares authorized 3,000 shared issued and outstanding) Pald-in capital in excess of par-Preferred Common Stock - S1 par value, 100,000 shares authorized, 40,000 shares issued and outstanding Pald-in capital in excess of par Common Total Paid-In Capital Retained earnings Total Stockholders Equity TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY