Answered step by step

Verified Expert Solution

Question

1 Approved Answer

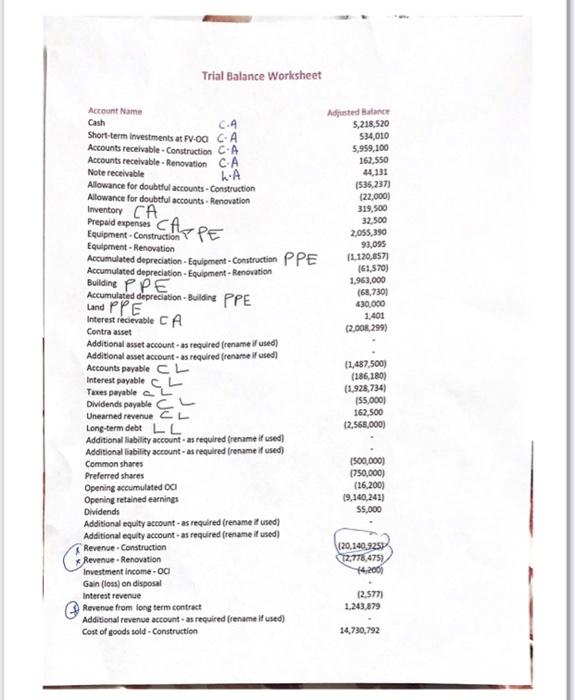

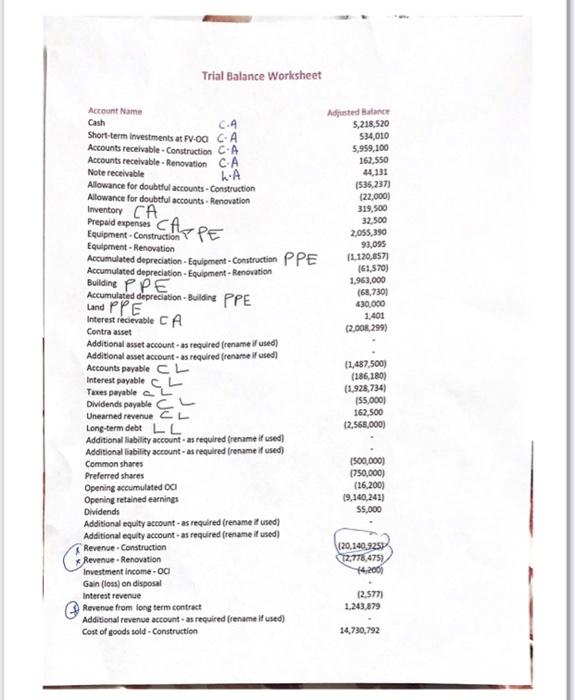

prepare a balancesheet Trial Balance Worksheet C-4 Prepaid expenses cft PE Adjusted Balance 5,218,520 534,010 5,959,100 162,550 4.131 (535,237) 122,000) 319.500 32.500 2,055,390 93,095 (1.120,8571

prepare a balancesheet

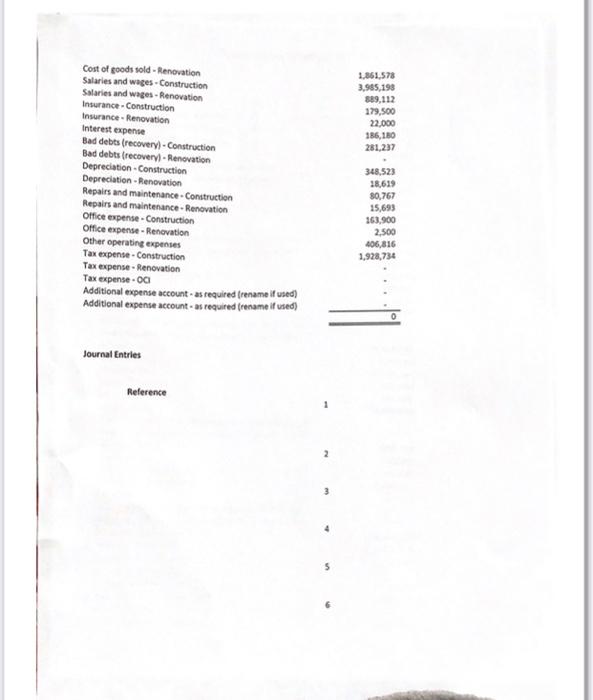

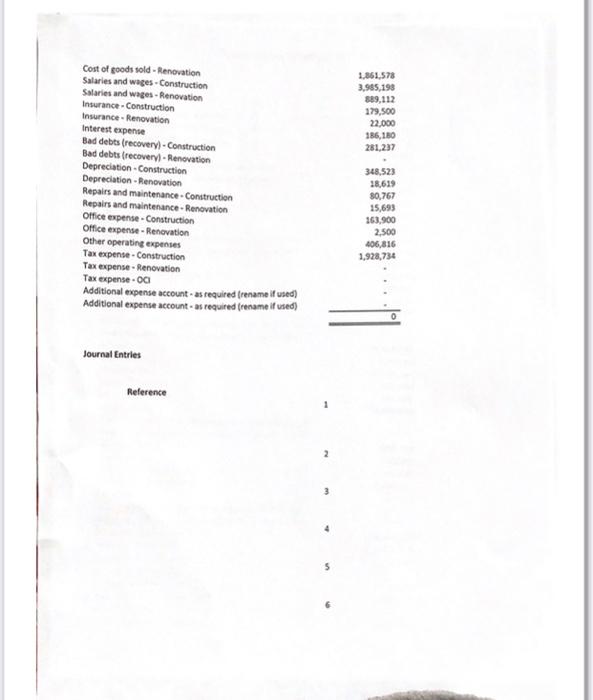

Trial Balance Worksheet C-4 Prepaid expenses cft PE Adjusted Balance 5,218,520 534,010 5,959,100 162,550 4.131 (535,237) 122,000) 319.500 32.500 2,055,390 93,095 (1.120,8571 161.570) 1.963.000 (68.7301 430,000 1.401 (2,00R. 299) Account Name Cash Short-term Investments at PV-00 GA Accounts receivable - Construction CA Accounts receivable - Renovation CA Note receivable LA Allowance for doubtful accounts - Construction Allowance for doubtful accounts - Renovation Inventory CA Equipment. Construction Equipment - Renovation Accumulated depreciation - Equipment - Construction PPE Accumulated depreciation - Equipment - Renovation Building PPE Accumulated depreciation Buildirne PPE Land PPE Interest recievable CA Contra asset Additional asset account - as required rename if used) Additional asset account as required frenare if used] Accounts payable CL Interest payable CL Taxes payable L Dividends payable cu Unearned revenue CL Long-term debe LL Additional ability account - as required (rename if used) Additional liability account - as required trename if used) Common shares Preferred shares Opening accumulated OCI Opening retained earnings Dividends Additional equity account - as required rename it used) Additional equity account - as required rename it used) Revenue Construction Revenue. Renovation Investment income-oc Gain (loss) on disposal Interest revenue Revenue from long term contract Additional revenue account - as required (rename if used) Cost of goods told - Construction (1.487.500) (186,180) (1.928,734) 155,000 162,500 12,568,000) 1500,000) [750,000) (16.200) 19,140,241) 55.000 (20,1409257 12,778,475 14.2001 12.577) 1,243.879 14,730,792 1.861,578 3,985,198 889,112 179,500 22.000 186,180 281,237 Cost of goods sold - Renovation Salaries and wages - Construction Salaries and wages - Renovation Insurance Construction Insurance - Renovation Interest expense Bad debts (recovery) - Construction Bad debts recovery - Renovation Depreciation - Construction Depreciation - Renovation Repairs and maintenance - Construction Repairs and maintenance. Renovation Office expense - Construction Office expense - Renovation Other operating expenses Tax expense - Construction Tax expense - Renovation Tax expense. Additional expense account - as required trename if used) Additional expense account - as required (rename if used) 348,523 18.619 30,767 15,693 163,900 2.500 406,816 1,928,734 Journal Entries Reference 1 Trial Balance Worksheet C-4 Prepaid expenses cft PE Adjusted Balance 5,218,520 534,010 5,959,100 162,550 4.131 (535,237) 122,000) 319.500 32.500 2,055,390 93,095 (1.120,8571 161.570) 1.963.000 (68.7301 430,000 1.401 (2,00R. 299) Account Name Cash Short-term Investments at PV-00 GA Accounts receivable - Construction CA Accounts receivable - Renovation CA Note receivable LA Allowance for doubtful accounts - Construction Allowance for doubtful accounts - Renovation Inventory CA Equipment. Construction Equipment - Renovation Accumulated depreciation - Equipment - Construction PPE Accumulated depreciation - Equipment - Renovation Building PPE Accumulated depreciation Buildirne PPE Land PPE Interest recievable CA Contra asset Additional asset account - as required rename if used) Additional asset account as required frenare if used] Accounts payable CL Interest payable CL Taxes payable L Dividends payable cu Unearned revenue CL Long-term debe LL Additional ability account - as required (rename if used) Additional liability account - as required trename if used) Common shares Preferred shares Opening accumulated OCI Opening retained earnings Dividends Additional equity account - as required rename it used) Additional equity account - as required rename it used) Revenue Construction Revenue. Renovation Investment income-oc Gain (loss) on disposal Interest revenue Revenue from long term contract Additional revenue account - as required (rename if used) Cost of goods told - Construction (1.487.500) (186,180) (1.928,734) 155,000 162,500 12,568,000) 1500,000) [750,000) (16.200) 19,140,241) 55.000 (20,1409257 12,778,475 14.2001 12.577) 1,243.879 14,730,792 1.861,578 3,985,198 889,112 179,500 22.000 186,180 281,237 Cost of goods sold - Renovation Salaries and wages - Construction Salaries and wages - Renovation Insurance Construction Insurance - Renovation Interest expense Bad debts (recovery) - Construction Bad debts recovery - Renovation Depreciation - Construction Depreciation - Renovation Repairs and maintenance - Construction Repairs and maintenance. Renovation Office expense - Construction Office expense - Renovation Other operating expenses Tax expense - Construction Tax expense - Renovation Tax expense. Additional expense account - as required trename if used) Additional expense account - as required (rename if used) 348,523 18.619 30,767 15,693 163,900 2.500 406,816 1,928,734 Journal Entries Reference 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started