Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a cash budget for May. Abc inc pays cash for all purchases ABC. Inc., manufactures kitchen tiles. The following information is available: Beginning cash

Prepare a cash budget for May. Abc inc pays cash for all purchases

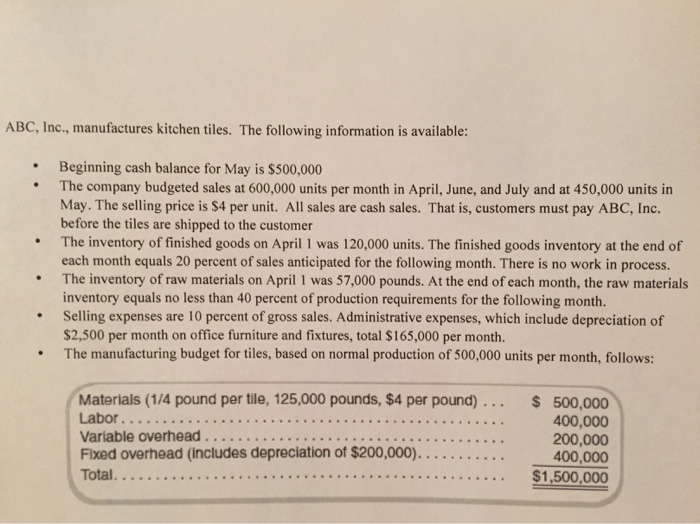

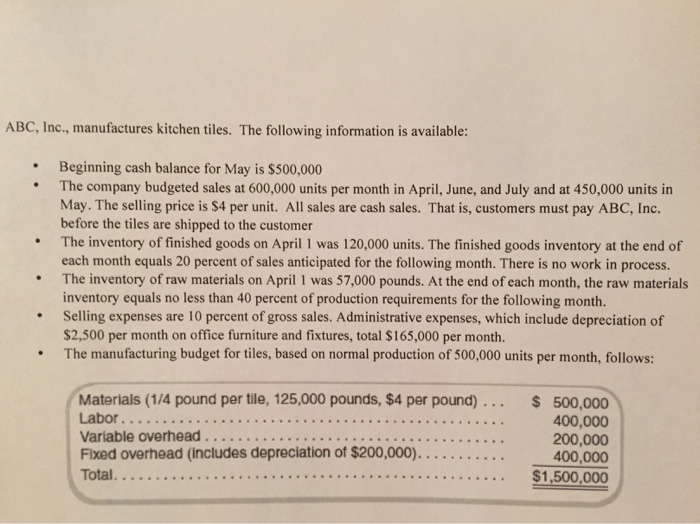

ABC. Inc., manufactures kitchen tiles. The following information is available: Beginning cash balance for May is $500,000 The company budgeted sales at 600,000 units per month in April, June, and July and at 450,000 units in May. The selling price is $4 per unit. All sales are cash sales. That is, customers must pay ABC, Inc. before the tiles are shipped to the customer The inventory of finished goods on April 1 was 120,000 units. The finished goods inventory at the end of each month equals 20 percent of sales anticipated for the following month. There is no work in process. The inventory of raw materials on April 1 was 57,000 pounds. At the end of each month, the raw materials inventory' equals no less than 40 percent of production requirements for the following month. Selling expenses are 10 percent of gross sales. Administrative expenses, which include depreciation of $2, 500 per month on office furniture and fixtures, total $165,000 per month. The manufacturing budget for tiles, based on normal production of 500,000 units per month, follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started