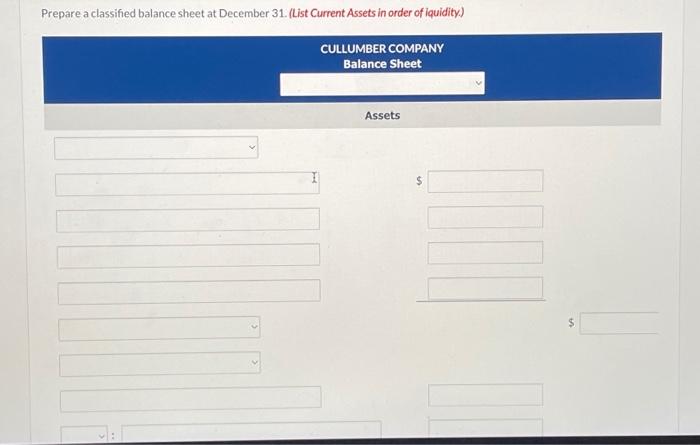

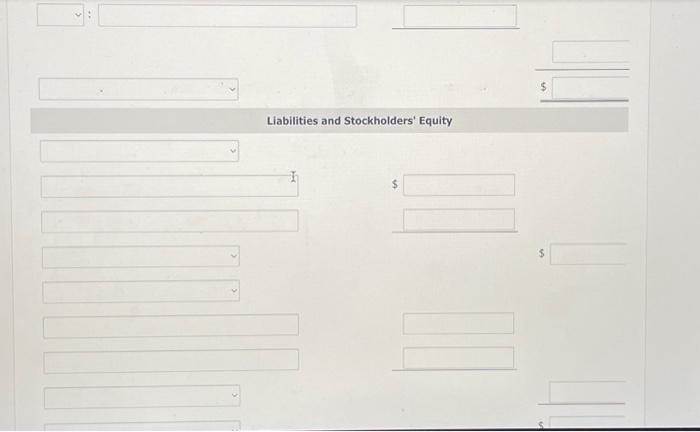

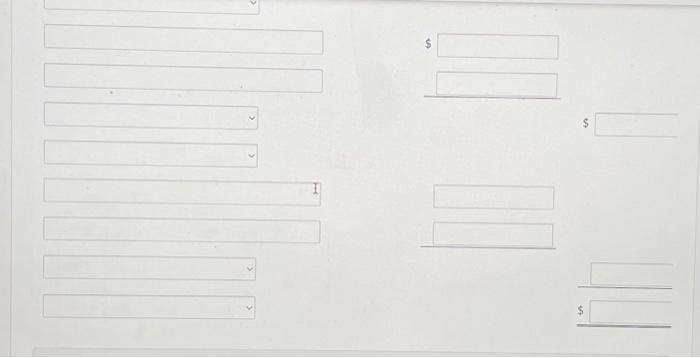

Prepare a classified balance sheet at December 31. (List current assers in order of liquidity)

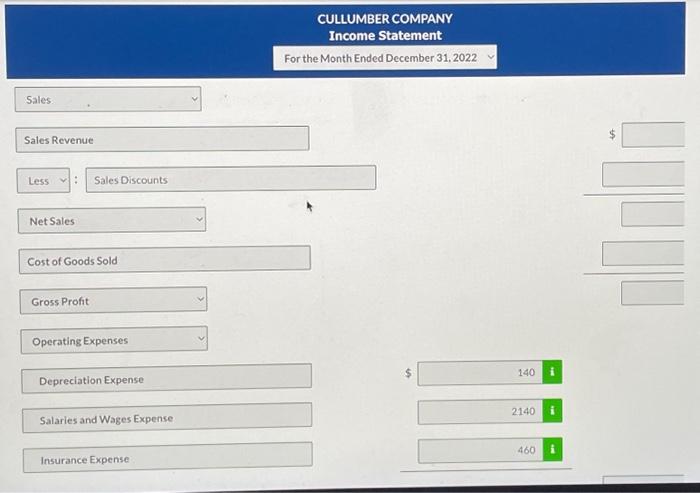

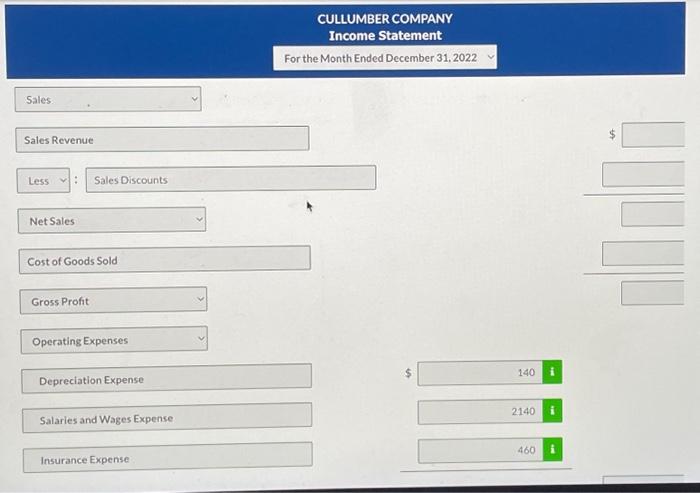

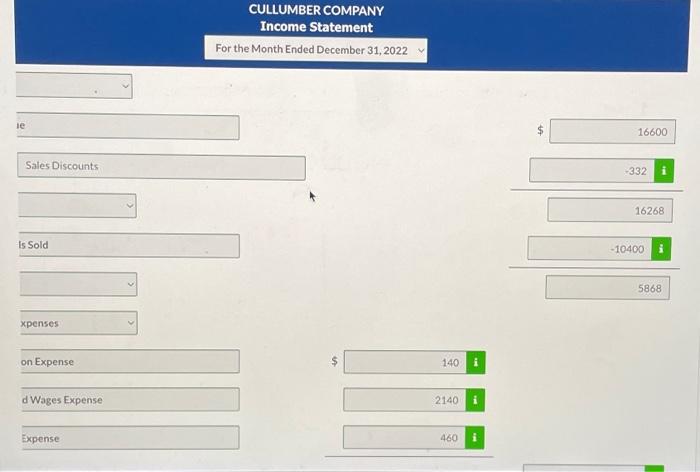

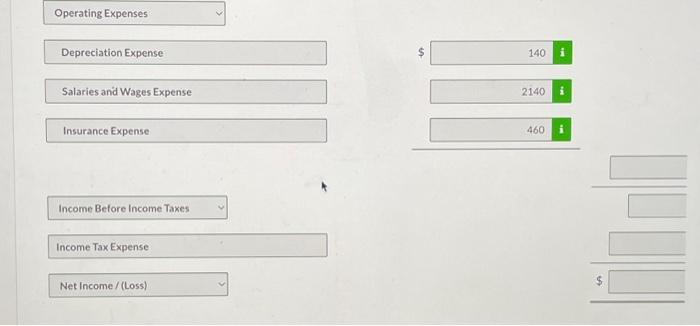

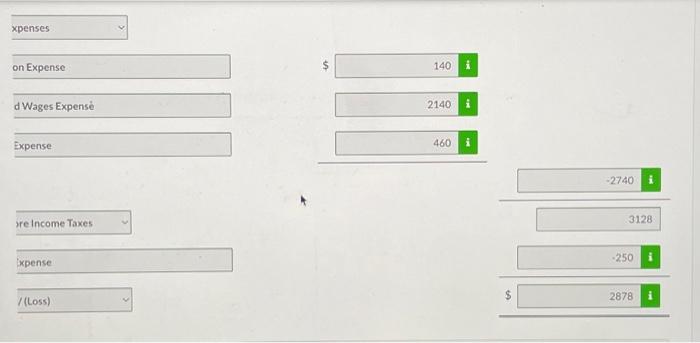

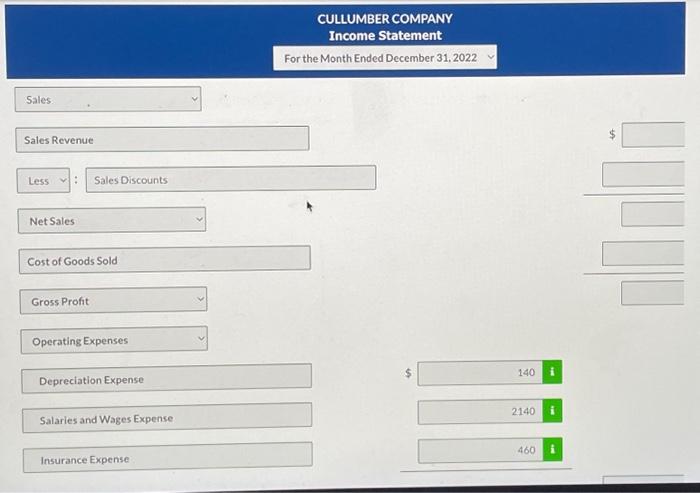

CULLUMBER COMPANY Income Statement For the Month Ended December 31, 2022 Sales: Sales Revenue Less : Sales Discounts Net Sales Cost of Goods Sold Gross Profit Operating Expenses Depreciation Expense $ [140 i Salaries and Wages Expense 2140 Insurance Expense CULLUMBER COMPANY Income Statement For the Month Ended December 31, 2022 ie $16600 Sales Discounts Is Sold 5868 xpenses on Expense $ 140 i d Wages Expense 2140 16268 10400 i +332 i 16268 \begin{tabular}{|r|} \hline-10400 \\ \hline 5868 \\ \hline \end{tabular} d Wages Expense 2140 Expense \begin{tabular}{|l|l|} \hline 460 & i \\ \hline \end{tabular} Operating Expenses Depreciation Expense $ 140 Salaries and Wages Expense \begin{tabular}{|l|l|} \hline 2140 & i \\ \hline \end{tabular} Insurance Expense 460 Income Before Income Taxes Income Tax Expense Net Income / (Loss) xpenses on Expense $140 i dWages Expens \begin{tabular}{|r|r|} \hline 2140 & i \\ \hline 460 & i \\ \hline \end{tabular} Expense \begin{tabular}{rr|} \hline-2740 & i \\ \hline 3128 \\ \hline \end{tabular} relncome Taxes ixpense \begin{tabular}{|c|c|c|} \hline & -250 & i \\ \hline$ & 2878 & i \\ \hline \end{tabular} Prepare a classified balance sheet at December 31. (List Current Assets in order of lquidity.) Liabilities and Stockholders' Equity $ $ CULLUMBER COMPANY Income Statement For the Month Ended December 31, 2022 Sales: Sales Revenue Less : Sales Discounts Net Sales Cost of Goods Sold Gross Profit Operating Expenses Depreciation Expense $ [140 i Salaries and Wages Expense 2140 Insurance Expense CULLUMBER COMPANY Income Statement For the Month Ended December 31, 2022 ie $16600 Sales Discounts Is Sold 5868 xpenses on Expense $ 140 i d Wages Expense 2140 16268 10400 i +332 i 16268 \begin{tabular}{|r|} \hline-10400 \\ \hline 5868 \\ \hline \end{tabular} d Wages Expense 2140 Expense \begin{tabular}{|l|l|} \hline 460 & i \\ \hline \end{tabular} Operating Expenses Depreciation Expense $ 140 Salaries and Wages Expense \begin{tabular}{|l|l|} \hline 2140 & i \\ \hline \end{tabular} Insurance Expense 460 Income Before Income Taxes Income Tax Expense Net Income / (Loss) xpenses on Expense $140 i dWages Expens \begin{tabular}{|r|r|} \hline 2140 & i \\ \hline 460 & i \\ \hline \end{tabular} Expense \begin{tabular}{rr|} \hline-2740 & i \\ \hline 3128 \\ \hline \end{tabular} relncome Taxes ixpense \begin{tabular}{|c|c|c|} \hline & -250 & i \\ \hline$ & 2878 & i \\ \hline \end{tabular} Prepare a classified balance sheet at December 31. (List Current Assets in order of lquidity.) Liabilities and Stockholders' Equity $ $