Prepare a Classified Balance Sheet on the proper worksheet as of 12/31/11. Your Statement should be formatted. You should use formulas in all cells, not constant numbers.

If possible, please include the formulas you used to get the numbers, I have a hard time using excel, so any example of the formulas would greatly help my understanding of the program. Thank you!

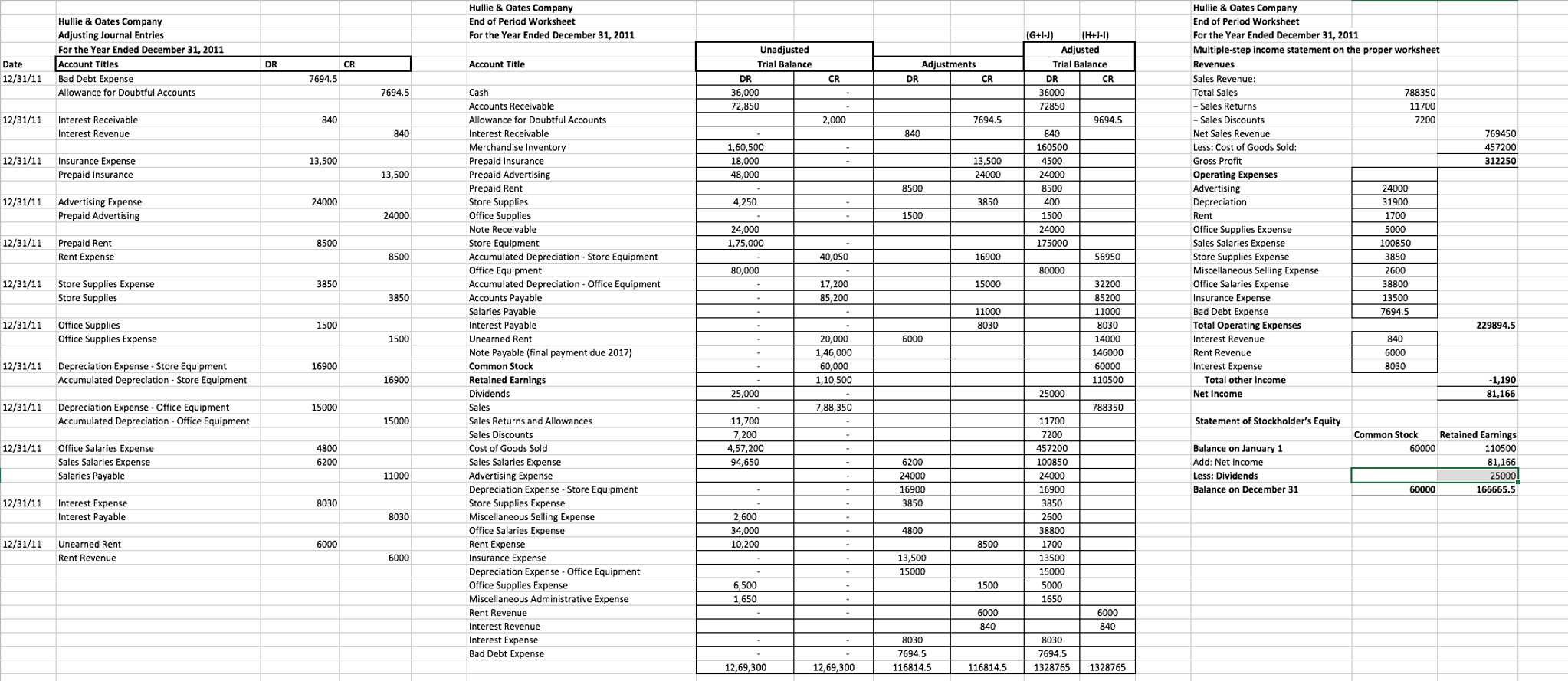

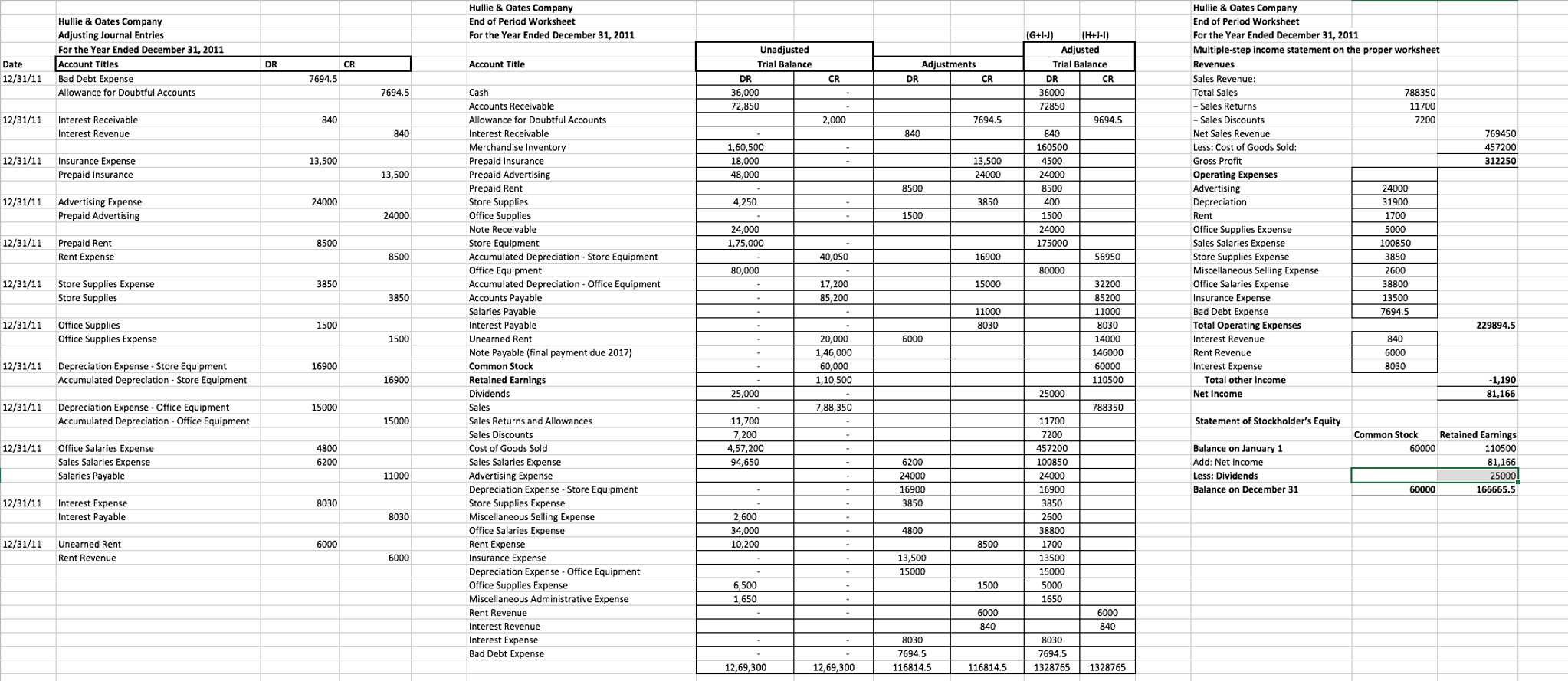

Hullie loantes company Hullile & Oates company Hullie & oates company End of Period work sheet End of Period works heet Adjusting Journal Entries For the Year Ended December 3 (GH) RIHH-) For the Year Ended December 31, 2011 Statement prop Revenues Account Titles Account Title Trial Balance Adjustments 12/31/11 Bad Debt Expense Allowance for Doubtful Accounts 7694,5 cash 36.000 36000 Total sales 788350 Accounts Receivable 72, 850 72 850 Sales Returns 11700 12/31/11 Interest Receivabl Interest Revenue 840 Interest Receivable 840 840 Nett sales Revenue 769450 Merchandise inventory 1.600,500 160500 Less: Cost of Goods sold: 457200 12/31/11 Insurance Expense 13,500 Prepaid Insurance 18000 13.S00 4500 Gross Profit 312250 Operating Expenses 48,000 12/31/11 Advertising Expense 24000 store supplies 4250 3850 4000 Note Receivable 240000 24000 Office Supplies Expense 5000 12/31/11 Prepaid Rent 8500 Store Equipment 175.000 175000 sales salaries Expense 100850 office Equipment 80,000 800000 Miscellaneous selling Expense 2600 12/31/11 Store supplies Expense 3850 Accumulated Depreciation Office Equipment 17200 15000 32200 office salaries Expense 38800 Accoun 12/31/11 office supplies 1500 Interest Payable 8030 8030 Total Operating Expenses 22989 4.5 office supplies Expense 1500 unearned Rent 20,000 6000 14000 Interest Revenu 840 Note Playable final payment due 2017) 1,46 000 146000 Rent Revenue 6000 12/31/11 Depreciation Expense Store Equipment 16900 Common Stock 60,000 60000 Interest Expense 8030 Accumulated Depreciation -store Equipment 16900 Retained Earnings 110500 110500 Total other income -1,190 Dividends 25,000 25000 Nett Income 1166 12/31/11 Depreciation Expense office Equipment 15000 sales 7,88350 788350 Accumulated Depreciation office Equipment 15000 sales Returns and Allowances 11,700 11700 Statement of Stockholder's Equity Common Stock Retained Earnings 12/31/11 office salaries Expense 4800 Cost of Goods Sold 457200 457200 Balance on January 1 60000 100850 11000 Advertising Expense 24000 24000 Less: Dividends Salaries Payable 25000 Balance on December 31 166665.5 12/31/11 Interest Expense 8030 Store supplies Expense 3850 33850 Interest payable 8030 Miscellaneous selling Expense 2,600 2600 office salaries Expense 34000 4800 388000 12/31/11 unearned Rent 6000 Rent Expense 10.200 8500 1700 6000 Insurance Expense 13,500 13500 Rent Revenue Depreciation Expense office equipment 15000 15000 office supplies Expense 6500 1500 Miscellaneous Administrative Expense 1.650 1650 Rent Revenue 6000 nterest Revenue 840 840 8030 8030 Interest Expense Bad Debt Expense 769 454 7694.5 12,69 R300 12, 69 300 1168 145 1168 14.54 132 8765 132 8765