Answered step by step

Verified Expert Solution

Question

1 Approved Answer

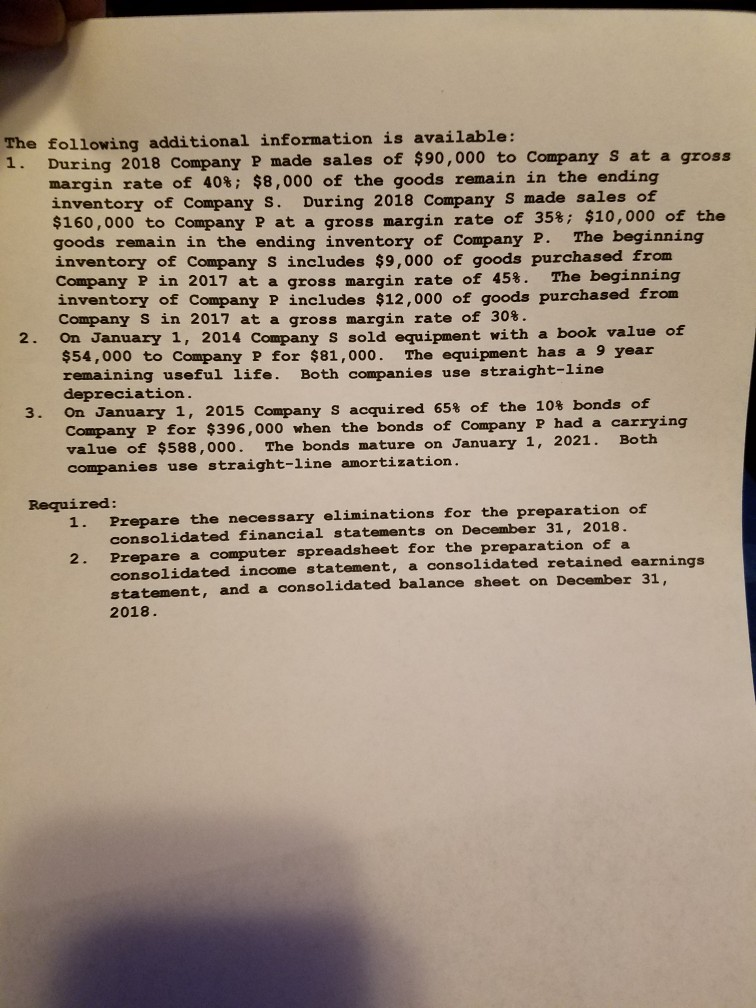

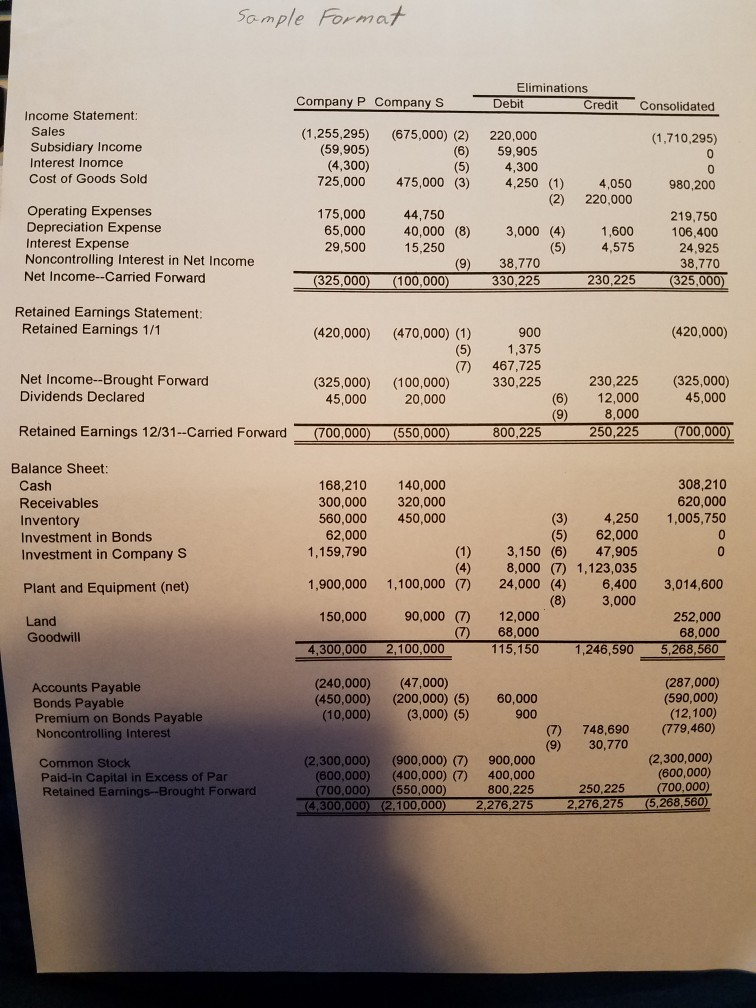

prepare a consolidated income statement, a consolidated retained earnings statement, and a consolidated balance sheet on December 31, 2018. (Sample Format) On January 1, 2014

prepare a consolidated income statement, a consolidated retained earnings statement, and a consolidated balance sheet on December 31, 2018.

(Sample Format)

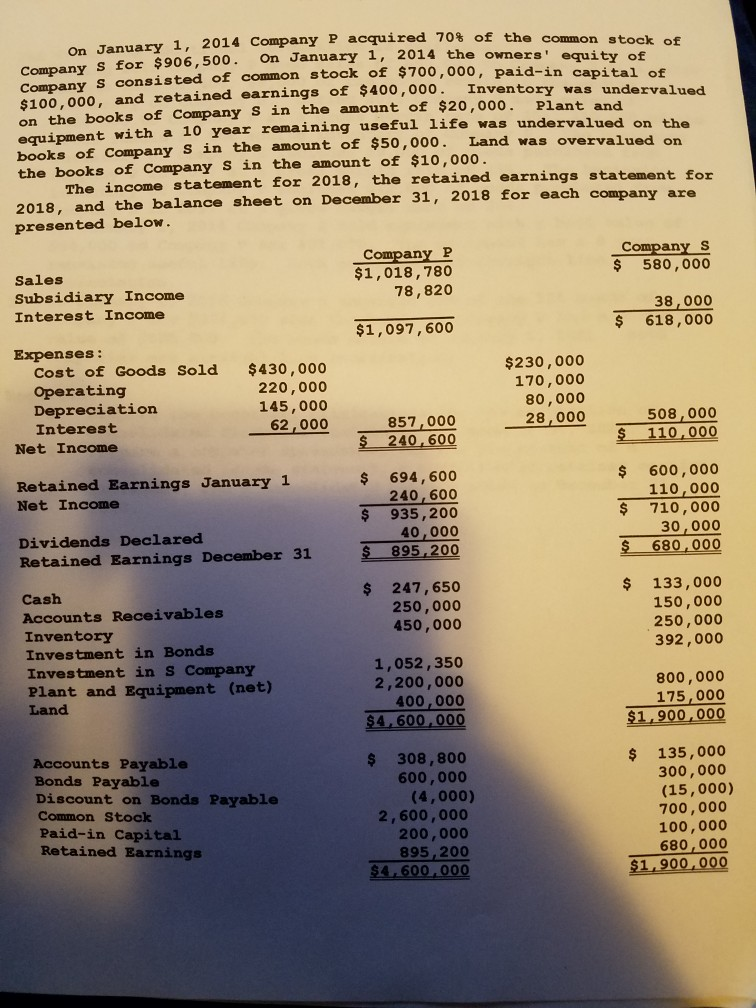

On January 1, 2014 Company P acquired 70% of the common stock of 1, 2014 the owners' equity of Company s for $906,500. On January Company s consisted of common stock of $700,000, paid-in $100,000, and retained earnings of $400,000 Inventory w on the books of Company s in the amount of $20,000. Plant equipment with a 10 year remaining useful life was books of Company S in the amount of $50,000. Land was over the books of Company S in the amount of $10,000o capital of was undervalued undervalued on the valued on The income statement for 2018, the retained earnings sta tement for 2018, and the balance sheet on December 31, 2018 for each presented below company are Sales Subsidiary Income Interest Income Company P $1,018,780 78,820 Company s $ 580,000 38,000 $ 618,000 $1,097,600 Expenses: Cost of Goods Sold $430,000 operating Depreciation Interest 220,000 145,000 62,000 $230,000o 170,000 80,000 28,000 857,000 508,000 Net Income 694,600 240,600 $ 935,200 40,000 $ 600,000 110,000 $ 710,000 30,000 Retained Earnings January 1 Net Income Dividends Declared Retained Earnings December 31 0 $ 247, 650 250,000 450,000 $ 133,000 150,000 250,000 392,000 Accounts Receivables Inventory Investment in Bonds Investment in S Company Plant and Equipment (net) Land 1,052,350 2,200,000 400,000 800,000 175,000 Accounts Payable Bonds Payable Discount on Bonds Payable Common Stock Paid-in Capital Retained Earnings $ 308,800 600,000 $ 135,000 300,000 (15,000) 700,000 100,000 680,000 (4,000) 2,600,000 200,000 895,200 On January 1, 2014 Company P acquired 70% of the common stock of 1, 2014 the owners' equity of Company s for $906,500. On January Company s consisted of common stock of $700,000, paid-in $100,000, and retained earnings of $400,000 Inventory w on the books of Company s in the amount of $20,000. Plant equipment with a 10 year remaining useful life was books of Company S in the amount of $50,000. Land was over the books of Company S in the amount of $10,000o capital of was undervalued undervalued on the valued on The income statement for 2018, the retained earnings sta tement for 2018, and the balance sheet on December 31, 2018 for each presented below company are Sales Subsidiary Income Interest Income Company P $1,018,780 78,820 Company s $ 580,000 38,000 $ 618,000 $1,097,600 Expenses: Cost of Goods Sold $430,000 operating Depreciation Interest 220,000 145,000 62,000 $230,000o 170,000 80,000 28,000 857,000 508,000 Net Income 694,600 240,600 $ 935,200 40,000 $ 600,000 110,000 $ 710,000 30,000 Retained Earnings January 1 Net Income Dividends Declared Retained Earnings December 31 0 $ 247, 650 250,000 450,000 $ 133,000 150,000 250,000 392,000 Accounts Receivables Inventory Investment in Bonds Investment in S Company Plant and Equipment (net) Land 1,052,350 2,200,000 400,000 800,000 175,000 Accounts Payable Bonds Payable Discount on Bonds Payable Common Stock Paid-in Capital Retained Earnings $ 308,800 600,000 $ 135,000 300,000 (15,000) 700,000 100,000 680,000 (4,000) 2,600,000 200,000 895,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started