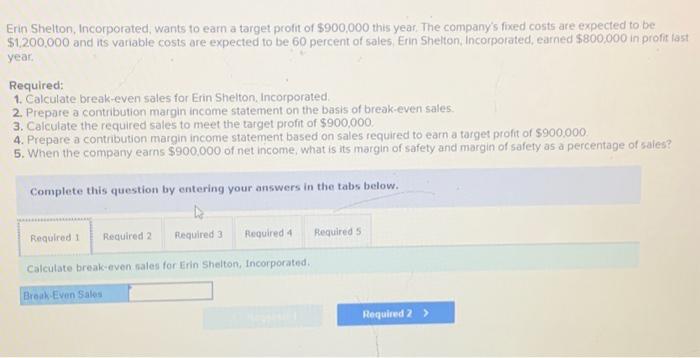

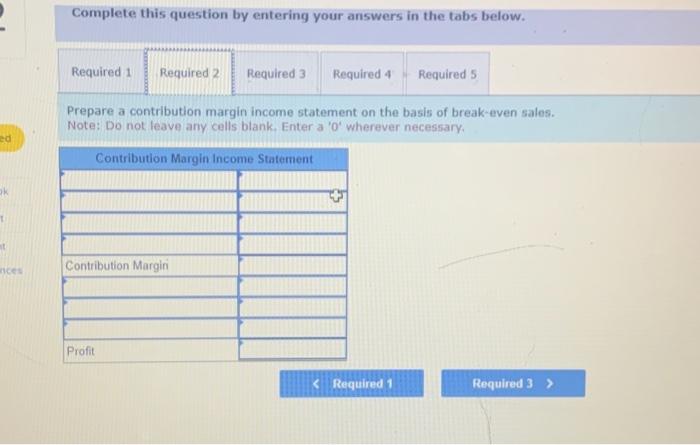

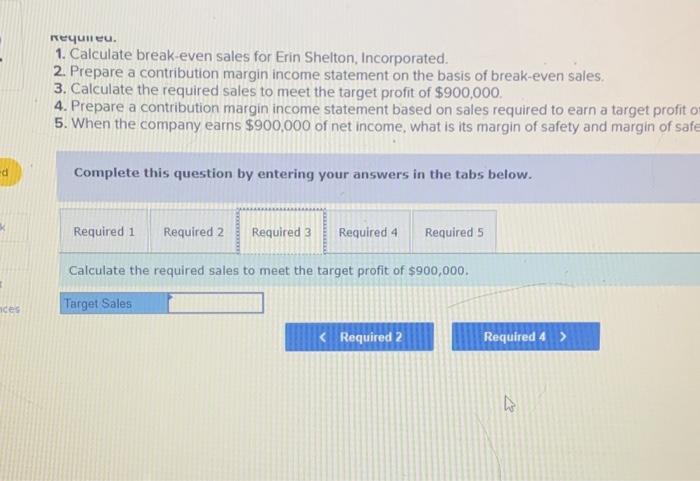

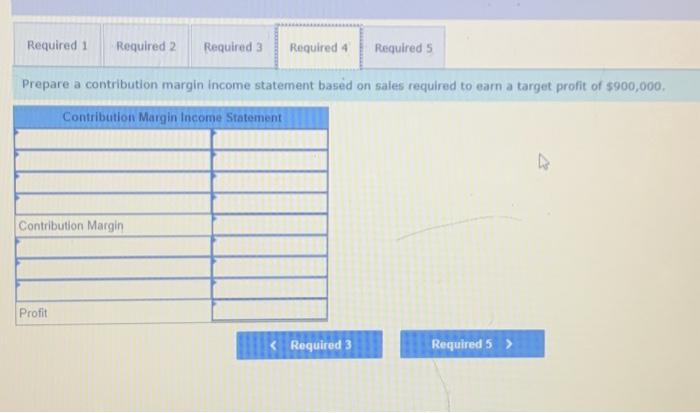

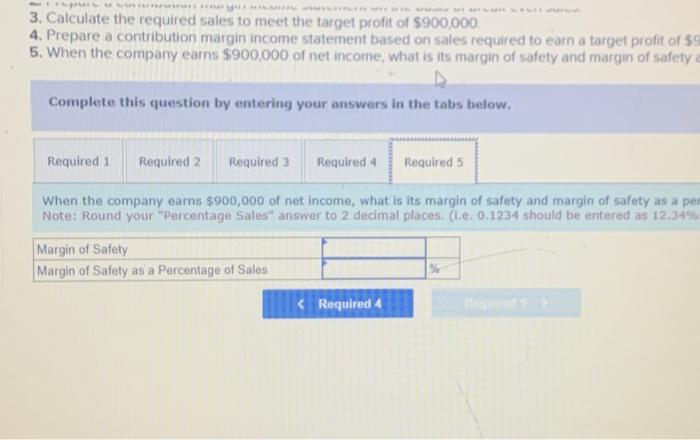

Prepare a contribution margin income statement based on saies required to earn a target profit of $900,000. Complete this question by entering your answers in the tabs below. Prepare a contribution margin income statement on the basis of break-even sales. Note: Do not leave any cells blank, Enter a ' 0 ' wherever necessary. 1. Calculate break-even sales for Erin Shelton, Incorporated. 2. Prepare a contribution margin income statement on the basis of break-even sales. 3. Calculate the required sales to meet the target profit of $900,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit 0 5. When the company earns $900,000 of net income, what is its margin of safety and margin of safe Complete this question by entering your answers in the tabs below. Calculate the required sales to meet the target profit of $900,000. 3. Calculate the required sales to meet the target profit of $900,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $ 5. When the company earns $900,000 of net income, what is its margin of safety and margin of safety Complete this question by entering your answers in the tabs below. When the company earns $900,000 of net income, what is its margin of safety and margin of safety as a pe Note: Round your "Percentage Sales" answer to 2 decimal places. (i.e. 0.1234 should be entered as 12.34 S Erin Shelton, Incorporated, wants to earn a target profit of $900,000 this year. The company's fixed costs are expected to be $1,200,000 and its variable costs are expected to be 60 percent of sales, Erin Shelton, Incorporated, earned $800,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Incorporated. 2. Prepare a contribution margin income statement on the basis of break-even sales. 3. Calculate the required sales to meet the target profit of $900,000 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $900,000. 5 . When the company earns $900,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Complete this question by entering your answers in the tabs below. Calculate break-even sales for Erin Sheiton, Incorporated