Prepare a cost estimate using the below format Appendix A? Also 2015-16 particulars of expenses are mentioned below in the cost estimate. Only amounts are

Prepare a cost estimate using the below format Appendix A? Also 2015-16 particulars of expenses are mentioned below in the "cost estimate". Only amounts are mentioned. What do the amounts pertain to?

***(This is the Appendix A): Format for Cost Estimate

Use these headings and add your own text, graphics and tables:

Identifying Information:

Overview:

Service Count:

Work Breakdown Structure: [This must be a graph.]

Work Breakdown Structure Description:

Cost Estimate Table: [This must be a table.]

Cost Estimate Explanation:

Offsets:

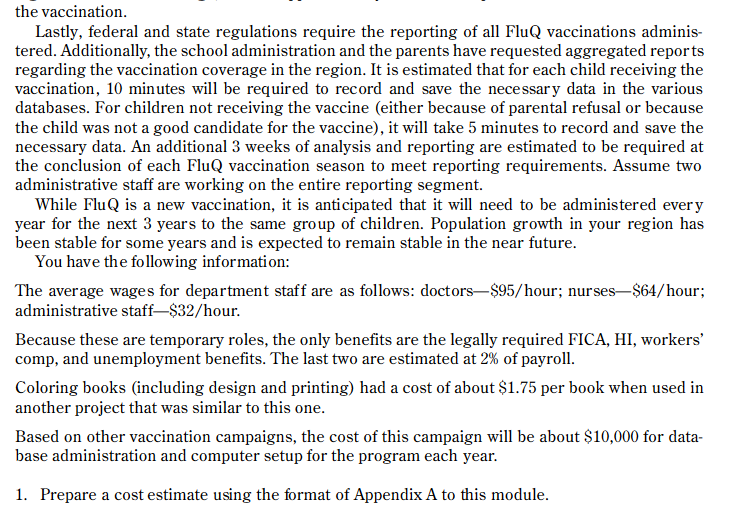

The following case is used with this assignment.

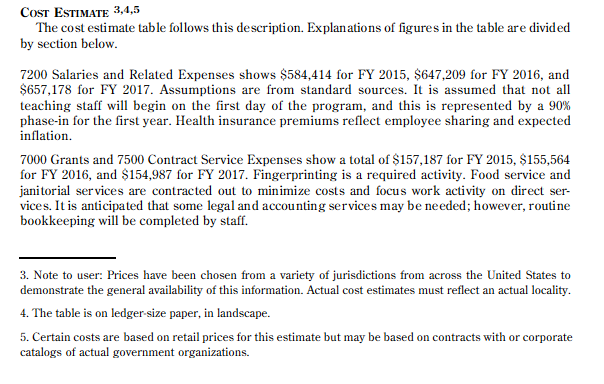

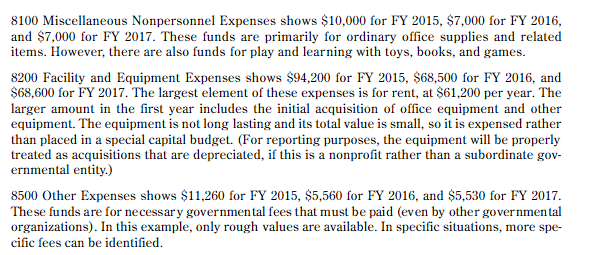

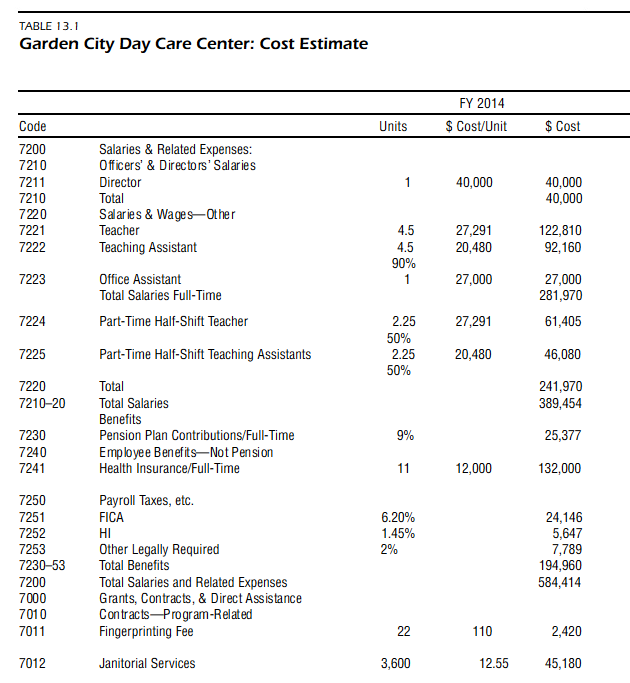

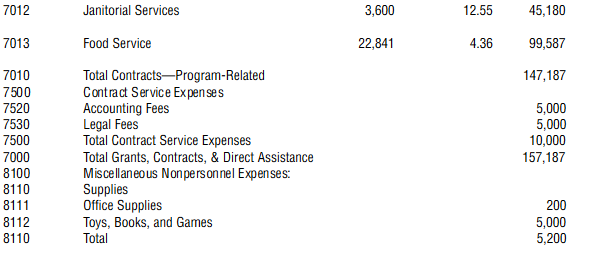

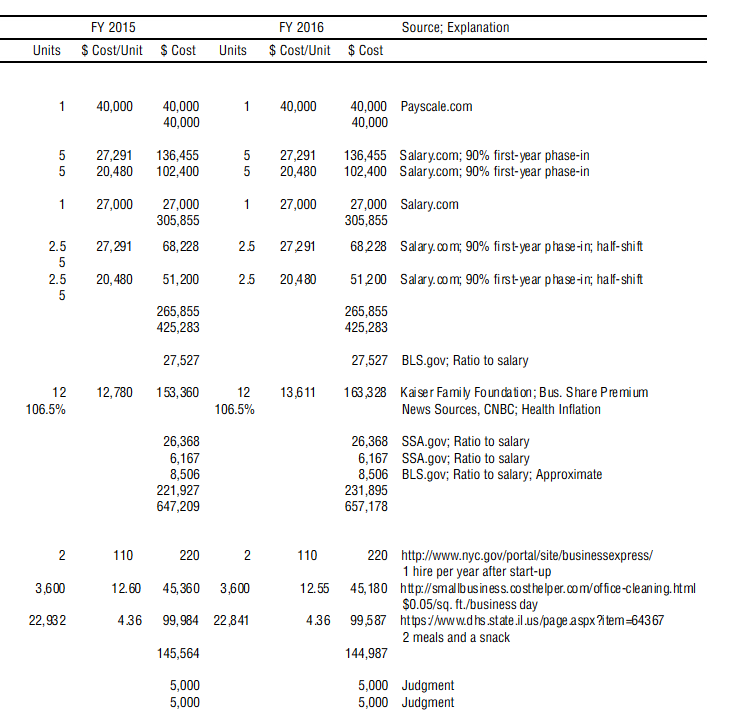

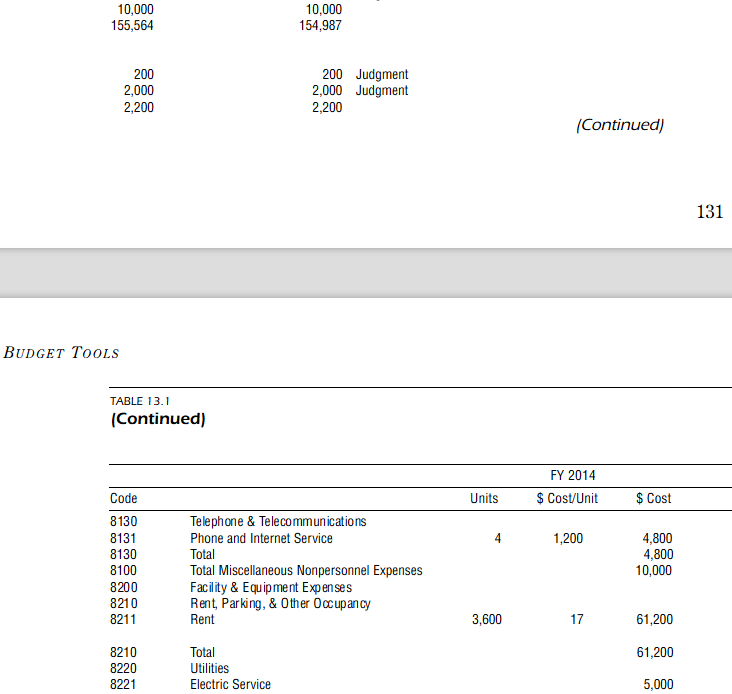

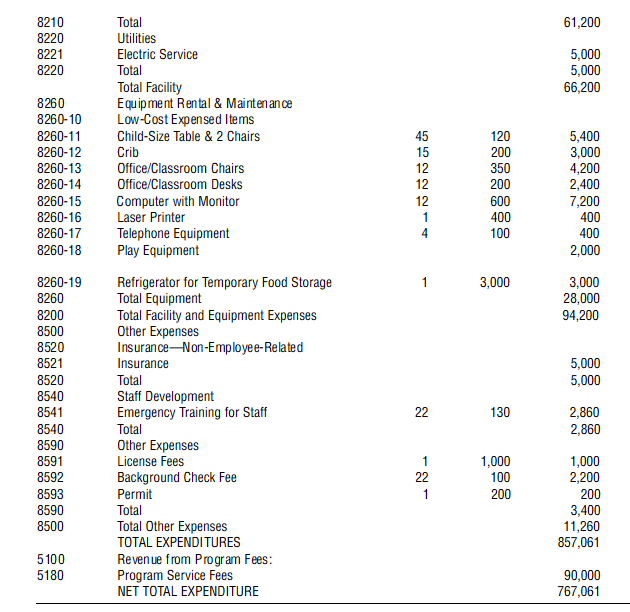

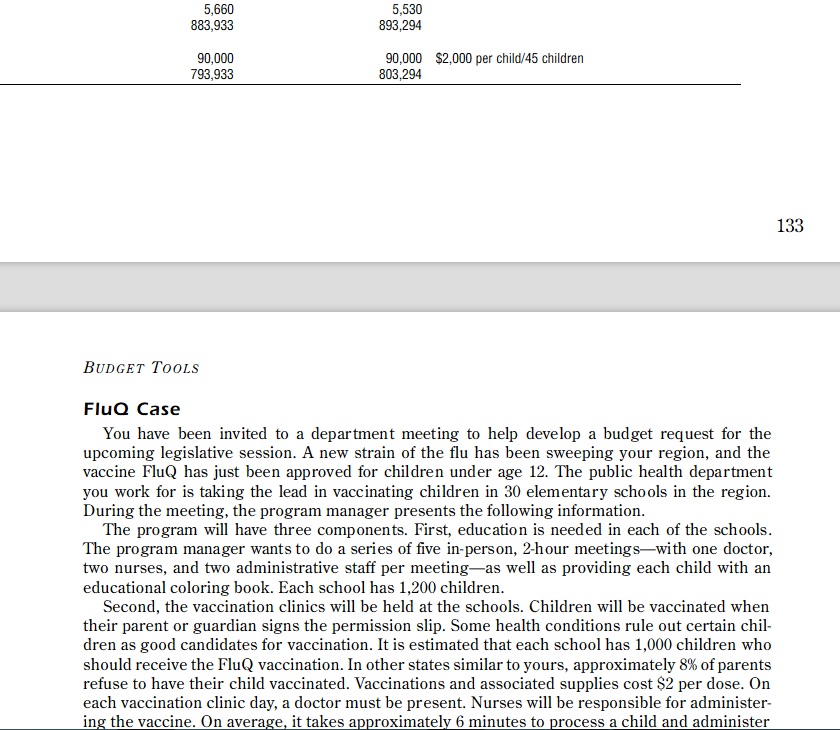

COST ESTIMATE 3.4.5 The cost estimate table follows this description. Explanations of figures in the table are divided by section below. 7200 Salaries and Related Expenses shows $584,414 for FY 2015, $647,209 for FY 2016, and $657,178 for FY 2017. Assumptions are from standard sources. It is assumed that not all teaching staff will begin on the first day of the program, and this is represented by a 90% phase-in for the first year. Health insurance premiums reflect employee sharing and expected inflation 7000 Grants and 7500 Contract Service Expenses show a total of $157,187 for FY 2015, $155,564 for FY 2016, and $154,987 for FY 2017. Fingerprinting is a required activity. Food service and janitorial services are contracted out to minimize costs and focus work activity on direct ser- vices. It is anticipated that some legal and accounting services may be needed; however, routine bookkeeping will be completed by staff. 3. Note to user: Prices have been chosen from a variety of jurisdictions from across the United States to demonstrate the general availability of this information. Actual cost estimates must reflect an actual locality. 4. The table is on ledger-size paper, in landscape. 5. Certain costs are based on retail prices for this estimate but may be based on contracts with or corporate catalogs of actual government organizations. COST ESTIMATE 3.4.5 The cost estimate table follows this description. Explanations of figures in the table are divided by section below. 7200 Salaries and Related Expenses shows $584,414 for FY 2015, $647,209 for FY 2016, and $657,178 for FY 2017. Assumptions are from standard sources. It is assumed that not all teaching staff will begin on the first day of the program, and this is represented by a 90% phase-in for the first year. Health insurance premiums reflect employee sharing and expected inflation 7000 Grants and 7500 Contract Service Expenses show a total of $157,187 for FY 2015, $155,564 for FY 2016, and $154,987 for FY 2017. Fingerprinting is a required activity. Food service and janitorial services are contracted out to minimize costs and focus work activity on direct ser- vices. It is anticipated that some legal and accounting services may be needed; however, routine bookkeeping will be completed by staff. 3. Note to user: Prices have been chosen from a variety of jurisdictions from across the United States to demonstrate the general availability of this information. Actual cost estimates must reflect an actual locality. 4. The table is on ledger-size paper, in landscape. 5. Certain costs are based on retail prices for this estimate but may be based on contracts with or corporate catalogs of actual government organizations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started