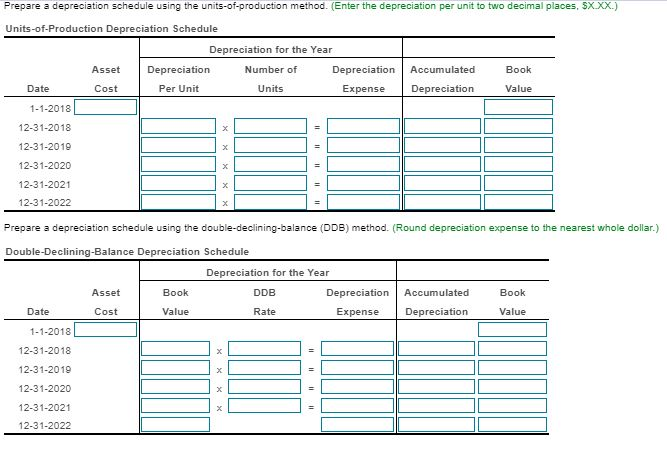

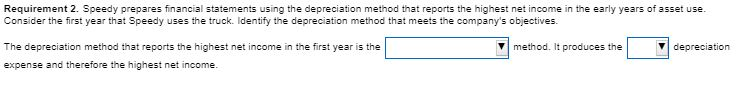

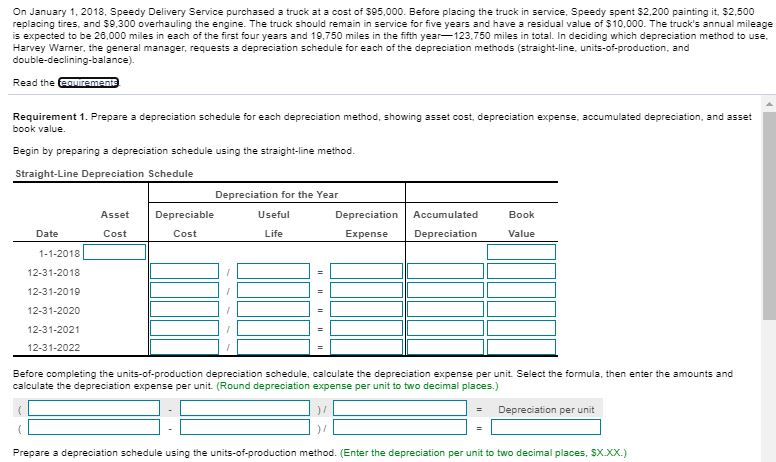

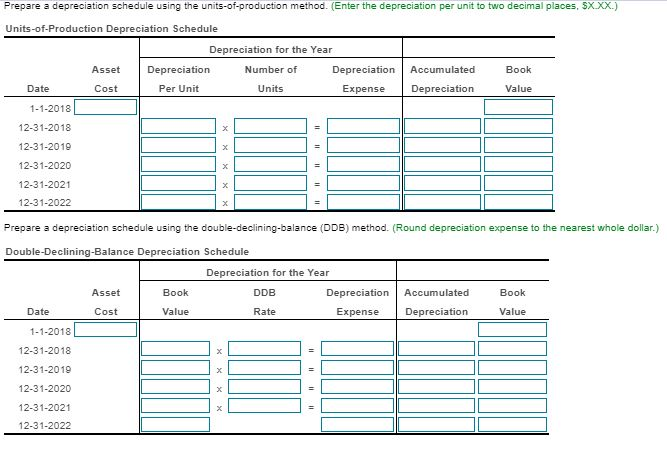

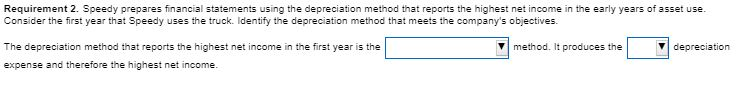

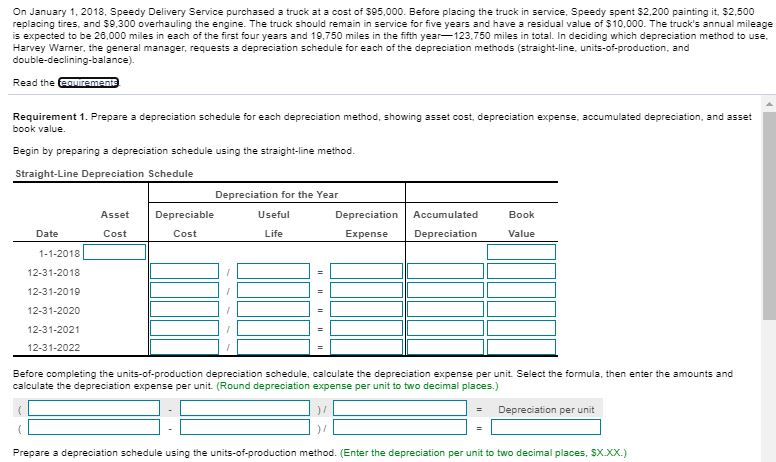

Prepare a depreciation schedule using the units-of-production method. (Enter the depreciation per unit to two decimal places, SX.XX.) Units-of-Production Depreciation Schedule Asset Depreciation for the Year Depreciation Number of Depreciation Per Unit Units Expense Accumulated Book Date Cost Depreciation Value 1-1-2018 12-31-2018 12-31-2019 x x 12-31-2020 12-31-2021 12-31-2022 Prepare a depreciation schedule using the double-declining-balance (DDB) method. (Round depreciation expense to the nearest whole dollar.) Double-Declining-Balance Depreciation Schedule Depreciation for the Year Asset Book DDB Depreciation Accumulated Book Date Cost Value Rate Expense Depreciation Value 1-1-2018 12-31-2018 x 12-31-2010 x 12-31-2020 12-31-2021 X 12-31-2022 Requirement 2. Speedy prepares financial statements using the depreciation method that reports the highest net income in the early years of asset use. Consider the first year that Speedy uses the truck. Identify the depreciation method that meets the company's objectives. method. It produces the depreciation The depreciation method that reports the highest net income in the first year is the expense and therefore the highest net income. On January 1, 2018, Speedy Delivery Service purchased a truck at a cost of $95.000. Before placing the truck in service, Speedy spent $2.200 painting it. $2.500 replacing tires, and $9.300 overhauling the engine. The truck should remain in service for five years and have a residual value of $10,000. The truck's annual mileage is expected to be 26,000 miles in each of the first four years and 19,750 miles in the fifth year-123.750 miles in total. In deciding which depreciation method to use, Harvey Warner, the general manager, requests a depreciation schedule for each of the depreciation methods (straight-line, units-of-production, and double-declining-balance). Read the equirements Requirement 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense accumulated depreciation, and asset book value Begin by preparing a depreciation schedule using the straight-line method. Straight-Line Depreciation Schedule Depreciation for the Year Asset Depreciable Useful Book Depreciation Expense Accumulated Depreciation Date Cost Cost Life Value 1-1-2018 12-31-2018 12-31-2019 12-31-2020 12-31-2021 12-31-2022 Before completing the units-of-production depreciation schedule, calculate the depreciation expense per unit Select the formula, then enter the amounts and calculate the depreciation expense per unit. (Round depreciation expense per unit to two decimal places.) 37 Depreciation per unit )/ Prepare a depreciation schedule using the units-of-production method. (Enter the depreciation per unit to two decimal places, SX.XX.)