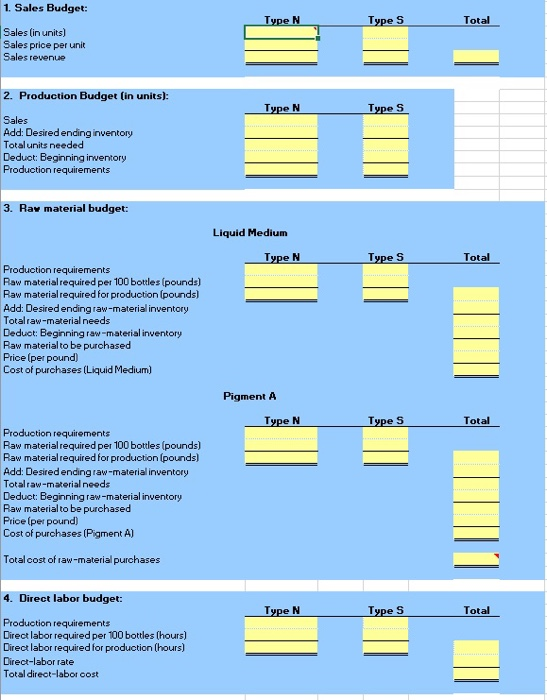

Prepare a master budget for V & T Faces, Inc., for the next year. Assume an income tax rate of 40 percent. Include the following:

Sales budget

Production budget

Direct-material budget

Direct-labor budget

please use attached budget template

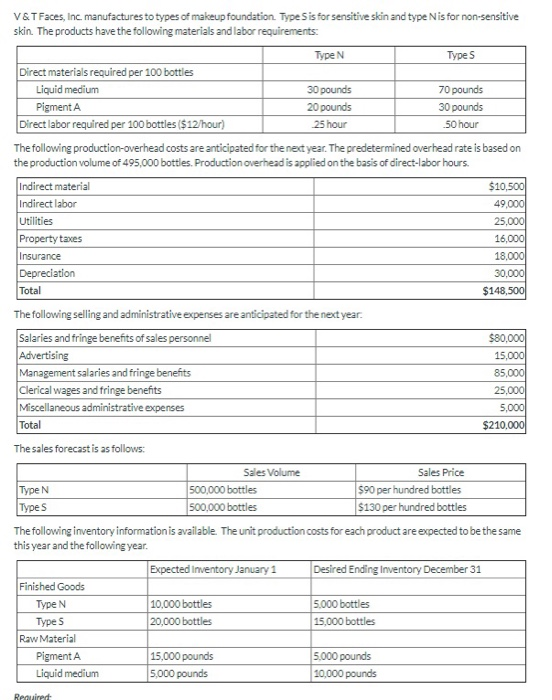

V&T Faces, Inc. manufactures to types of makeup foundation Type Sis for sensitive skin and type Nis for non-sensitive skin. The products have the following materials and labor requirements: Type N Types Direct materials required per 100 bottles Liquid medium 30 pounds 70 pounds Pigmenta 20 pounds 30 pounds Direct labor required per 100 bottles ($12/hour) 25 hour 50 hour The following production-overhead costs are anticipated for the next year. The predetermined overhead rate is based on the production volume of 495,000 bottles. Production overhead is applied on the basis of direct-labor hours. Indirect material $10,500 Indirect labor 49,000 Utilities 25,000 Property taxes 16,000 Insurance 18,000 Depreciation 30,000 Total $148,500 The following selling and administrative expenses are anticipated for the next year. Salaries and fringe benefits of sales personnel $80,000 Advertising 15,000 Management salaries and fringe benefits 85,000 Clerical wages and fringe benefits 25.000 Miscellaneous administrative expenses 5,000 Total $210,000 The sales forecast is as follows: Sales Volume Sales Price Type N 500,000 bottles $90 per hundred bottles Types 500,000 bottles $130 per hundred bottles The following inventory information is available. The unit production costs for each product are expected to be the same this year and the following year. Expected Inventory January 1 Desired Ending Inventory December 31 Finished Goods Type N 10,000 bottles 5.000 bottles Types 20,000 bottles 15,000 bottles Raw Material Pigment A 15,000 pounds 5.000 pounds Liquid medium 5.000 pounds 10,000 pounds Required Type N Type S Total 1. Sales Budget Sales (in units) Sales price per unit Sales revenue 2. Production Budget (in units): Type N Type S Sales Add: Desired ending inventory Total units needed Deduct: Beginning inventory Production requirements 3. Rav material budget: Liquid Medium Type N Type S Total Production requirements Raw material required per 100 bottles (pounds) Raw material required for production (pounds) Add: Desired ending raw-material inventory Totalraw-material needs Deduct: Beginning raw material inventory Raw material to be purchased Price (per pound) Cost of purchases (Liquid Medium) Pigment A Type N Type Total Production requirements Raw material required per 100 bottles (pounds) Raw material required for production (pounds) Add: Desired ending raw-material inventory Totalraw-material needs Deduct: Beginning raw material inventory Raw material to be purchased Price (per pound) Cost of purchases (Pigment A) Total cost of raw material purchases Type N Types Total 4. Direct labor budget: Production requirements Direct labor required per 100 bottles (hours) Direct labor required for production (hours) Direct-labor rate Total direct-labor cost