prepare a memo summarizing your analysis of Quick Companys financial performance

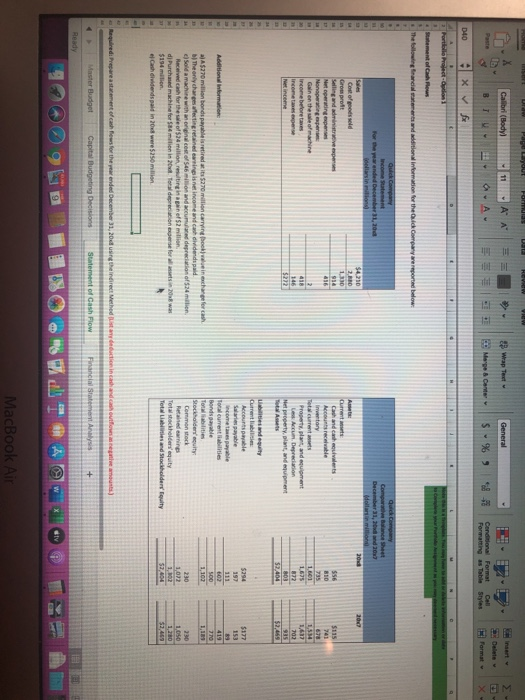

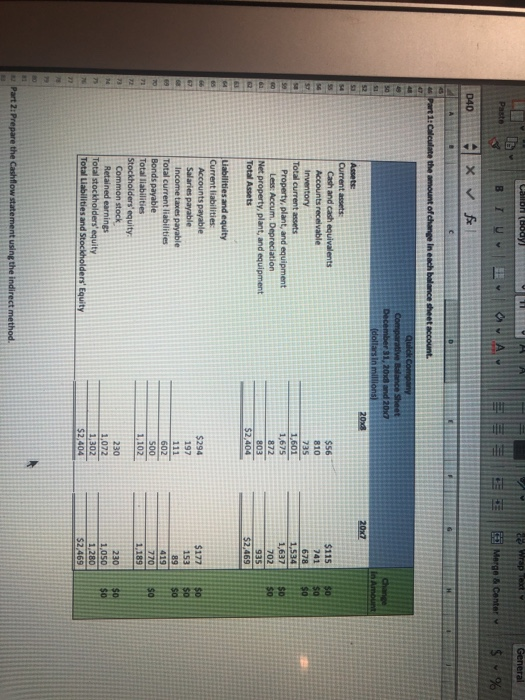

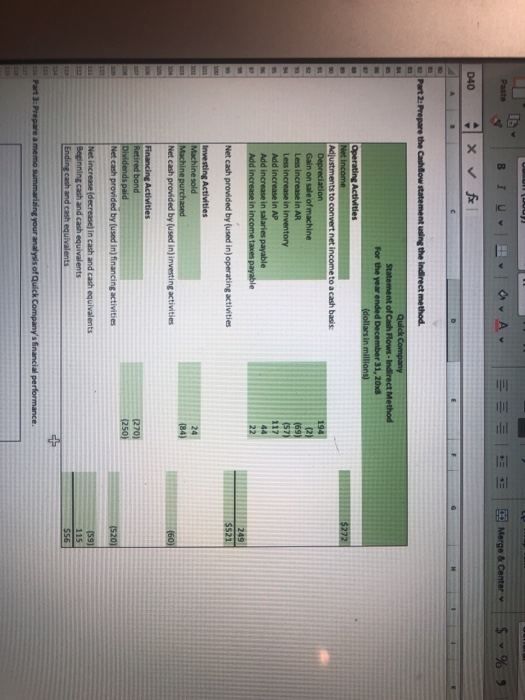

Lot Format Rev View AAS W Calibri (Body BIM x fax 11 A rap Test General Mapeams % * Formatting as Table Styles Format ante D40 X- Portfolio P o tion Statement of Chow The following financial atements and additional information for the Quick Company are eported be For the year ended December 31,200 non Quick Company Comparative Balance Sheet December, 201707 olim Cost of goods sold cash and c u Selling and ad v eepers Net operating expenses Monoperating per Gainen the sale of machine incomeberetes income net income Totalcrentes Property, plant, and equipment Les cum Depreciation Net property, plant, and equipment To sets bities and equity Accounts payable Addition formation income taxes payable Total current liabilities Bondsayable A $270 million bonds payable retired at its $270 million carrying ockwein charge for cas The only charges affecting retained earning is net income and cash dividend paid Soda machine with engine coo n and depreciation of $24 milion Received cash for these won ing in an ef$2 million di Purchased machine form ation in 20 Total depreciation for $194 milion cash dividends paldinou were $ 250 million Stockholdersuit Common stock Retained earning Total stockholders' equity Total e s and holders quity Required. Prepare a statement of cashews for the ended December 31, 20 using the indirect Methodist Master Budget Capital Budgeting Desi S tatement of Cash Flow Financial Statement Analysis Ready 999 TWIN MacBook Air BU 1 x fe A ce Wrap Toot Marge & Conter General $ % art 1: Calculate the amount of change in each balance sheet account Quick Company Comparative Balance Sheet December 31, 20 and 2017 (dollarsin millions Change $56 Assett Current assets Cash and cash equivalents Accounts receivable Inventory Total current assets Property, plant, and equipment Less: Accum. Depreciation Net property, plant, and equipment Total Assets 702 $2,404 Liabilities and equity Current liabilities: Accounts payable Salaries payable Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders'equity Common stock Retained earnings Total stockholders' equity Total Liabilities and Stockholders' Equity 500 1,102 189 230 1,072 1,302 $2,404 1,050 1,280 $2,469 Part 2: Prepare the Cashflow statement using the Indirect method. Pasta & O AN E Merge & Centar $ % BID fe D40 x $272 Part 2: Prepare the Cashflow statement using the Indirect method. Quick Company Statement of Cash Flows-Indirect Method For the year ended December 31, 2014 (dollars in millions) Operating Activities Net Income Adjustments to convert net income to a cash basis Depreciation Gain on sale of machine Less increase in AR Less increase in Inventory Add increase in AP Add increase in salaries payable Add increase in income taxes payable Net cash provided by used in) operating activities Investing Activities Machine sold Machine purchased Net cash provided by used in) investing activities Financing Activities Retired bond Dividends paid Net cash provided by used in)financing activities (270) (250) 1520 Net increase (decrease in cash and cash equivalents Beginning cash and cash equivalents Ending cash and cash equivalents Part 3: Prepare a memo summarizing your analysis of Quick Company's financial performance. Lot Format Rev View AAS W Calibri (Body BIM x fax 11 A rap Test General Mapeams % * Formatting as Table Styles Format ante D40 X- Portfolio P o tion Statement of Chow The following financial atements and additional information for the Quick Company are eported be For the year ended December 31,200 non Quick Company Comparative Balance Sheet December, 201707 olim Cost of goods sold cash and c u Selling and ad v eepers Net operating expenses Monoperating per Gainen the sale of machine incomeberetes income net income Totalcrentes Property, plant, and equipment Les cum Depreciation Net property, plant, and equipment To sets bities and equity Accounts payable Addition formation income taxes payable Total current liabilities Bondsayable A $270 million bonds payable retired at its $270 million carrying ockwein charge for cas The only charges affecting retained earning is net income and cash dividend paid Soda machine with engine coo n and depreciation of $24 milion Received cash for these won ing in an ef$2 million di Purchased machine form ation in 20 Total depreciation for $194 milion cash dividends paldinou were $ 250 million Stockholdersuit Common stock Retained earning Total stockholders' equity Total e s and holders quity Required. Prepare a statement of cashews for the ended December 31, 20 using the indirect Methodist Master Budget Capital Budgeting Desi S tatement of Cash Flow Financial Statement Analysis Ready 999 TWIN MacBook Air BU 1 x fe A ce Wrap Toot Marge & Conter General $ % art 1: Calculate the amount of change in each balance sheet account Quick Company Comparative Balance Sheet December 31, 20 and 2017 (dollarsin millions Change $56 Assett Current assets Cash and cash equivalents Accounts receivable Inventory Total current assets Property, plant, and equipment Less: Accum. Depreciation Net property, plant, and equipment Total Assets 702 $2,404 Liabilities and equity Current liabilities: Accounts payable Salaries payable Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders'equity Common stock Retained earnings Total stockholders' equity Total Liabilities and Stockholders' Equity 500 1,102 189 230 1,072 1,302 $2,404 1,050 1,280 $2,469 Part 2: Prepare the Cashflow statement using the Indirect method. Pasta & O AN E Merge & Centar $ % BID fe D40 x $272 Part 2: Prepare the Cashflow statement using the Indirect method. Quick Company Statement of Cash Flows-Indirect Method For the year ended December 31, 2014 (dollars in millions) Operating Activities Net Income Adjustments to convert net income to a cash basis Depreciation Gain on sale of machine Less increase in AR Less increase in Inventory Add increase in AP Add increase in salaries payable Add increase in income taxes payable Net cash provided by used in) operating activities Investing Activities Machine sold Machine purchased Net cash provided by used in) investing activities Financing Activities Retired bond Dividends paid Net cash provided by used in)financing activities (270) (250) 1520 Net increase (decrease in cash and cash equivalents Beginning cash and cash equivalents Ending cash and cash equivalents Part 3: Prepare a memo summarizing your analysis of Quick Company's financial performance