Answered step by step

Verified Expert Solution

Question

1 Approved Answer

One day in March 2013, John Sutherland, industrial commissioner for the cityse South Elk, received a telephone call from Nick Faranda, president of Anderson

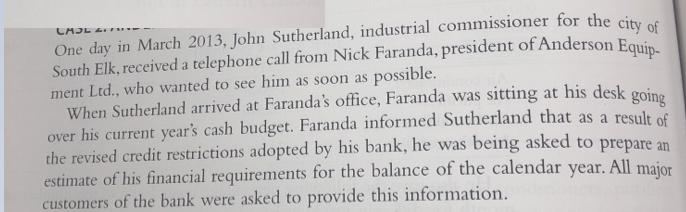

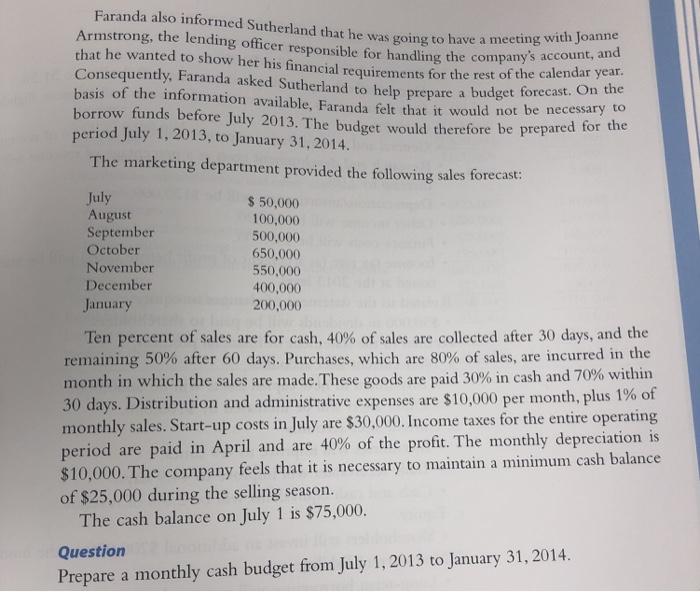

One day in March 2013, John Sutherland, industrial commissioner for the cityse South Elk, received a telephone call from Nick Faranda, president of Anderson Equin ment Ltd., who wanted to see him as soon as possible. When Sutherland arrived at Faranda's office, Faranda was sitting at his desk goine over his current year's cash budget. Faranda informed Sutherland that as a result of the revised credit restrictions adopted by his bank, he was being asked to prepare an estimate of his financial requirements for the balance of the calendar customers of the bank were asked to provide this information. CAJL L year. All major Armstrong, the lending officer responsible for handling the company's account, and Faranda also informed Sutherland that he was going to have a meeting with Joam that he wanted to show her his financial requirements for the rest of the calendar year. Consequently, Faranda asked Sutherland to help prepare a budget forecast. On the basis of the information available, Faranda felt that it would not be necessary to borrow funds before July 2013. The budget would therefore be prepared for the period July 1, 2013, to January 31, 2014. The marketing department provided the following sales forecast: July August September October $ 50,000 100,000 500,000 650,000 550,000 400,000 200,000 November December January Ten percent of sales are for cash, 40% of sales are collected after 30 days, and the remaining 50% after 60 days. Purchases, which are 80% of sales, are incurred in the month in which the sales are made. These goods are paid 30% in cash and 70% within 30 days. Distribution and administrative expenses are $10,000 per month, plus 1% of monthly sales. Start-up costs in July are $30,000. Income taxes for the entire operating period are paid in April and are 40% of the profit. The monthly depreciation is $10,000. The company feels that it is necessary to maintain a minimum cash balance of $25,000 during the selling season. The cash balance on July 1 is $75,000. Question Prepare a monthly cash budget from July 1, 2013 to January 31, 2014.

Step by Step Solution

★★★★★

3.51 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started