Answered step by step

Verified Expert Solution

Question

1 Approved Answer

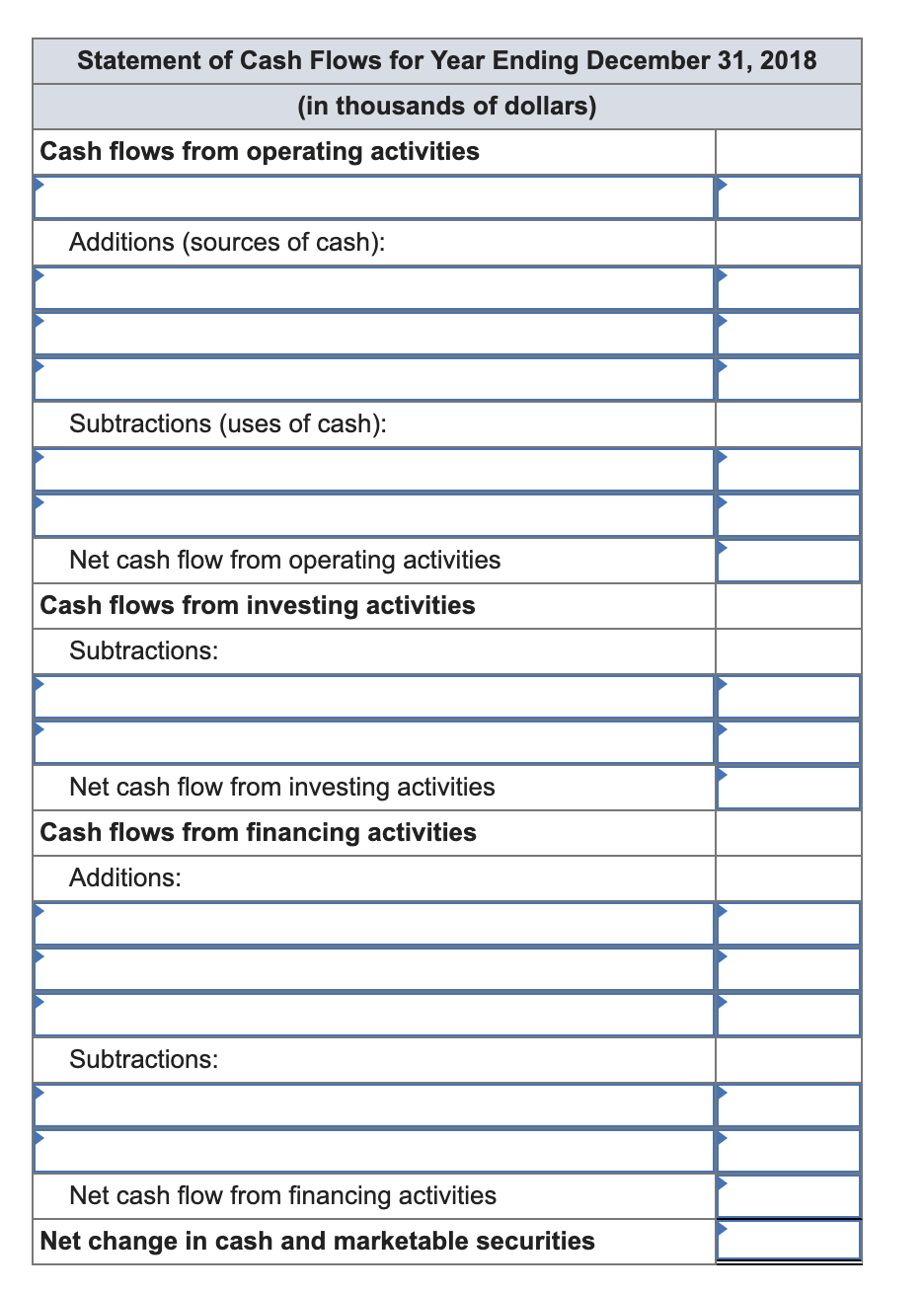

Prepare a statement of cash flows for Valiums Medical Supply Corporation. (Enter your answers in thousands. Amounts to be deducted should be indicated with a

Prepare a statement of cash flows for Valiums Medical Supply Corporation. (Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign.)

**** Chart at bottom is what needs to be completed and filled in to obtain the correct answer*****

You can view the pictures... They are screenshots

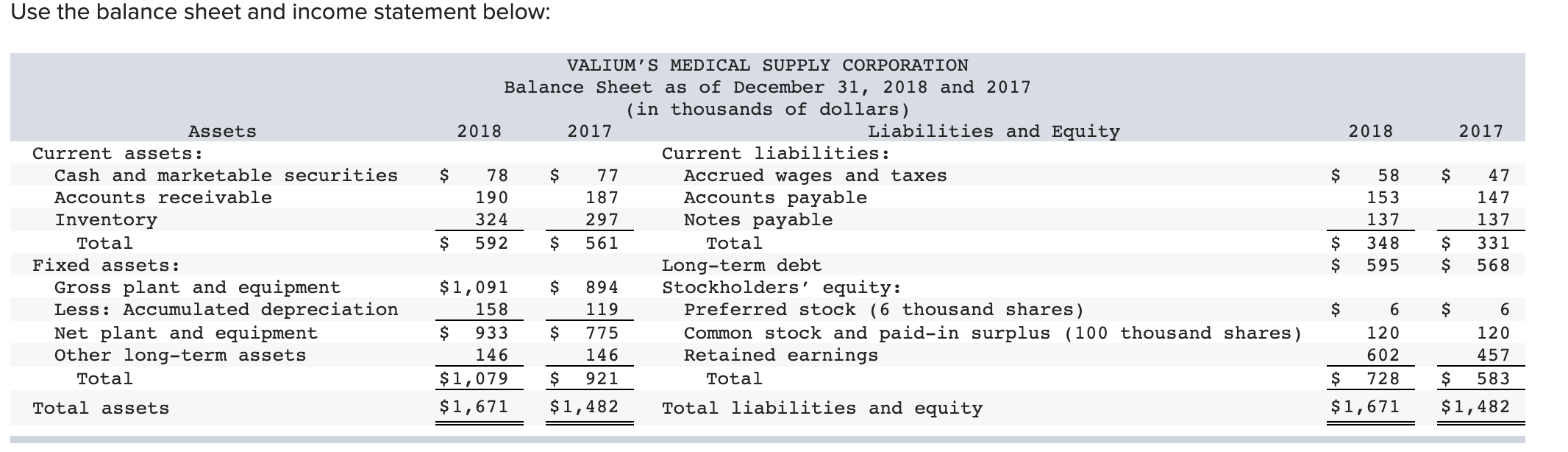

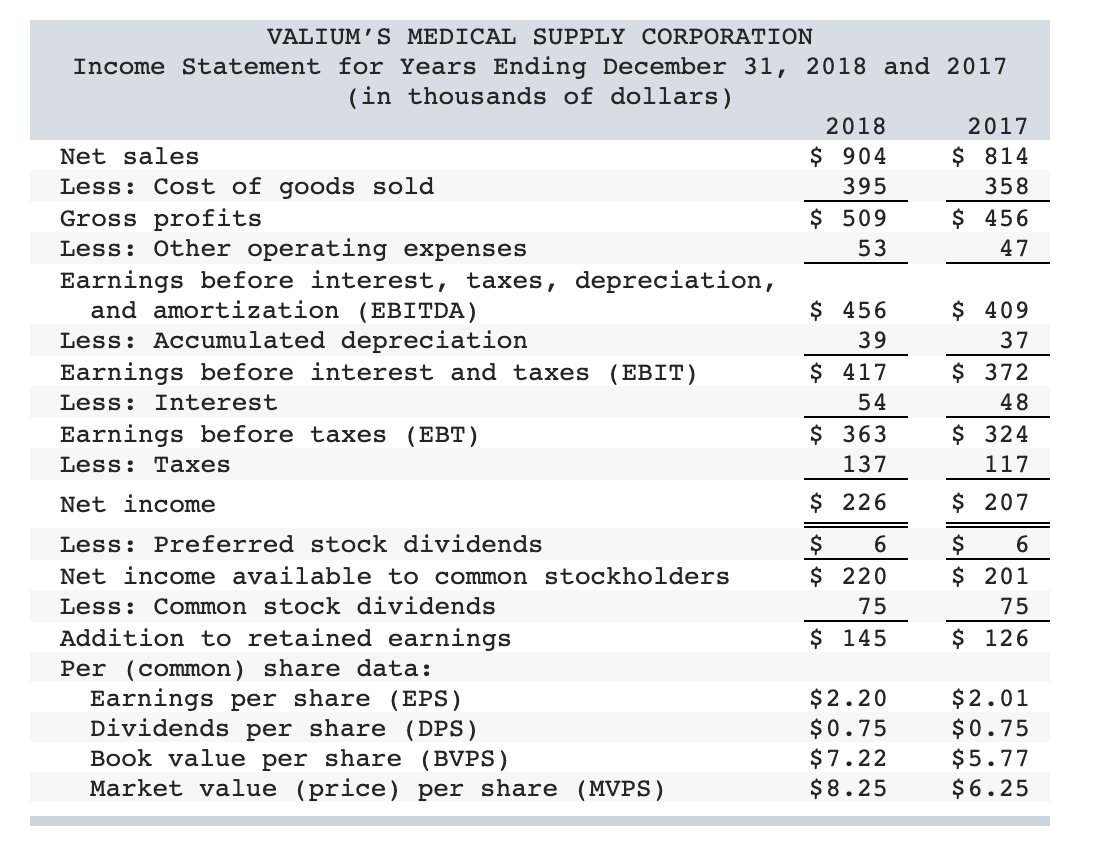

Use the balance sheet and income statement below: 2018 2017 $ $ 297 Assets Current assets: Cash and marketable securities Accounts receivable Inventory Total Fixed assets: Gross plant and equipment Less: Accumulated depreciation Net plant and equipment Other long-term assets Total VALIUM'S MEDICAL SUPPLY CORPORATION Balance Sheet as of December 31, 2018 and 2017 (in thousands of dollars) 2018 2017 Liabilities and Equity Current liabilities: $ 78 $ 77 Accrued wages and taxes 190 187 Accounts payable 324 Notes payable $ 592 $ 561 Total Long-term debt $1,091 $ 894 Stockholders' equity: 158 119 Preferred stock (6 thousand shares) $ 933 $ 775 Common stock and paid-in surplus (100 thousand shares) 146 146 Retained earnings $1,079 $ 921 Total $1,671 $1,482 Total liabilities and equity 58 153 137 348 595 47 147 137 331 568 $ $ $ $ 6 120 $ 6 120 602 $ 728 $1,671 457 $ 583 $1,482 Total assets 2017 VALIUM'S MEDICAL SUPPLY CORPORATION Income Statement for Years Ending December 31, 2018 and 2017 (in thousands of dollars) 2018 Net sales $ 904 $ 814 Less: Cost of goods sold 395 358 Gross profits $ 509 $ 456 Less: Other operating expenses 53 47 Earnings before interest, taxes, depreciation, and amortization (EBITDA) $ 456 $ 409 Less: Accumulated depreciation 39 37 Earnings before interest and taxes (EBIT) $ 417 $ 372 Less: Interest 54 48 Earnings before taxes (EBT) $ 363 $ 324 Less: Taxes 137 117 Net income $ 226 $ 207 Less: Preferred stock dividends $ 6 $ 6 Net income available to common stockholders $ 220 $ 201 Less: Common stock dividends 75 75 Addition to retained earnings $ 145 $ 126 Per (common) share data: Earnings per share (EPS) $2.20 $2.01 Dividends per share (DPS) $0.75 $0.75 Book value per share (BVPS) $7.22 $5.77 Market value (price) per share (MVPS) $ 8.25 $6.25 Statement of Cash Flows for Year Ending December 31, 2018 (in thousands of dollars) Cash flows from operating activities Additions (sources of cash): Subtractions (uses of cash): Net cash flow from operating activities Cash flows from investing activities Subtractions: Net cash flow from investing activities Cash flows from financing activities Additions: Subtractions: Net cash flow from financing activities Net change in cash and marketable securitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started