Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a summary of cash flows from operating activities using the indirect method of presentation. Amber Ltd Statement of cash flows (extract) for the year

Prepare a summary of cash flows from operating activities using the indirect method of presentation.

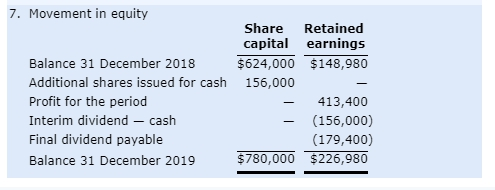

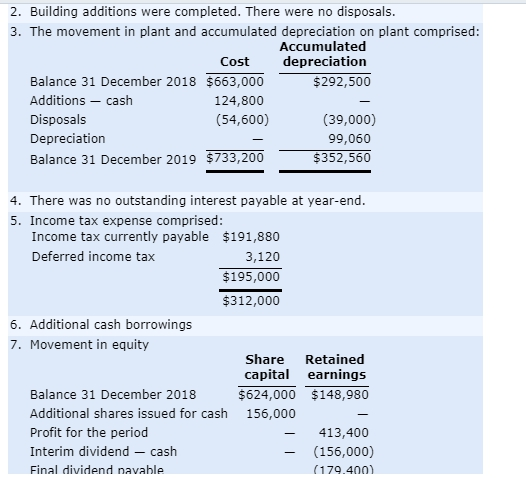

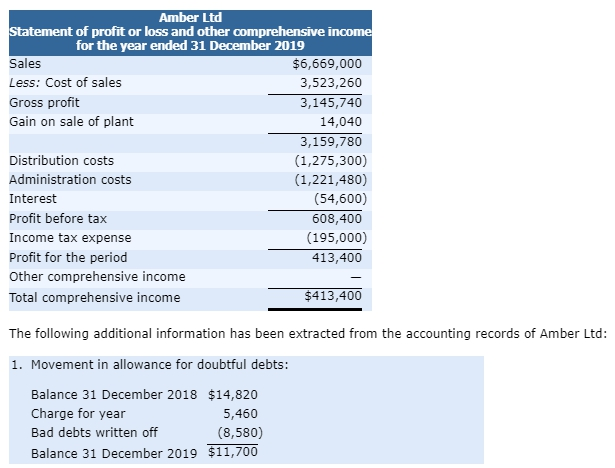

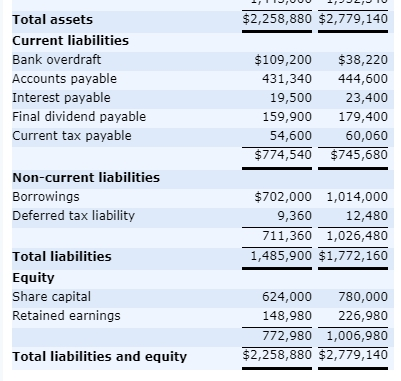

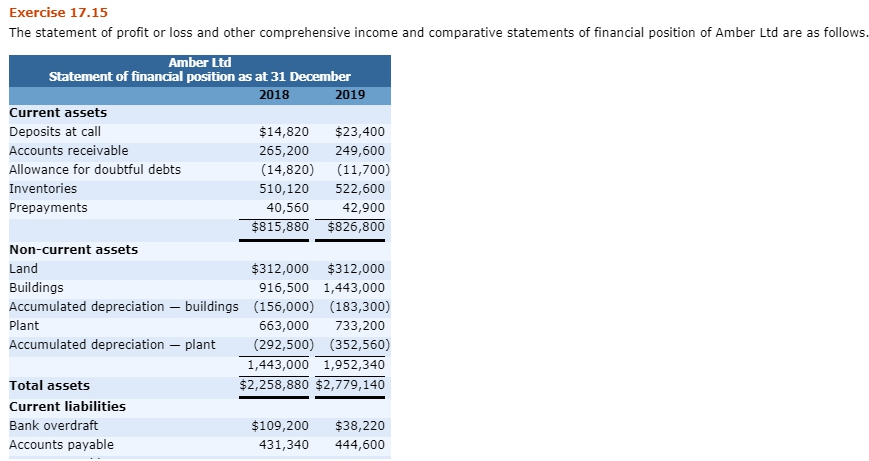

Amber Ltd Statement of cash flows (extract) for the year ended 31 December 2019 7. Movement in equity Share capital earnings $624,000 $148,980 Retained Balance 31 December 2018 Additional shares issued for cash 156,000 Profit for the period 413,400 Interim dividend - cash (156,000) Final dividend payable (179,400) $780,000 $226,980 Balance 31 December 2019 2. Building additions were completed. There were no disposals. 3. The movement in plant and accumulated depreciation on plant comprised: Accumulated depreciation Cost Balance 31 December 2018 $663,000 Additions cash $292,500 124,800 Disposals (54,600) (39,000) Depreciation 99,060 $352,560 Balance 31 December 2019 $733,200 4. There was no outstanding interest payable at year-end. 5. Income tax expense comprised: Income tax currently payable $191,880 Deferred income tax 3,120 $195,000 $312,000 6. Additional cash borrowings 7. Movement in equity Share Retained capital earnings Balance 31 December 2018 $624,000 $148,980 Additional shares issued for cash 156,000 Profit for the period 413,400 Interim dividend - cash (156,000) (179.400) Final dividend navable Amber Ltd Statement of profit or loss and other comprehensive income for the year ended 31 December 2019 Sales $6,669,000 Less: Cost of sales 3,523,260 Gross profit 3,145,740 Gain on sale of plant 14,040 3,159,780 Distribution costs (1,275,300) Administration costs (1,221,480) (54,600) Interest Profit before tax 608,400 Income tax expense (195,000) Profit for the period 413,400 Other comprehensive income $413,400 Total comprehensive income The following additional information has been extracted from the accounting records of Amber Ltd: 1. Movement in allowance for doubtful debts: Balance 31 December 2018 $14,820 Charge for year 5,460 Bad debts written off (8,580) Balance 31 December 2019 $11,700 $2,258,880 $2,779,140 Total assets Current liabilities Bank overdraft $109,200 $38,220 Accounts payable 431,340 444,600 Interest payable 23,400 19,500 Final dividend payable 159,900 179,400 Current tax payable 54,600 60,060 $774,540 $745,680 Non-current liabilities Borrowings $702,000 1,014,000 Deferred tax liability 12,480 9,360 711,360 1,026,480 1,485,900 $1,772,160 Total liabilities Equity Share capital 624,000 780,000 Retained earnings 148,980 226,980 772,980 1,006,980 $2,258,880 $2,779,140 Total liabilities and equity Exercise 17.15 The statement of profit or loss and other comprehensive income and comparative statements of financial position of Amber Ltd are as follows. Amber Ltd Statement of financial position as at 31 December 2018 2019 Current assets Deposits at call $14,820 $23,400 Accounts receivable 265,200 249,600 Allowance for doubtful debts (14,820) (11,700) Inventories 510,120 522,600 Prepayments 40,560 42,900 $815,880 $826,800 Non-current assets Land $312,000 $312,000 Buildings 916,500 1,443,000 Accumulated depreciation buildings (156,000) (183,300) Plant 663,000 733,200 Accumulated depreciation plant (292,500) (352,560) 1,443,000 1,952,340 $2,258,880 $2,779,140 Total assets Current liabilities Bank overdraft $109,200 $38,220 Accounts payable 431,340 444,600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started