Answered step by step

Verified Expert Solution

Question

1 Approved Answer

prepare a talk on credit and the young professional. She has decided to use a question-and-answer format. Help her answer the following questions. b. What

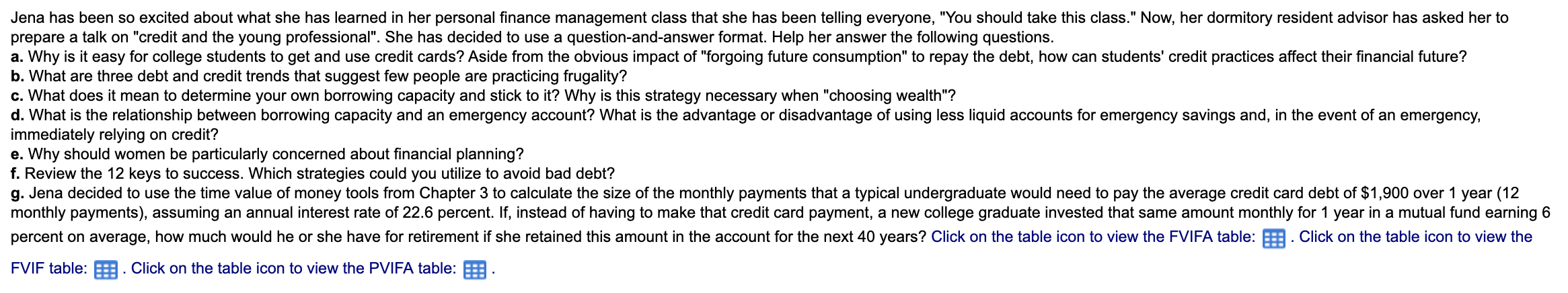

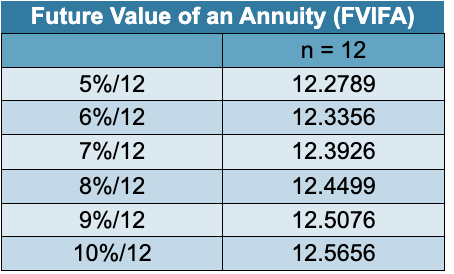

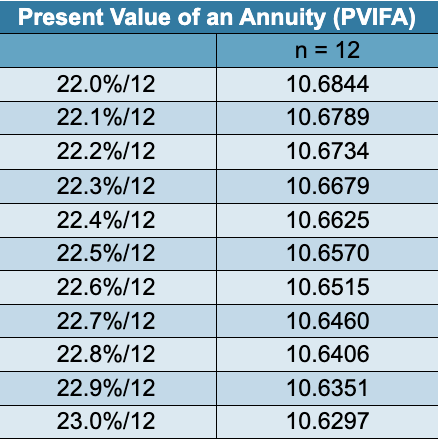

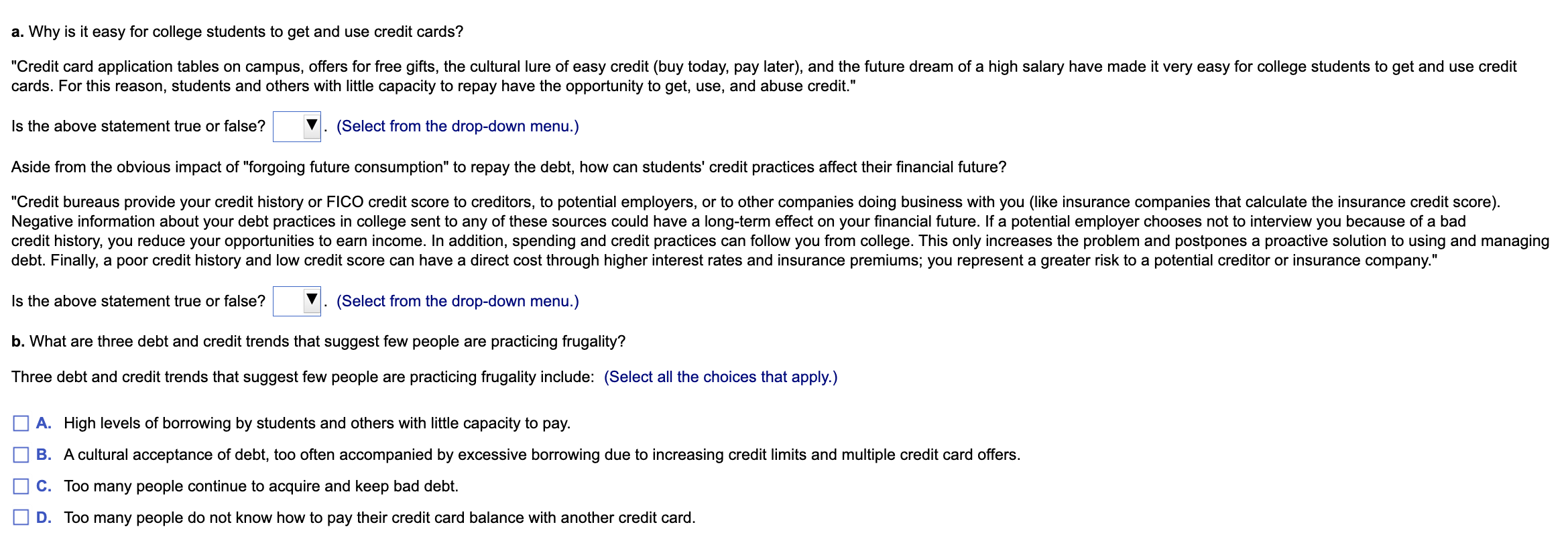

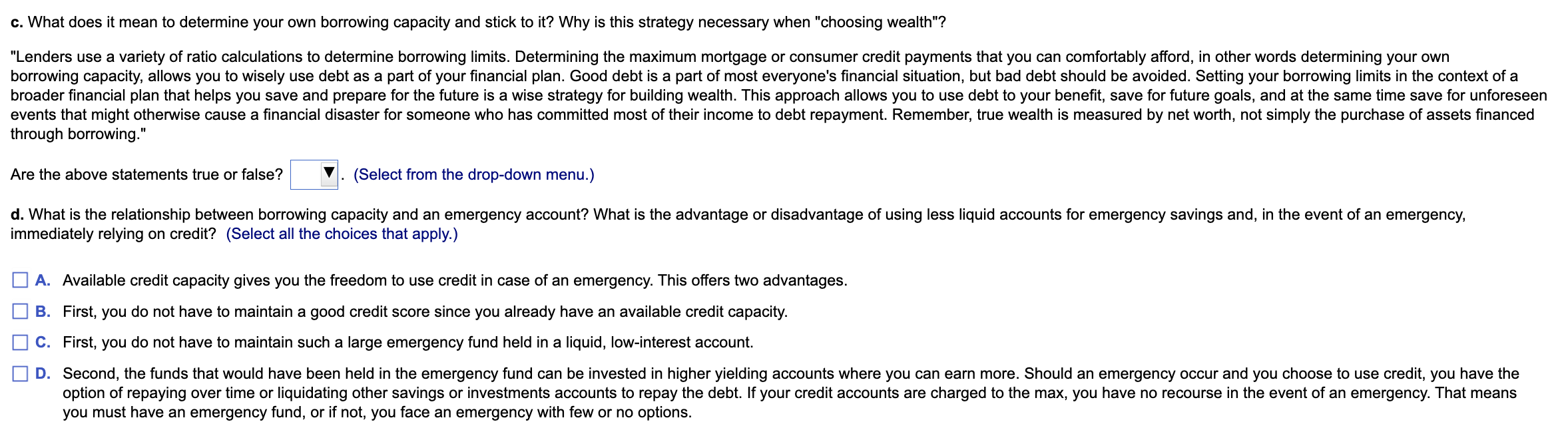

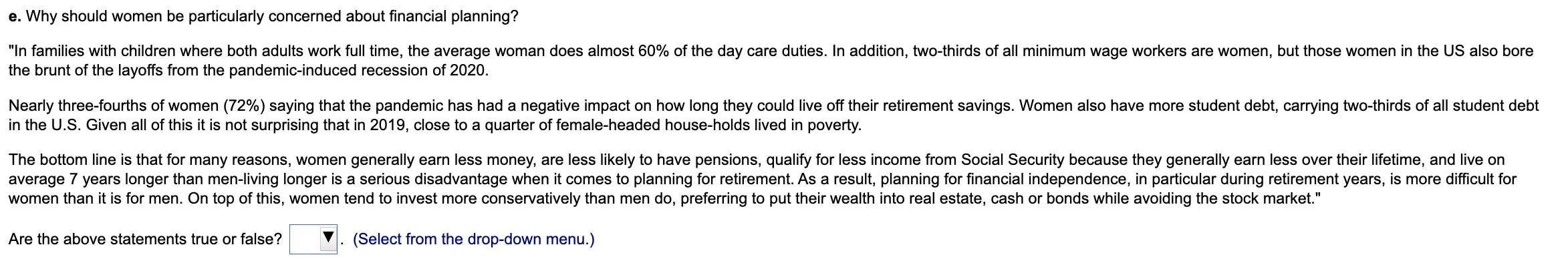

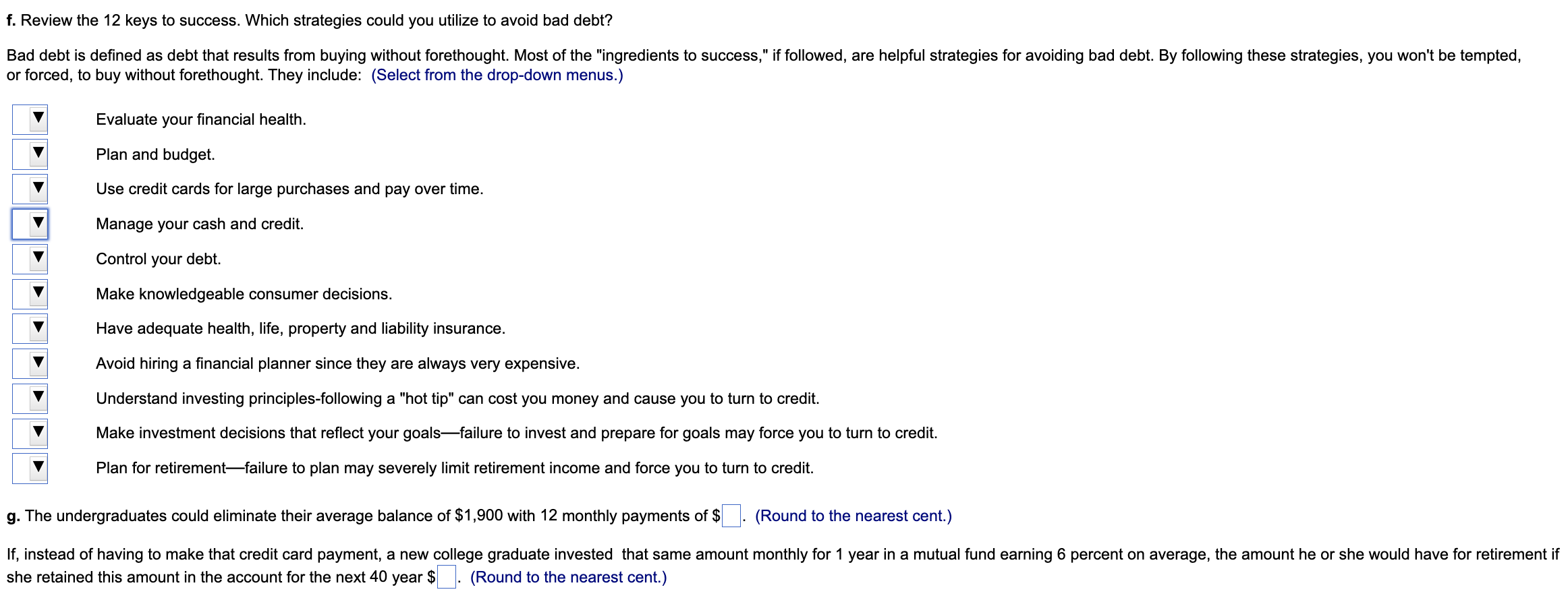

prepare a talk on "credit and the young professional". She has decided to use a question-and-answer format. Help her answer the following questions. b. What are three debt and credit trends that suggest few people are practicing frugality? c. What does it mean to determine your own borrowing capacity and stick to it? Why is this strategy necessary when "choosing wealth"? immediately relying on credit? e. Why should women be particularly concerned about financial planning? f. Review the 12 keys to success. Which strategies could you utilize to avoid bad debt? FVIF table: . Click on the table icon to view the PVIFA table: \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Future Value of an Annuity (FVIFA) } \\ \hline & n=12 \\ \hline 5%/12 & 12.2789 \\ \hline 6%/12 & 12.3356 \\ \hline 7%/12 & 12.3926 \\ \hline 8%/12 & 12.4499 \\ \hline 9%/12 & 12.5076 \\ \hline 10%/12 & 12.5656 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{2}{|c|}{ Compound Sum of \$1 (FVIF) } \\ \hline & n=39 & n=40 \\ \hline 5% & 8.5572 & 8.9850 \\ \hline 6% & 12.9855 & 13.7646 \\ \hline 7% & 19.6285 & 21.0025 \\ \hline 8% & 29.5560 & 31.9204 \\ \hline 9% & 44.3370 & 48.3273 \\ \hline 10% & 66.2641 & 72.8905 \\ \hline \end{tabular} Present Value of an Annuity (PVIFA) \begin{tabular}{|c|c|} \hline & n=12 \\ \hline 22.0%/12 & 10.6844 \\ \hline 22.1%/12 & 10.6789 \\ \hline 22.2%/12 & 10.6734 \\ \hline 22.3%/12 & 10.6679 \\ \hline 22.4%/12 & 10.6625 \\ \hline 22.5%/12 & 10.6570 \\ \hline 22.6%/12 & 10.6515 \\ \hline 22.7%/12 & 10.6460 \\ \hline 22.8%/12 & 10.6406 \\ \hline 22.9%/12 & 10.6351 \\ \hline 23.0%/12 & 10.6297 \\ \hline \end{tabular} a. Why is it easy for college students to get and use credit cards? cards. For this reason, students and others with little capacity to repay have the opportunity to get, use, and abuse credit." Is the above statement true or false? (Select from the drop-down menu.) Aside from the obvious impact of "forgoing future consumption" to repay the debt, how can students' credit practices affect their financial future? Is the above statement true or false? (Select from the drop-down menu.) b. What are three debt and credit trends that suggest few people are practicing frugality? Three debt and credit trends that suggest few people are practicing frugality include: (Select all the choices that apply.) A. High levels of borrowing by students and others with little capacity to pay. B. A cultural acceptance of debt, too often accompanied by excessive borrowing due to increasing credit limits and multiple credit card offers. C. Too many people continue to acquire and keep bad debt. D. Too many people do not know how to pay their credit card balance with another credit card. the brunt of the layoffs from the pandemic-induced recession of 2020. in the U.S. Given all of this it is not surprising that in 2019 , close to a quarter of female-headed house-holds lived in poverty. women than it is for men. On top of this, women tend to invest more conservatively than men do, preferring to put their wealth into real estate, cash or bonds while avoiding the stock market." Are the above statements true or false? (Select from the drop-down menu.) or forced, to buy without forethought. They include: (Select from the drop-down menus.) Evaluate your financial health. Plan and budget. Use credit cards for large purchases and pay over time. Manage your cash and credit. Control your debt. Make knowledgeable consumer decisions. Have adequate health, life, property and liability insurance. Avoid hiring a financial planner since they are always very expensive. Understand investing principles-following a "hot tip" can cost you money and cause you to turn to credit. Make investment decisions that reflect your goals - failure to invest and prepare for goals may force you to turn to credit. Plan for retirement-failure to plan may severely limit retirement income and force you to turn to credit. g. The undergraduates could eliminate their average balance of $1,900 with 12 monthly payments of $. (Round to the nearest cent.) she retained this amount in the account for the next 40 year $. (Round to the nearest cent.)

prepare a talk on "credit and the young professional". She has decided to use a question-and-answer format. Help her answer the following questions. b. What are three debt and credit trends that suggest few people are practicing frugality? c. What does it mean to determine your own borrowing capacity and stick to it? Why is this strategy necessary when "choosing wealth"? immediately relying on credit? e. Why should women be particularly concerned about financial planning? f. Review the 12 keys to success. Which strategies could you utilize to avoid bad debt? FVIF table: . Click on the table icon to view the PVIFA table: \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Future Value of an Annuity (FVIFA) } \\ \hline & n=12 \\ \hline 5%/12 & 12.2789 \\ \hline 6%/12 & 12.3356 \\ \hline 7%/12 & 12.3926 \\ \hline 8%/12 & 12.4499 \\ \hline 9%/12 & 12.5076 \\ \hline 10%/12 & 12.5656 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{2}{|c|}{ Compound Sum of \$1 (FVIF) } \\ \hline & n=39 & n=40 \\ \hline 5% & 8.5572 & 8.9850 \\ \hline 6% & 12.9855 & 13.7646 \\ \hline 7% & 19.6285 & 21.0025 \\ \hline 8% & 29.5560 & 31.9204 \\ \hline 9% & 44.3370 & 48.3273 \\ \hline 10% & 66.2641 & 72.8905 \\ \hline \end{tabular} Present Value of an Annuity (PVIFA) \begin{tabular}{|c|c|} \hline & n=12 \\ \hline 22.0%/12 & 10.6844 \\ \hline 22.1%/12 & 10.6789 \\ \hline 22.2%/12 & 10.6734 \\ \hline 22.3%/12 & 10.6679 \\ \hline 22.4%/12 & 10.6625 \\ \hline 22.5%/12 & 10.6570 \\ \hline 22.6%/12 & 10.6515 \\ \hline 22.7%/12 & 10.6460 \\ \hline 22.8%/12 & 10.6406 \\ \hline 22.9%/12 & 10.6351 \\ \hline 23.0%/12 & 10.6297 \\ \hline \end{tabular} a. Why is it easy for college students to get and use credit cards? cards. For this reason, students and others with little capacity to repay have the opportunity to get, use, and abuse credit." Is the above statement true or false? (Select from the drop-down menu.) Aside from the obvious impact of "forgoing future consumption" to repay the debt, how can students' credit practices affect their financial future? Is the above statement true or false? (Select from the drop-down menu.) b. What are three debt and credit trends that suggest few people are practicing frugality? Three debt and credit trends that suggest few people are practicing frugality include: (Select all the choices that apply.) A. High levels of borrowing by students and others with little capacity to pay. B. A cultural acceptance of debt, too often accompanied by excessive borrowing due to increasing credit limits and multiple credit card offers. C. Too many people continue to acquire and keep bad debt. D. Too many people do not know how to pay their credit card balance with another credit card. the brunt of the layoffs from the pandemic-induced recession of 2020. in the U.S. Given all of this it is not surprising that in 2019 , close to a quarter of female-headed house-holds lived in poverty. women than it is for men. On top of this, women tend to invest more conservatively than men do, preferring to put their wealth into real estate, cash or bonds while avoiding the stock market." Are the above statements true or false? (Select from the drop-down menu.) or forced, to buy without forethought. They include: (Select from the drop-down menus.) Evaluate your financial health. Plan and budget. Use credit cards for large purchases and pay over time. Manage your cash and credit. Control your debt. Make knowledgeable consumer decisions. Have adequate health, life, property and liability insurance. Avoid hiring a financial planner since they are always very expensive. Understand investing principles-following a "hot tip" can cost you money and cause you to turn to credit. Make investment decisions that reflect your goals - failure to invest and prepare for goals may force you to turn to credit. Plan for retirement-failure to plan may severely limit retirement income and force you to turn to credit. g. The undergraduates could eliminate their average balance of $1,900 with 12 monthly payments of $. (Round to the nearest cent.) she retained this amount in the account for the next 40 year $. (Round to the nearest cent.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started