Answered step by step

Verified Expert Solution

Question

1 Approved Answer

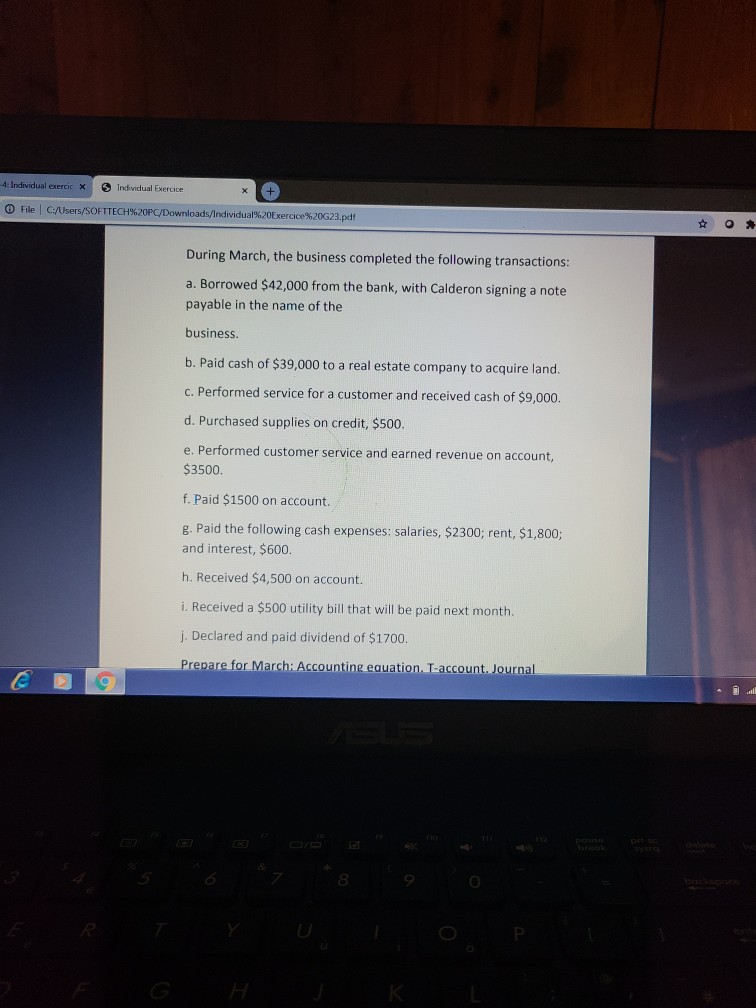

prepare accounting equation,T-account and journal 4: Individual exercic X Individual Exercice X File C:/Users/SOFTTECH%20PC/Downloads/Individual%20Exercice%20G23.pdf o During March, the business completed the following transactions: a. Borrowed

prepare accounting equation,T-account and journal

4: Individual exercic X Individual Exercice X File C:/Users/SOFTTECH%20PC/Downloads/Individual%20Exercice%20G23.pdf o During March, the business completed the following transactions: a. Borrowed $42,000 from the bank, with Calderon signing a note payable in the name of the business. b. Paid cash of $39,000 to a real estate company to acquire land. c. Performed service for a customer and received cash of $9,000. d. Purchased supplies on credit, $500. e. Performed customer service and earned revenue on account, $3500 f. Paid $1500 on account. g. Paid the following cash expenses: salaries, $2300; rent, $1,800; and interest, $600 h. Received $4,500 on account. i. Received a $500 utility bill that will be paid next month. j. Declared and paid dividend of $1700. Prepare for March: Accounting equation. T-account. Journal c 4: Individual exercic X Individual Exercice X File C:/Users/SOFTTECH%20PC/Downloads/Individual%20Exercice%20G23.pdf o During March, the business completed the following transactions: a. Borrowed $42,000 from the bank, with Calderon signing a note payable in the name of the business. b. Paid cash of $39,000 to a real estate company to acquire land. c. Performed service for a customer and received cash of $9,000. d. Purchased supplies on credit, $500. e. Performed customer service and earned revenue on account, $3500 f. Paid $1500 on account. g. Paid the following cash expenses: salaries, $2300; rent, $1,800; and interest, $600 h. Received $4,500 on account. i. Received a $500 utility bill that will be paid next month. j. Declared and paid dividend of $1700. Prepare for March: Accounting equation. T-account. Journal cStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started