Answered step by step

Verified Expert Solution

Question

1 Approved Answer

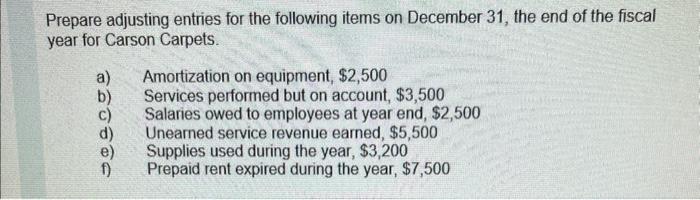

Prepare adjusting entries for the following items on December 31, the end of the fiscal year for Carson Carpets. Seenge Amortization on equipment, $2,500

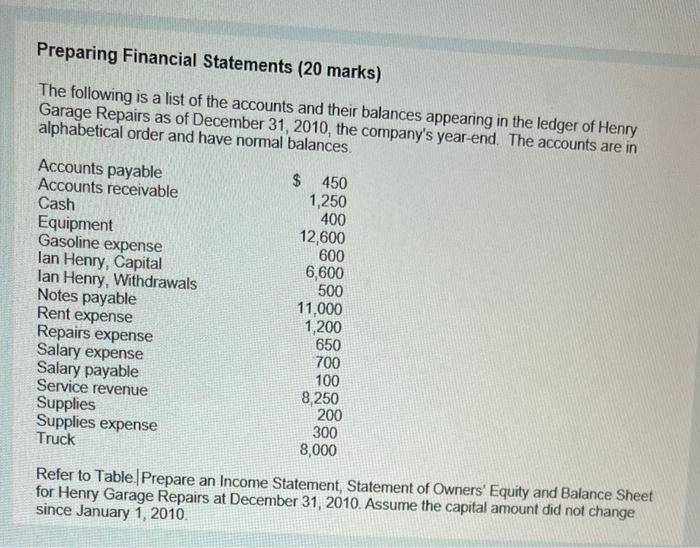

Prepare adjusting entries for the following items on December 31, the end of the fiscal year for Carson Carpets. Seenge Amortization on equipment, $2,500 Services performed but on account, $3,500 Salaries owed to employees at year end, $2,500 Unearned service revenue earned, $5,500 Supplies used during the year, $3,200 Prepaid rent expired during the year, $7,500 Preparing Financial Statements (20 marks) The following is a list of the accounts and their balances appearing in the ledger of Henry Garage Repairs as of December 31, 2010, the company's year-end. The accounts are in alphabetical order and have normal balances. Accounts payable Accounts receivable Cash Equipment Gasoline expense lan Henry, Capital lan Henry, Withdrawals Notes payable Rent expense Repairs expense Salary expense Salary payable Service revenue Supplies Supplies expense Truck $ 450 1,250 400 12,600 600 6,600 500 11,000 1,200 650 700 100 8,250 200 300 8,000 Refer to Table Prepare an Income Statement, Statement of Owners' Equity and Balance Sheet for Henry Garage Repairs at December 31, 2010. Assume the capital amount did not change since January 1, 2010.

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started