Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare adjusting journal entries on Dec 31, 2012 to the record the following unrelated year- end adjustments. a. On October 1st, we collected $4,000

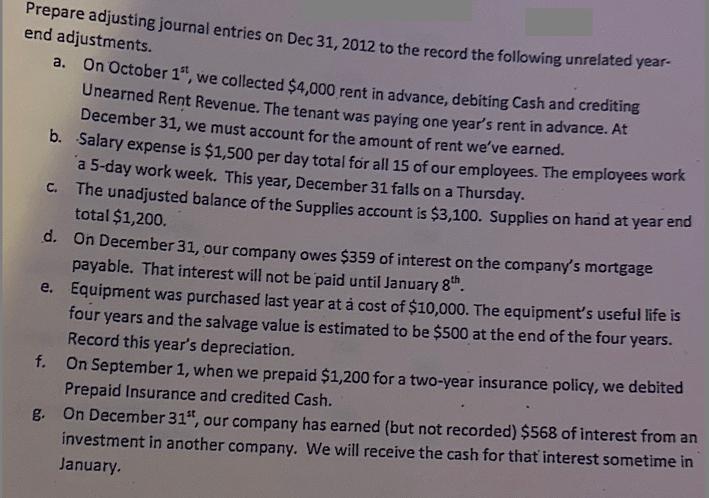

Prepare adjusting journal entries on Dec 31, 2012 to the record the following unrelated year- end adjustments. a. On October 1st, we collected $4,000 rent in advance, debiting Cash and crediting Unearned Rent Revenue. The tenant was paying one year's rent in advance. At December 31, we must account for the amount of rent we've earned. b. Salary expense is $1,500 per day total for all 15 of our employees. The employees work a 5-day work week. This year, December 31 falls on a Thursday. c. The unadjusted balance of the Supplies account is $3,100. Supplies on hand at year end total $1,200. d. On December 31, our company owes $359 of interest on the company's mortgage payable. That interest will not be paid until January 8th. e. Equipment was purchased last year at a cost of $10,000. The equipment's useful life is four years and the salvage value is estimated to be $500 at the end of the four years. Record this year's depreciation. f. On September 1, when we prepaid $1,200 for a two-year insurance policy, we debited Prepaid Insurance and credited Cash. g. On December 31", our company has earned (but not recorded) $568 of interest from an investment in another company. We will receive the cash for that interest sometime in January.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started