Question

Maybank shares are currently trading at RM10.00 in the stock market. 3-month call and put options with RM 10.00 exercise price are being quoted

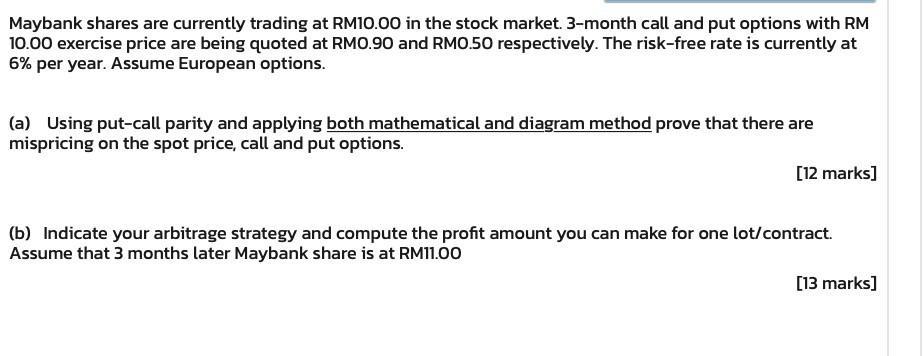

Maybank shares are currently trading at RM10.00 in the stock market. 3-month call and put options with RM 10.00 exercise price are being quoted at RM0.90 and RM0.50 respectively. The risk-free rate is currently at 6% per year. Assume European options. (a) Using put-call parity and applying both mathematical and diagram method prove that there are mispricing on the spot price, call and put options. [12 marks] (b) Indicate your arbitrage strategy and compute the profit amount you can make for one lot/contract. Assume that 3 months later Maybank share is at RM11.00 [13 marks]

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a value of Call Vc Present value of stoike price Value of put Up value adeo 4 share RM 090 RM 10 Erm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials of Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

10th edition

1260013955, 1260013952, 978-1260013955

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App