Answered step by step

Verified Expert Solution

Question

1 Approved Answer

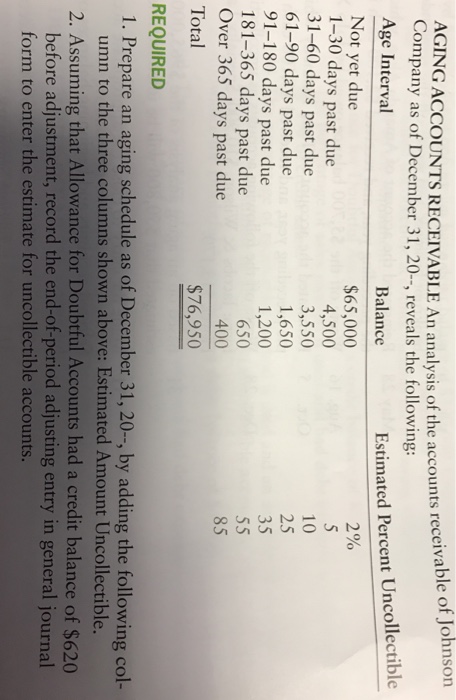

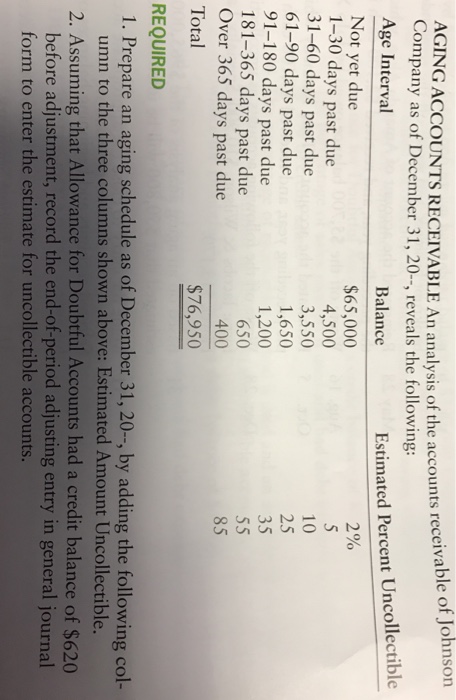

Prepare an aging schedule as of December 31, 20, by adding the following column to the three columns shown above: Estimated Amount Uncollectible AGING ACCOUNTS

Prepare an aging schedule as of December 31, 20, by adding the following column to the three columns shown above: Estimated Amount Uncollectible

AGING ACCOUNTS RECEIVABLE Company as of December 31, 20-, reveals the following: Ke TABLE An analysis of the counts receivable of Johnson Age Interval Estimated Percent Uncollectible Balance Not yet due 1-30 days past due 31-60 days past due 61-90 days past due 91-180 days past due 181-365 days past due Over 365 days past due Total 2% $65,000 4,500 3,550 1,650 1,200 650 400 10 25 35 85 $76,950 REQUIRED 1. Prepare an aging schedule as of December 31, 20-, by adding the following col- umn to the three columns shown above: Estimated Amount Uncollectible. 2. Assuming that Allowance for Doubtful Accounts had a credit balance of $620 before adjustment, record the end-of-period adjusting entry in general journal form to enter the estimate for uncollectible accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started