prepare an income stmt and changes in stockholder equity

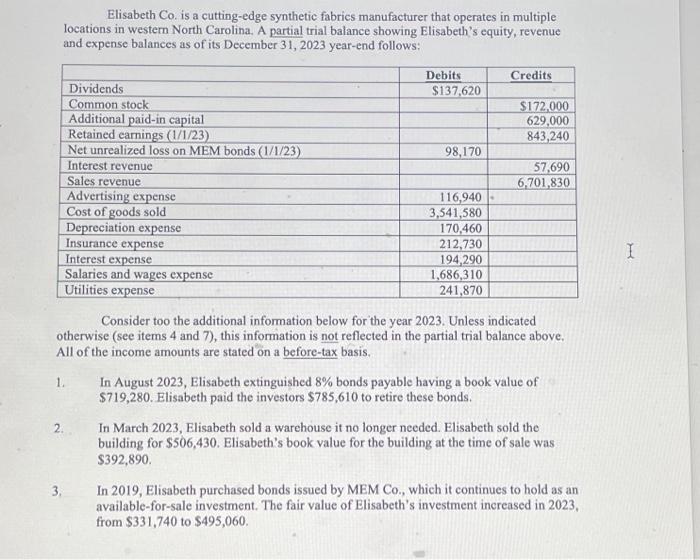

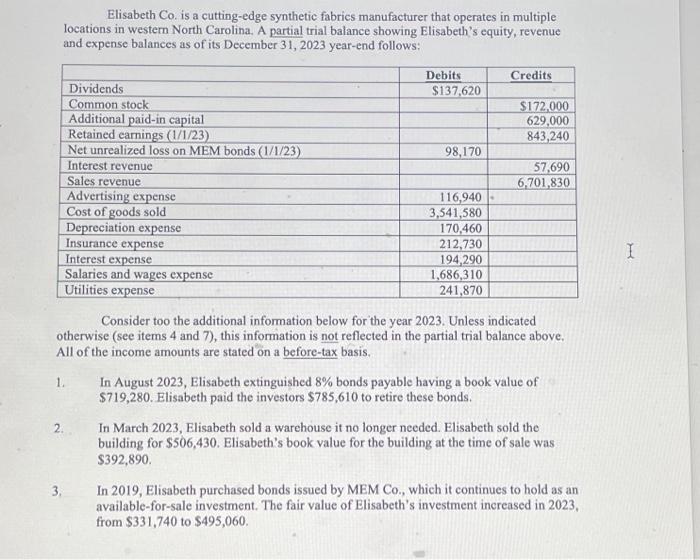

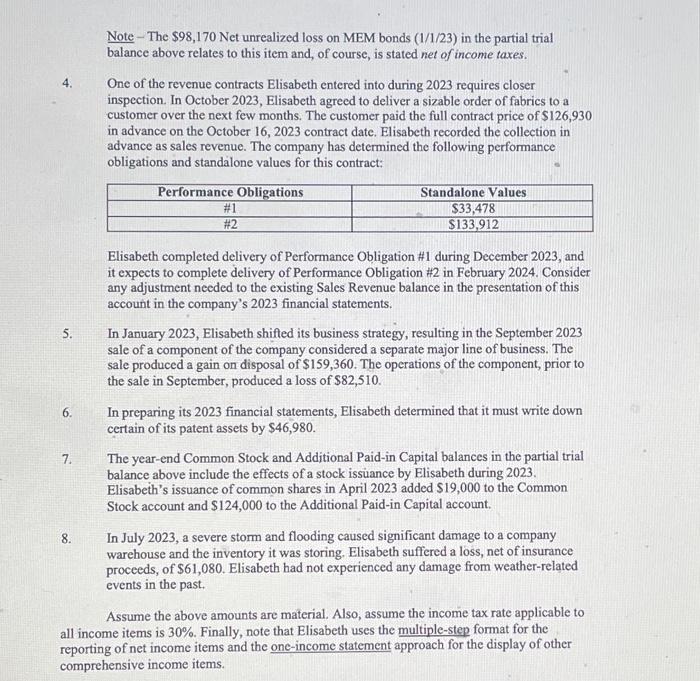

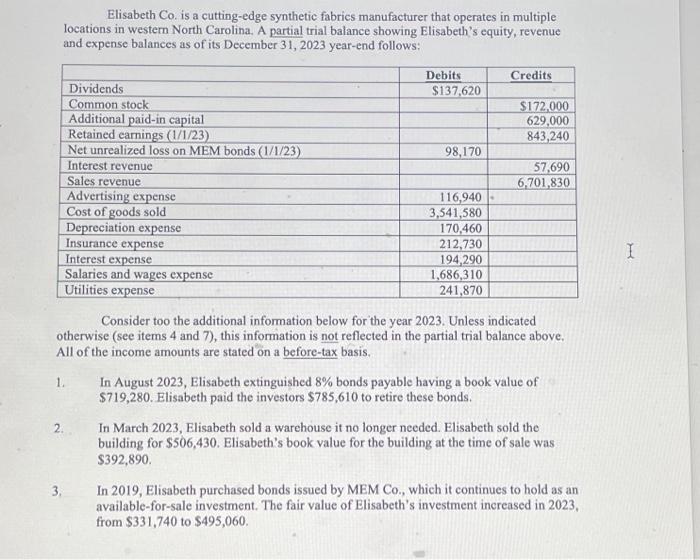

Elisabeth Co. is a cutting-edge synthetic fabrics manufacturer that operates in multiple locations in western North Carolina. A partial trial balance showing Elisabeth's equity, revenue and expense balances as of its December 31,2023 year-end follows: Consider too the additional information below for the year 2023. Unless indicated otherwise (see items 4 and 7), this information is not reflected in the partial trial balance above. All of the income amounts are stated on a before-tax basis. 1. In August 2023, Elisabeth extinguished 8% bonds payable having a book value of $719,280. Elisabeth paid the investors $785,610 to retire these bonds. 2. In March 2023, Elisabeth sold a warehouse it no longer needed. Elisabeth sold the building for $506,430. Elisabeth's book value for the building at the time of sale was $392,890. 3. In 2019, Elisabeth purchased bonds issued by MEM Co., which it continues to hold as an available-for-sale investment. The fair value of Elisabeth's investment increased in 2023. from $331,740 to $495,060. Note - The $98,170 Net unrealized loss on MEM bonds (1/1/23) in the partial trial balance above relates to this item and, of course, is stated net of income taxes. 4. One of the revenue contracts Elisabeth entered into during 2023 requires closer inspection. In October 2023, Elisabeth agreed to deliver a sizable order of fabrics to a customer over the next few months. The customer paid the full contract price of $126,930 in advance on the October 16, 2023 contract date. Elisabeth recorded the collection in advance as sales revenue. The company has determined the following performance obligations and standalone values for this contract: Elisabeth completed delivery of Performance Obligation \#1 during December 2023, and it expects to complete delivery of Performance Obligation $2 in February 2024. Consider any adjustment needed to the existing Sales Revenue balance in the presentation of this account in the company's 2023 financial statements. 5. In January 2023, Elisabeth shifted its business strategy, resulting in the September 2023 sale of a component of the company considered a separate major line of business. The sale produced a gain on disposal of $159,360. The operations of the component, prior to the sale in September, produced a loss of $82,510. 6. In preparing its 2023 financial statements, Elisabeth determined that it must write down certain of its patent assets by $46,980. 7. The year-end Common Stock and Additional Paid-in Capital balances in the partial trial balance above include the effects of a stock issuance by Elisabeth during 2023. Elisabeth's issuance of common shares in April 2023 added \$19,000 to the Common Stock account and $124,000 to the Additional Paid-in Capital account. 8. In July 2023, a severe storm and flooding caused significant damage to a company warehouse and the inventory it was storing. Elisabeth suffered a loss, net of insurance proceeds, of \$61,080. Elisabeth had not experienced any damage from weather-related events in the past. Assume the above amounts are material. Also, assume the income tax rate applicable to all income items is 30%. Finally, note that Elisabeth uses the multiple-step format for the reporting of net income items and the one-income statement approach for the display of other comprehensive income items