Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare an indirect method statement of cash flows for 2018. A T-account worksheet is provided to assist you but you will only be rewarded

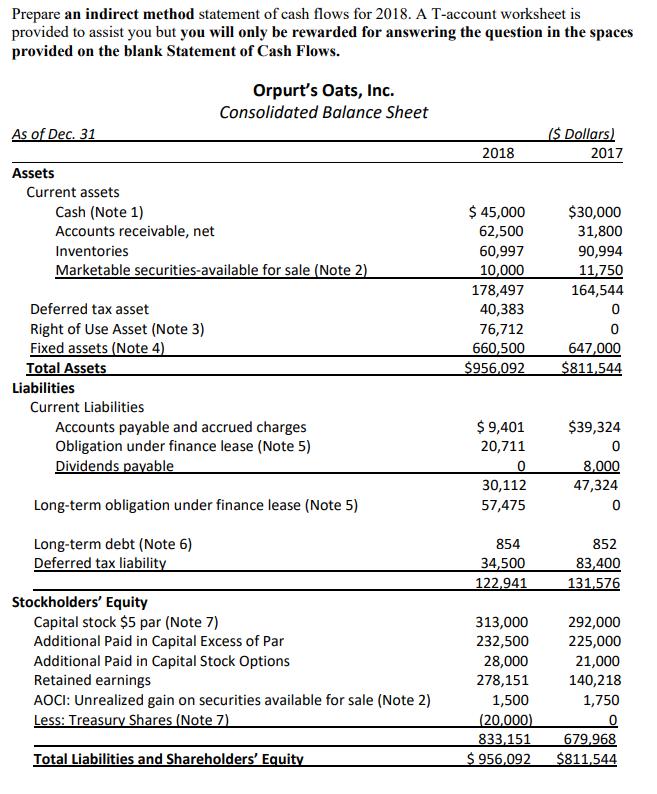

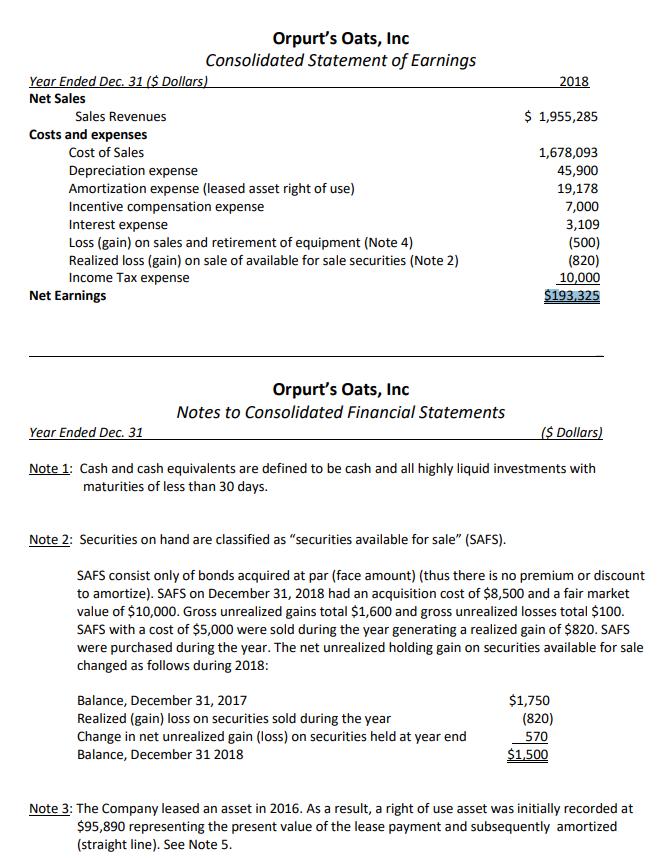

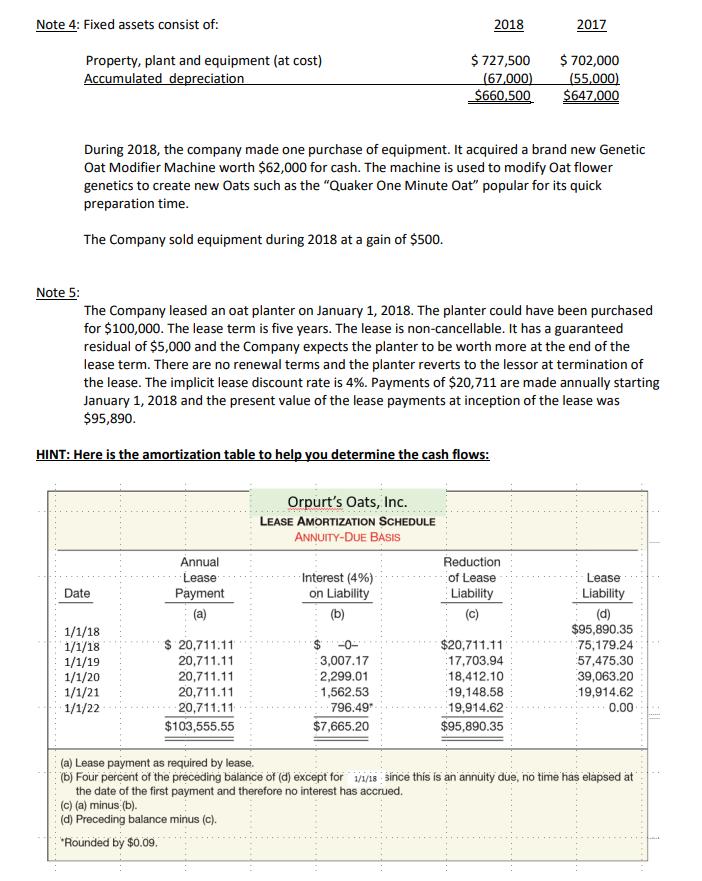

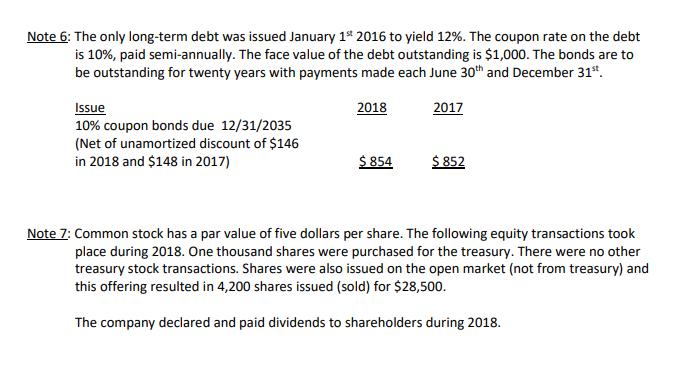

Prepare an indirect method statement of cash flows for 2018. A T-account worksheet is provided to assist you but you will only be rewarded for answering the question in the spaces provided on the blank Statement of Cash Flows. As of Dec. 31 Assets Current assets Cash (Note 1) Accounts receivable, net Inventories Marketable securities-available for sale (Note 2) Deferred tax asset Right of Use Asset (Note 3) Fixed assets (Note 4) Total Assets Liabilities Current Liabilities Orpurt's Oats, Inc. Consolidated Balance Sheet Accounts payable and accrued charges Obligation under finance lease (Note 5) Dividends payable Long-term obligation under finance lease (Note 5) Long-term debt (Note 6) Deferred tax liability Stockholders' Equity Capital stock $5 par (Note 7) Additional Paid in Capital Excess of Par Additional Paid in Capital Stock Options Retained earnings AOCI: Unrealized gain on securities available for sale (Note 2) Less: Treasury Shares (Note 7) Total Liabilities and Shareholders' Equity 2018 $ 45,000 62,500 60,997 10,000 178,497 40,383 76,712 660,500 $956,092 $ 9,401 20,711 0 30,112 57,475 854 34,500 122,941 313,000 232,500 28,000 278,151 1,500 (20,000) 833,151 $ 956,092 ($ Dollars) 2017 $30,000 31,800 90,994 11,750 164,544 0 0 647,000 $811,544 $39,324 0 8,000 47,324 0 852 83,400 131,576 292,000 225,000 21,000 140,218 1,750 0 679,968 $811,544 Year Ended Dec. 31 ($ Dollars) Net Sales Sales Revenues Costs and expenses Cost of Sales Orpurt's Oats, Inc Consolidated Statement of Earnings Depreciation expense Amortization expense (leased asset right of use) Incentive compensation expense Interest expense Loss (gain) on sales and retirement of equipment (Note 4) Realized loss (gain) on sale of available for sale securities (Note 2) Income Tax expense Net Earnings Year Ended Dec. 31 Orpurt's Oats, Inc Notes to Consolidated Financial Statements 2018 $ 1,955,285 ($ Dollars) Note 1: Cash and cash equivalents are defined to be cash and all highly liquid investments with maturities of less than 30 days. Balance, December 31, 2017 Realized (gain) loss on securities sold during the year Change in net unrealized gain (loss) on securities held at year end Balance, December 31 2018 1,678,093 45,900 19,178 7,000 3,109 (500) (820) 10,000 $193,325 Note 2: Securities on hand are classified as "securities available for sale" (SAFS). SAFS consist only of bonds acquired at par (face amount) (thus there is no premium or discount to amortize). SAFS on December 31, 2018 had an acquisition cost of $8,500 and a fair market value of $10,000. Gross unrealized gains total $1,600 and gross unrealized losses total $100. SAFS with a cost of $5,000 were sold during the year generating a realized gain of $820. SAFS were purchased during the year. The net unrealized holding gain on securities available for sale changed as follows during 2018: $1,750 (820) 570 $1,500 Note 3: The Company leased an asset in 2016. As a result, a right of use asset was initially recorded at $95,890 representing the present value of the lease payment and subsequently amortized (straight line). See Note 5. Note 4: Fixed assets consist of: Property, plant and equipment (at cost) Accumulated depreciation During 2018, the company made one purchase of equipment. It acquired a brand new Genetic Oat Modifier Machine worth $62,000 for cash. The machine is used to modify Oat flower genetics to create new Oats such as the "Quaker One Minute Oat" popular for its quick preparation time. The Company sold equipment during 2018 at a gain of $500. HINT: Here is the amortization table to help you determine the cash flows: Date Note 5: The Company leased an oat planter on January 1, 2018. The planter could have been purchased for $100,000. The lease term is five years. The lease is non-cancellable. It has a guaranteed residual of $5,000 and the Company expects the planter to be worth more at the end of the lease term. There are no renewal terms and the planter reverts to the lessor at termination of the lease. The implicit lease discount rate is 4%. Payments of $20,711 are made annually starting January 1, 2018 and the present value of the lease payments at inception of the lease was $95,890. 1/1/18 1/1/18 1/1/19 1/1/20 1/1/21 1/1/22 Annual Lease Payment (a) $ 20,711.11 20,711.11 20,711.11 20,711.11 20,711.11 $103,555.55 Orpurt's Oats, Inc. LEASE AMORTIZATION SCHEDULE ANNUITY-DUE BASIS Interest (4%) on Liability (b) 2018 $ 727,500 (67,000) $660,500 $ -0- 3,007.17 2,299.01 1,562.53 796.49* $7,665.20 Reduction of Lease Liability (C) 2017 $ 702,000 (55,000) $647,000 $20,711.11 17,703.94 18,412.10 19,148.58 19,914.62 $95,890.35 Lease Liability (d) $95,890.35 75,179.24 57,475.30 39,063.20 19,914.62 0.00 (a) Lease payment as required by lease. (b) Four percent of the preceding balance of (d) except for 1/1/18 since this is an annuity due, no time has elapsed at the date of the first payment and therefore no interest has accrued. (c) (a) minus (b). (d) Preceding balance minus (c). "Rounded by $0.09. Note 6: The only long-term debt was issued January 1st 2016 to yield 12%. The coupon rate on the debt is 10%, paid semi-annually. The face value of the debt outstanding is $1,000. The bonds are to be outstanding for twenty years with payments made each June 30th and December 31st. 2018 2017 Issue 10% coupon bonds due 12/31/2035 (Net of unamortized discount of $146 in 2018 and $148 in 2017) $ 854 $ 852 Note 7: Common stock has a par value of five dollars per share. The following equity transactions took place during 2018. One thousand shares were purchased for the treasury. There were no other treasury stock transactions. Shares were also issued on the open market (not from treasury) and this offering resulted in 4,200 shares issued (sold) for $28,500. The company declared and paid dividends to shareholders during 2018.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started