Answered step by step

Verified Expert Solution

Question

1 Approved Answer

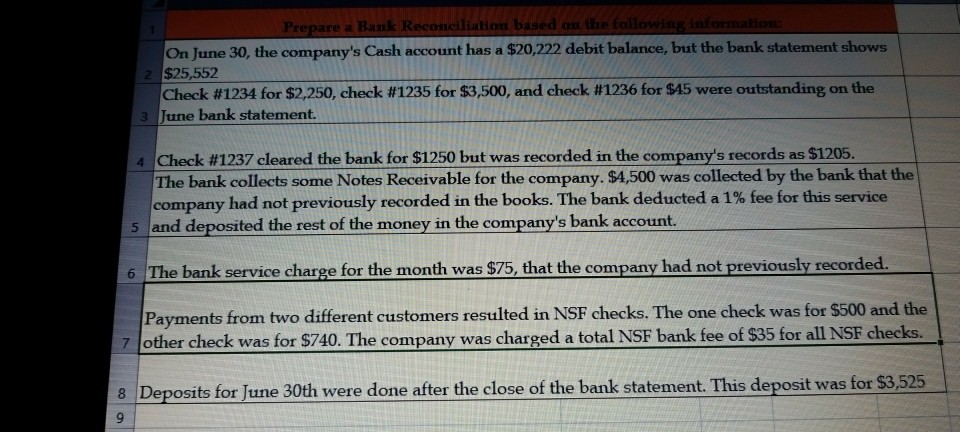

prepare bank reconciliation on June 30 On June 30, the company's Cash account has a $20,222 debit balance, but the bank statement shows $25,552 Check

prepare bank reconciliation on June 30

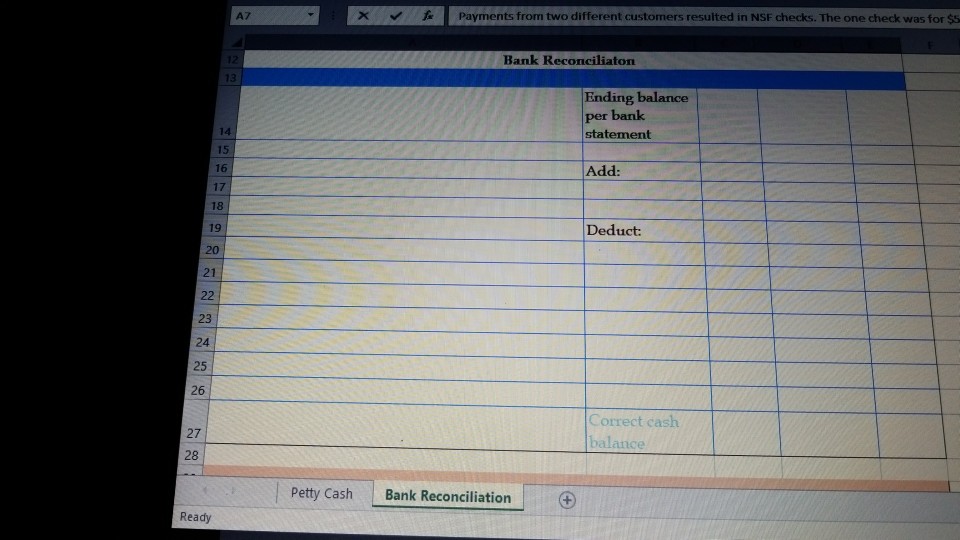

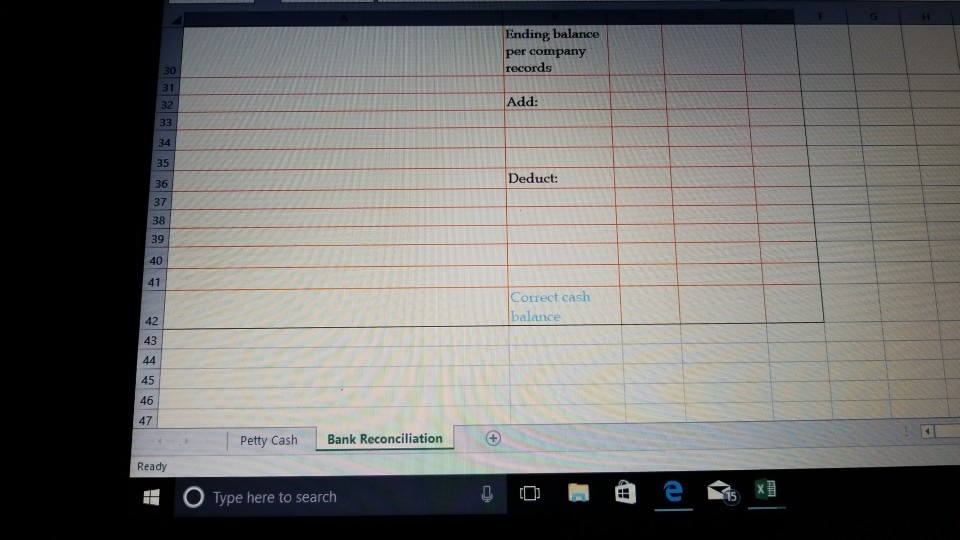

On June 30, the company's Cash account has a $20,222 debit balance, but the bank statement shows $25,552 Check #1234 for $2,250, check #1235 for $3,500, and check #1236 for $45 were outstanding on the 2 3 June bank statement Check #1237 cleared the bank for $1250 but was recorded in the company's records as $1205. The bank collects some Notes Receivable for the company. $4,500 was collected by the bank that the company had not previously recorded in the books. The bank deducted a 1% fee for this service 4 s and deposited the rest of the money in the company's bank account. 6 The bank service charge for the month was $75, that the company had not previously recorded Payments from two different customers resulted in NSF checks. The one check was for $500 and the other check was for $740. The company was charged a total NSF bank fee of $35 for all NSE checks. osits for June 30th were done after the close of the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started