Answered step by step

Verified Expert Solution

Question

1 Approved Answer

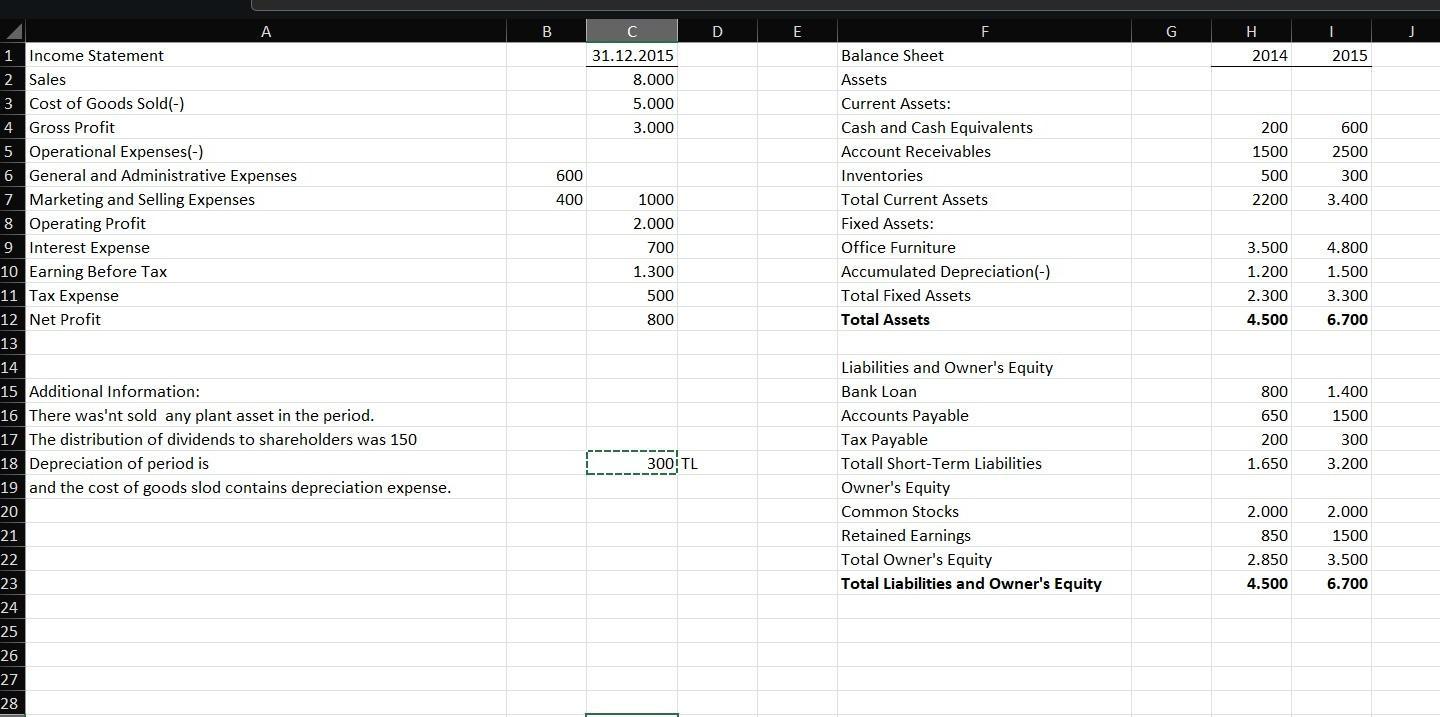

Prepare Cash flow report. 1 Income Statement 2 Sales 3 Cost of Goods Sold(-) 4 Gross Profit 5 Operational Expenses(-) 6 General and Administrative Expenses

Prepare Cash flow report.

Prepare Cash flow report. 1 Income Statement 2 Sales 3 Cost of Goods Sold(-) 4 Gross Profit 5 Operational Expenses(-) 6 General and Administrative Expenses 7 Marketing and Selling Expenses 8 Operating Profit 9 Interest Expense 10 Earning Before Tax A 11 Tax Expense 12 Net Profit 13 14 15 Additional Information: 16 There was'nt sold any plant asset in the period. 17 The distribution of dividends to shareholders was 150 18 Depreciation of period is 19 and the cost of goods slod contains depreciation expense. 20 21 22 23 24 25 26 27 28 B 600 400 C 31.12.2015 8.000 5.000 3.000 1000 2.000 700 1.300 500 800 300 TL D E F Balance Sheet Assets Current Assets: Cash and Cash Equivalents Account Receivables Inventories Total Current Assets Fixed Assets: Office Furniture Accumulated Depreciation (-) Total Fixed Assets Total Assets Liabilities and Owner's Equity Bank Loan Accounts Payable Tax Payable Totall Short-Term Liabilities Owner's Equity Common Stocks Retained Earnings Total Owner's Equity Total Liabilities and Owner's Equity G H 2014 200 1500 500 2200 3.500 1.200 2.300 4.500 800 650 200 1.650 2.000 850 2.850 4.500 2015 600 2500 300 3.400 4.800 1.500 3.300 6.700 1.400 1500 300 3.200 2.000 1500 3.500 6.700 J

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

CASHFLOW FROM OPERATING ACTIVITIES Operating profit as per income statement 2000 Adjustment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started