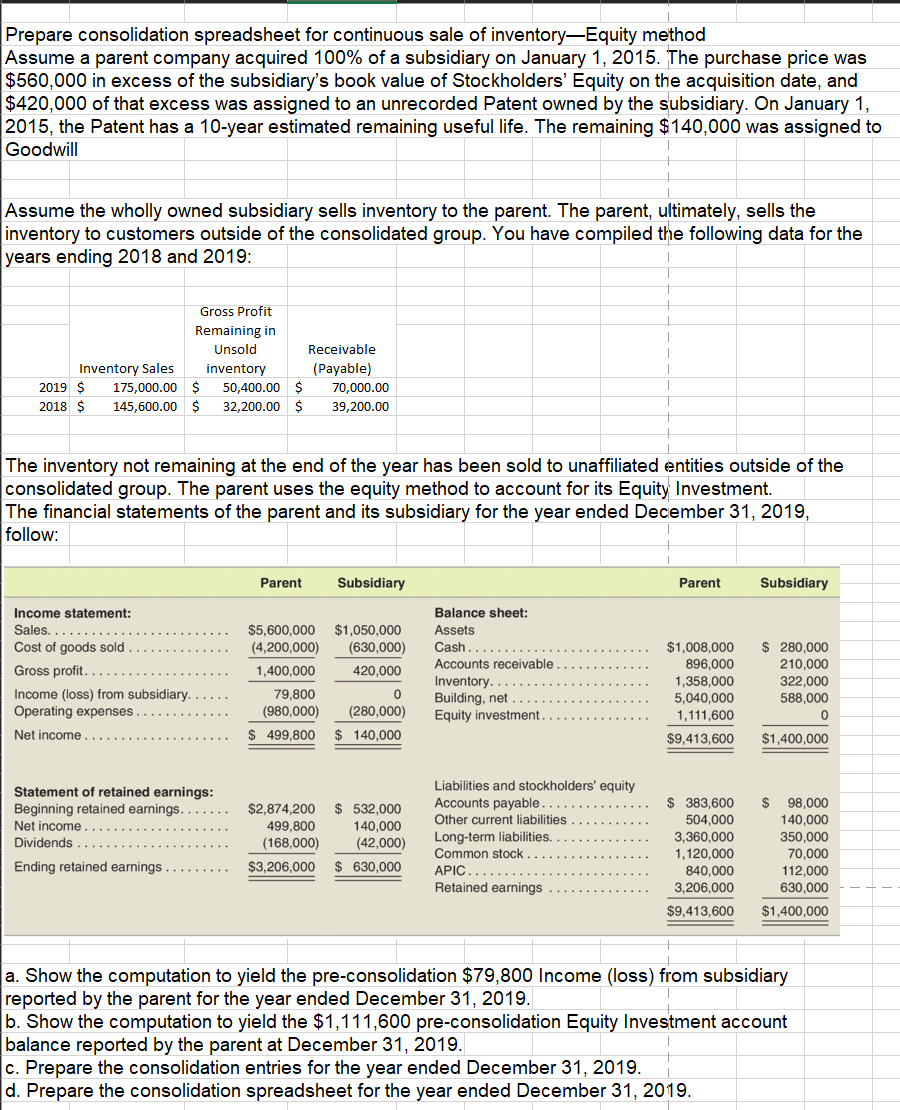

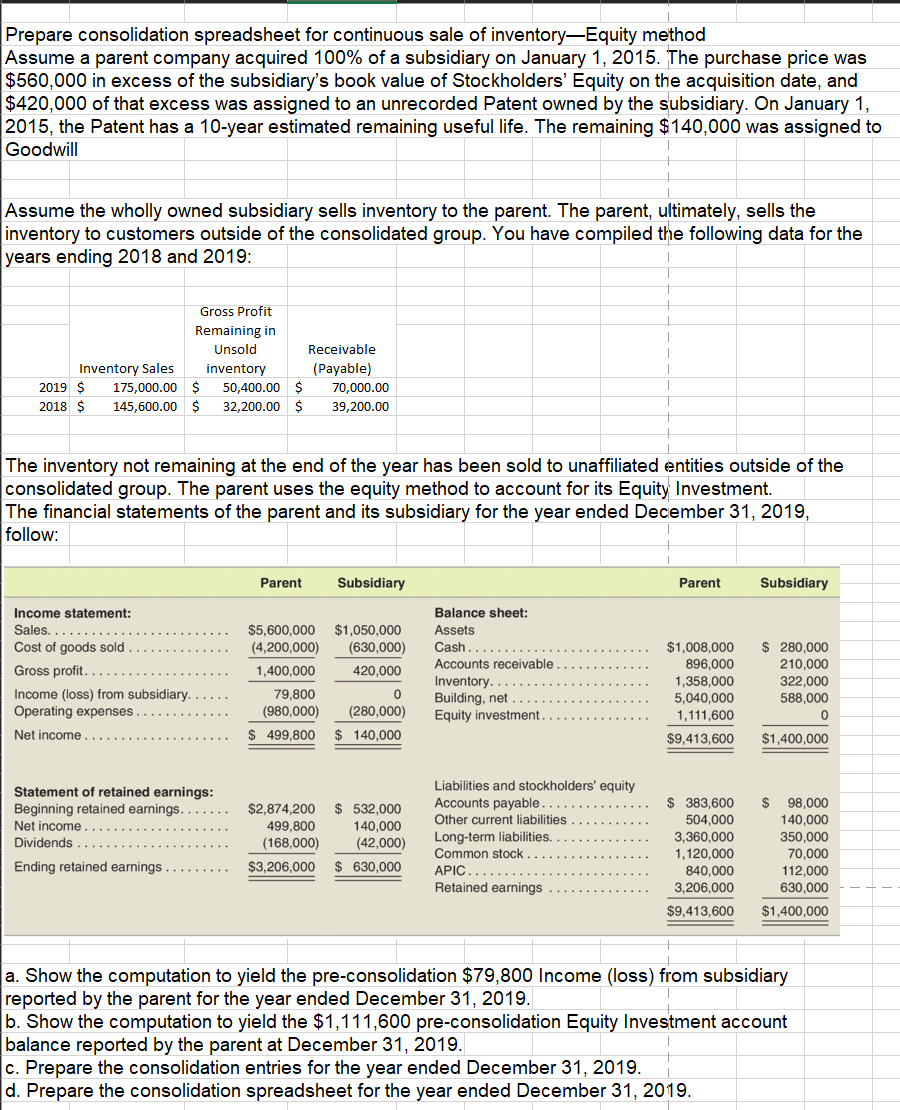

Prepare consolidation spreadsheet for continuous sale of inventory-Equity method Assume a parent company acquired 100% of a subsidiary on January 1, 2015. The purchase price was $560,000 in excess of the subsidiary's book value of Stockholders' Equity on the acquisition date, and $420,000 of that excess was assigned to an unrecorded Patent owned by the subsidiary. On January 1, 2015, the Patent has a 10-year estimated remaining useful life. The remaining $ 140,000 was assigned to Goodwill Assume the wholly owned subsidiary sells inventory to the parent. The parent, ultimately, sells the inventory to customers outside of the consolidated group. You have compiled the following data for the years ending 2018 and 2019: Gross Profit Remaining in Unsold Receivable inventory (Payable) $ 50,400.00 $ 70,000.00 $ 32,200.00 $ 39,200.00 Inventory Sales 2019 $ 175,000.00 2018 $ 145,600.00 The inventory not remaining at the end of the year has been sold to unaffiliated entities outside of the consolidated group. The parent uses the equity method to account for its Equity Investment. The financial statements of the parent and its subsidiary for the year ended December 31, 2019, follow: Parent Subsidiary Parent Subsidiary Income statement: Sales......... .. Cost of goods sold ........ Gross profit. Income (loss) from subsidiary...... Operating expenses............. Net income $1,050,000 (630,000) 420,000 $5,600,000 (4,200,000) 1,400,000 79,800 (980,000) $ 499,800 Balance sheet: Assets Cash.......... Accounts receivable... Inventory...................... Building, net .... Equity investment...... $1,008,000 896,000 1,358,000 5,040,000 1,111,600 $9,413,600 $ 280,000 210,000 322,000 588,000 (280,000) $ 140,000 $1,400,000 Statement of retained earnings: Beginning retained earnings........ Net income.................... Dividends ..................... $2,874,200 499,800 (168,000) $3,206,000 $ 532,000 140,000 (42,000) $ 630,000 Liabilities and stockholders' equity Accounts payable.... Other current liabilities ........... Long-term liabilities. .. Common stock ............ APIC.... Retained earnings .......... $ 383,600 504,000 3,360,000 1,120,000 840,000 3,206,000 $9,413,600 $ 98,000 140,000 350,000 70,000 112,000 630,000 $1,400,000 Ending retained earnings ......... a. Show the computation to yield the pre-consolidation $79,800 Income (loss) from subsidiary reported by the parent for the year ended December 31, 2019. b. Show the computation to yield the $1,111,600 pre-consolidation Equity Investment account balance reported by the parent at December 31, 2019. c. Prepare the consolidation entries for the year ended December 31, 2019. d. Prepare the consolidation spreadsheet for the year ended December 31, 2019. Prepare consolidation spreadsheet for continuous sale of inventory-Equity method Assume a parent company acquired 100% of a subsidiary on January 1, 2015. The purchase price was $560,000 in excess of the subsidiary's book value of Stockholders' Equity on the acquisition date, and $420,000 of that excess was assigned to an unrecorded Patent owned by the subsidiary. On January 1, 2015, the Patent has a 10-year estimated remaining useful life. The remaining $ 140,000 was assigned to Goodwill Assume the wholly owned subsidiary sells inventory to the parent. The parent, ultimately, sells the inventory to customers outside of the consolidated group. You have compiled the following data for the years ending 2018 and 2019: Gross Profit Remaining in Unsold Receivable inventory (Payable) $ 50,400.00 $ 70,000.00 $ 32,200.00 $ 39,200.00 Inventory Sales 2019 $ 175,000.00 2018 $ 145,600.00 The inventory not remaining at the end of the year has been sold to unaffiliated entities outside of the consolidated group. The parent uses the equity method to account for its Equity Investment. The financial statements of the parent and its subsidiary for the year ended December 31, 2019, follow: Parent Subsidiary Parent Subsidiary Income statement: Sales......... .. Cost of goods sold ........ Gross profit. Income (loss) from subsidiary...... Operating expenses............. Net income $1,050,000 (630,000) 420,000 $5,600,000 (4,200,000) 1,400,000 79,800 (980,000) $ 499,800 Balance sheet: Assets Cash.......... Accounts receivable... Inventory...................... Building, net .... Equity investment...... $1,008,000 896,000 1,358,000 5,040,000 1,111,600 $9,413,600 $ 280,000 210,000 322,000 588,000 (280,000) $ 140,000 $1,400,000 Statement of retained earnings: Beginning retained earnings........ Net income.................... Dividends ..................... $2,874,200 499,800 (168,000) $3,206,000 $ 532,000 140,000 (42,000) $ 630,000 Liabilities and stockholders' equity Accounts payable.... Other current liabilities ........... Long-term liabilities. .. Common stock ............ APIC.... Retained earnings .......... $ 383,600 504,000 3,360,000 1,120,000 840,000 3,206,000 $9,413,600 $ 98,000 140,000 350,000 70,000 112,000 630,000 $1,400,000 Ending retained earnings ......... a. Show the computation to yield the pre-consolidation $79,800 Income (loss) from subsidiary reported by the parent for the year ended December 31, 2019. b. Show the computation to yield the $1,111,600 pre-consolidation Equity Investment account balance reported by the parent at December 31, 2019. c. Prepare the consolidation entries for the year ended December 31, 2019. d. Prepare the consolidation spreadsheet for the year ended December 31, 2019