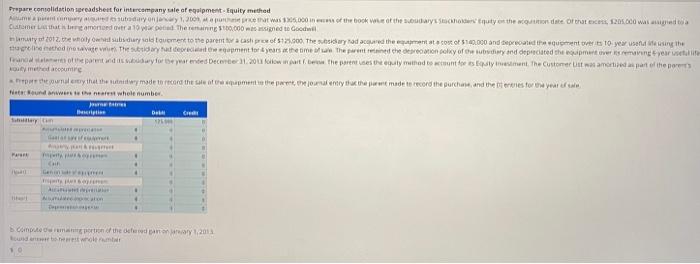

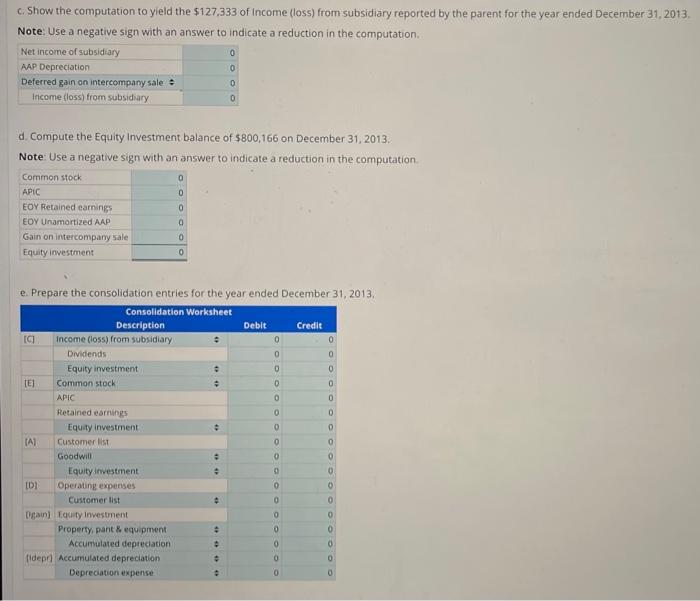

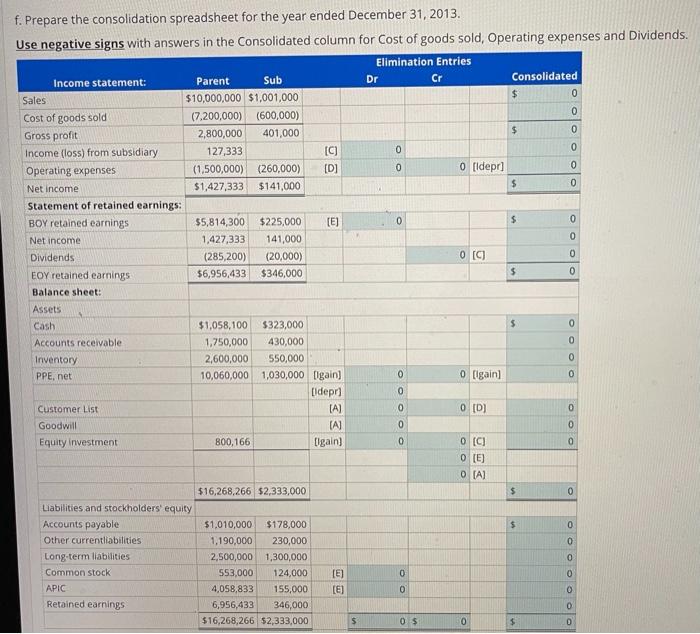

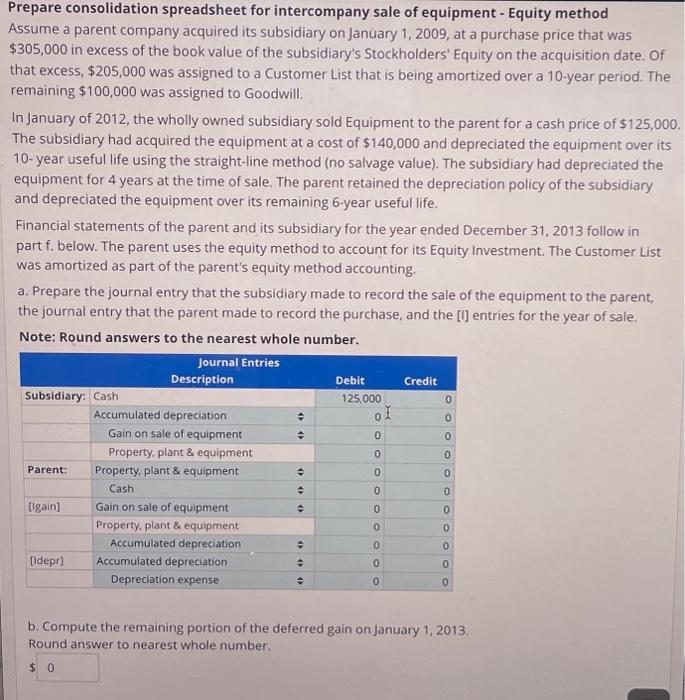

Prepare consolidation spreadsheet for intercompany sale of equipment quity method mwenye utryny. Met was 15.000 of the book of the stars nutes the wounde Ortach 120.000 witam Customers that morto tra low on the remaining 100.000 signed to Goodwill ity of 2012. olywed by ale tourment to the parent tash prof 17.000 The story nadared the cost of $100.000 and Gerda que estoy en eging the the prethodno svete Theaterment or years the time the winter clay of tuby and deprecated the woment versenyrtilli uw wone parent and way to parented Dec. 2oow wote the prey munod to stronte se customer it was amortidas por the olymer contre The una entry that the dwy made to record the same time the permettere made to record the purchase and the terms to your Note und te the nearest whole number mi DI CH Smyth Car GE D Computer portion of the day 2013 But Show the computation to yield the $127.333 of Income (loss) from subsidiary reported by the parent for the year ended December 31, 2013 Note: Use a negative sign with an answer to indicate a reduction in the computation Net income of subsidiary AAP Depreciation 0 Deferred gain on intercompany sale 0 Income doss) from subsidiary 0 0 0 d. Compute the Equity Investment balance of $800,166 on December 31, 2013 Note: Use a negative sign with an answer to indicate a reduction in the computation Common stock APIC EOY Retained earnings 0 EOY Unamortized AAP 0 Gain on intercompany sale Equity investment 0 0 0 e. Prepare the consolidation entries for the year ended December 31, 2013, Consolidation Worksheet Description Debit Credit IC) Income (loss) from subsidiary 0 0 Dividends 0 0 Equity investment 0 0 IE) Common stock 2 0 0 APIC 0 0 Retained earnings 0 Equity investment O 0 TAI Customer list 0 Goodwill 0 Equity investment 0 ID Operating expenses 0 Customer list 0 0 Din Tuity Investment 0 0 Property, pant & equipment 0 0 Accumulated depreciation 0 0 fidepr Accumulated depreciation 0 0 Depreciation expense + 0 O o o o OO f. Prepare the consolidation spreadsheet for the year ended December 31, 2013. Use negative signs with answers in the Consolidated column for Cost of goods sold, Operating expenses and Dividends. Elimination Entries Income statement: Parent Sub Dr Cr Consolidated Sales $10,000,000 $1,001,000 $ 0 0 Cost of goods sold (7.200,000) (600,000) 2,800,000 Gross profit 401,000 $ 0 Income (loss) from subsidiary 127,333 [C] Operating expenses (1,500,000) (260,000) [D] 0 0 [idepr) 0 Net income $1,427,333 $141,000 $ 0 Statement of retained earnings: BOY retained earnings $5,814,300 $225,000 [E] 0 $ 0 Net income 1,427,333 141,000 0 Dividends (285,200) (20,000) 0 (0) 0 EOY retained earnings $6,956,433 $346,000 $ 0 Balance sheet: o OO ) VA Assets Cash Accounts receivable Inventory PPE, net o gain) $1,058,100 $323,000 1,750,000 430,000 2,600,000 550,000 10,060,000 1,030,000 tlgain) [idepr) (A) [A] 800,166 Ilgain) ooOOO 0 [D] Customer List Goodwill Equity investment 0 0 0 0 0 (0) 0 [E] O [A] $16,268,266 $2,333,000 $ 0 $ 0 0 Liabilities and stockholders equity Accounts payable Other currentliabilities Long-term liabilities Common stock APIC Retained earnings 0 $1,010,000 $178,000 1,190,000 230,000 2,500,000 1,300,000 553,000 124,000 4,058,833 155,000 6,956,433 346,000 $16,268,266 $2,333,000 o 0 [E] [E] 0 0 0 5 0 $ o 0 Prepare consolidation spreadsheet for intercompany sale of equipment - Equity method Assume a parent company acquired its subsidiary on January 1, 2009, at a purchase price that was $305,000 in excess of the book value of the subsidiary's Stockholders' Equity on the acquisition date. Of that excess, $205,000 was assigned to a Customer List that is being amortized over a 10-year period. The remaining $100,000 was assigned to Goodwill. In January of 2012, the wholly owned subsidiary sold Equipment to the parent for a cash price of $125,000. The subsidiary had acquired the equipment at a cost of $140,000 and depreciated the equipment over its 10-year useful life using the straight-line method (no salvage value). The subsidiary had depreciated the equipment for 4 years at the time of sale. The parent retained the depreciation policy of the subsidiary and depreciated the equipment over its remaining 6-year useful life. Financial statements of the parent and its subsidiary for the year ended December 31, 2013 follow in part f. below. The parent uses the equity method to account for its Equity Investment. The Customer List was amortized as part of the parent's equity method accounting. a. Prepare the journal entry that the subsidiary made to record the sale of the equipment to the parent, the journal entry that the parent made to record the purchase, and the [I] entries for the year of sale. Note: Round answers to the nearest whole number. Journal Entries Description Credit Subsidiary: Cash 125,000 Accumulated depreciation ol Gain on sale of equipment Property, plant & equipment Property, plant & equipment Cash [gain) Gain on sale of equipment Property, plant & equipment Accumulated depreciation [ldepr) Accumulated depreciation Depreciation expense Debit