Prepare forecasts of its income statement, statement of financial position and statement of cash flows for 2007 under the following assumptions: a. All financial ratio remains at 2006 level. b. Kodak will not record restructuring costs for 2007. c. Taxes payable are at the 2006 level of $544 million. d. Depreciation expense charged to Selling, general and administrative is $765million for 2006 and 2005 repectively. e. Gross PPE is $12,982 million and $12,963 million for 2006 and 2005 respectively. f. Projected current maturities of long term debt are RM13 million for 2007. g. Capital expenditure for 2006 and 2005 are $1,047 and $783, respectively

will not record restructuring costs for 2007. c. Taxes payable are at the 2006 level of $544 million. d. Depreciation expense charged to Selling, general and administrative is $765million for 2006 and 2005 repectively. e. Gross PPE is $12,982 million and $12,963 million for 2006 and 2005 respectively. f. Projected current maturities of long term debt are RM13 million for 2007. g. Capital expenditure for 2006 and 2005 are $1,047 and $783, respectively

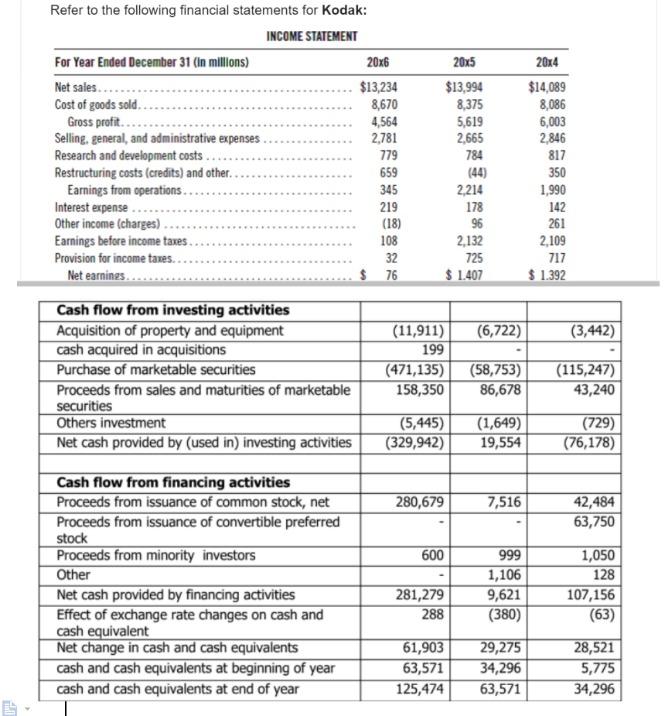

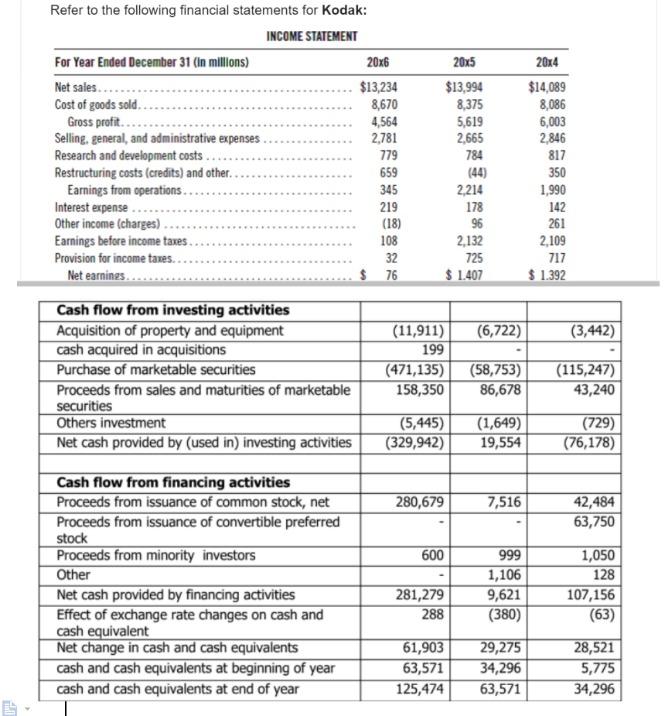

Refer to the following financial statements for Kodak: INCOME STATEMENT For Year Ended December 31 (In millions) 20x6 Net sales......... $13,234 Cost of goods sold 8,670 Gross profit... 4,564 Selling, general, and administrative expenses 2,781 Research and development costs. 779 Restructuring costs (credits) and other 659 Earnings from operations .... 345 Interest expense.. 219 Other income (charges) (18) Earnings before income taxes 108 Provision for income taxes... 32 Net earnings... $ 76 20x5 $13,994 8,375 5,619 2,665 784 2014 $14,089 8,086 6,003 2,846 817 350 1,990 142 261 2,214 178 96 2,132 725 $ 1.407 2,109 717 $ 1.392 (6,722) (3,442) Cash flow from investing activities Acquisition of property and equipment cash acquired in acquisitions Purchase of marketable securities Proceeds from sales and maturities of marketable securities Others investment Net cash provided by (used in) investing activities (11,911) 199 (471,135) 158,350 (58,753) 86,678 (115,247) 43,240 (5,445) (329,942) (1,649) 19,554 (729) (76,178) 280,679 7,516 42,484 63,750 600 Cash flow from financing activities Proceeds from issuance of common stock, net Proceeds from issuance of convertible preferred stock Proceeds from minority investors Other Net cash provided by financing activities Effect of exchange rate changes on cash and cash equivalent Net change in cash and cash equivalents cash and cash equivalents at beginning of year cash and cash equivalents at end of year 999 1,106 9,621 (380) 281,279 288 1,050 128 107,156 (63) 61,903 63,571 125,474 29,275 34,296 63,571 28,521 5,775 34,296 Refer to the following financial statements for Kodak: INCOME STATEMENT For Year Ended December 31 (In millions) 20x6 Net sales......... $13,234 Cost of goods sold 8,670 Gross profit... 4,564 Selling, general, and administrative expenses 2,781 Research and development costs. 779 Restructuring costs (credits) and other 659 Earnings from operations .... 345 Interest expense.. 219 Other income (charges) (18) Earnings before income taxes 108 Provision for income taxes... 32 Net earnings... $ 76 20x5 $13,994 8,375 5,619 2,665 784 2014 $14,089 8,086 6,003 2,846 817 350 1,990 142 261 2,214 178 96 2,132 725 $ 1.407 2,109 717 $ 1.392 (6,722) (3,442) Cash flow from investing activities Acquisition of property and equipment cash acquired in acquisitions Purchase of marketable securities Proceeds from sales and maturities of marketable securities Others investment Net cash provided by (used in) investing activities (11,911) 199 (471,135) 158,350 (58,753) 86,678 (115,247) 43,240 (5,445) (329,942) (1,649) 19,554 (729) (76,178) 280,679 7,516 42,484 63,750 600 Cash flow from financing activities Proceeds from issuance of common stock, net Proceeds from issuance of convertible preferred stock Proceeds from minority investors Other Net cash provided by financing activities Effect of exchange rate changes on cash and cash equivalent Net change in cash and cash equivalents cash and cash equivalents at beginning of year cash and cash equivalents at end of year 999 1,106 9,621 (380) 281,279 288 1,050 128 107,156 (63) 61,903 63,571 125,474 29,275 34,296 63,571 28,521 5,775 34,296

will not record restructuring costs for 2007. c. Taxes payable are at the 2006 level of $544 million. d. Depreciation expense charged to Selling, general and administrative is $765million for 2006 and 2005 repectively. e. Gross PPE is $12,982 million and $12,963 million for 2006 and 2005 respectively. f. Projected current maturities of long term debt are RM13 million for 2007. g. Capital expenditure for 2006 and 2005 are $1,047 and $783, respectively

will not record restructuring costs for 2007. c. Taxes payable are at the 2006 level of $544 million. d. Depreciation expense charged to Selling, general and administrative is $765million for 2006 and 2005 repectively. e. Gross PPE is $12,982 million and $12,963 million for 2006 and 2005 respectively. f. Projected current maturities of long term debt are RM13 million for 2007. g. Capital expenditure for 2006 and 2005 are $1,047 and $783, respectively