Question

prepare in journal entry form the adjusting journal entries for the following items: A) On September 1, 2017 a 12-month insurance policy was purchased for

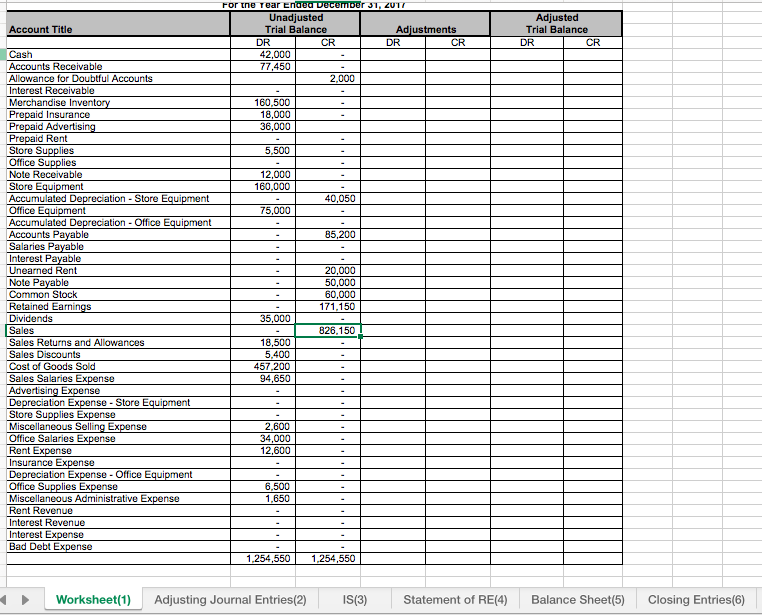

prepare in journal entry form the adjusting journal entries for the following items: A) On September 1, 2017 a 12-month insurance policy was purchased for $18,000 B) On January 1, 2017 H&L paid Brewster Advertising $36,000 for two years of advertising services. Equal services are provided in year 1 and year 2. C) H&L needed some additional storage space so on March 1, 2017 they rented a unit for an annual rate of $12,600. The entire amount was expensed when paid. D) $5,500 of store supplies were purchased during the year and the asset Store Supplies was increased. $4,100 of these supplies were used during the year. E) $6,500 of office supplies were purchased during the year and were immediately expensed. $750 of these supplies remained at the end of 2017. F) On July 1, 2017, H&L issued a 9-month note receivable to Greenstreet & Co. at an annual interest rate of 5.5%. Principle and interest will be paid at the end of the 9-months. The note was recorded as $12,000 in Notes Receivable and is the only note outstanding. G) Depreciation for store equipment is based on the following: Straight line depreciation Store Equipment Assets were held for the entire year; Residual Value = $5,500; Service life is estimated to be 12 years H) Depreciation for office equipment is based on the following: Double-Declining Method Office equipment Assets were purchased May 1; Residual Value = $3,000; Service life is estimated to be 6 years I) Sales salaries of $7,400 and office salaries of $5,200 remained unpaid at 12/31/16. J) On May 1, 2016, H&L rented a portion of one store to Henreid Co. The contract was for 8 months and H&L required the 8 months of cash upfront on October 1. The rent is being earned equally over the next 8 months. When cash was received, unearned rent was appropriately recorded as $20,000. K) The note payable was outstanding the entire year and a 4.25% interest rate exists on the note. No interest has been recorded for the year. L) At 12/31/2017, based on the aging method, H&L determined that uncollectible accounts are $4,300. M) Utilities expenses of $6,800 remained unpaid. 40% of the utilities expense is for office and 60% of utilities expense is for the store.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started