Answered step by step

Verified Expert Solution

Question

1 Approved Answer

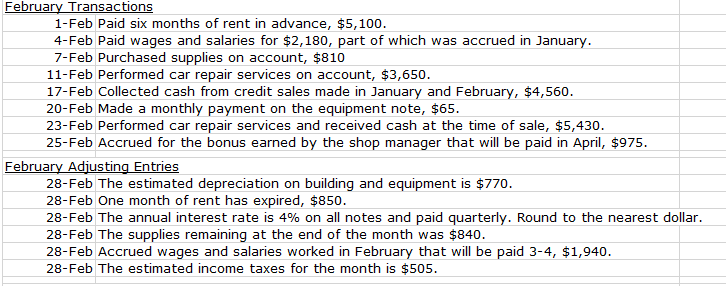

Prepare: Journal Entries for February and March February Transactions 1-Feb Paid six months of rent in advance, $5,100. 4-Feb Paid wages and salaries for $2,180,

Prepare: Journal Entries for February and March

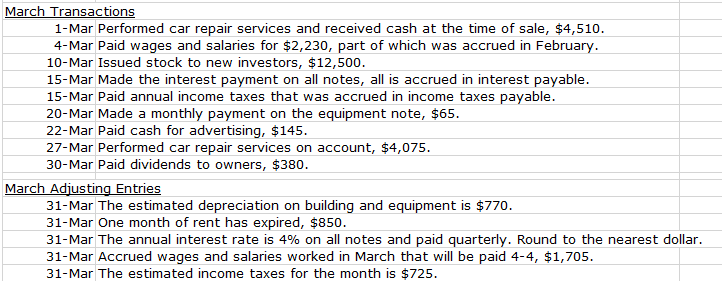

February Transactions 1-Feb Paid six months of rent in advance, $5,100. 4-Feb Paid wages and salaries for $2,180, part of which was accrued in January 7-Feb Purchased supplies on account, $810 11-Feb Performed car repair services on account, $3,650. 17-Feb Collected cash from credit sales made in January and February, $4,560. 20-Feb Made a monthly payment on the equipment note, $65. 23-Feb Performed car repair services and received cash at the time of sale, $5,430. 25-Feb Accrued for the bonus earned by the shop manager that will be paid in April, $975 February Adjusting Entries 28-Feb The estimated depreciation on building and equipment is $770. 28-Feb One month of rent has expired, $850. 28-Feb The annual interest rate is 4% on all notes and paid quarterly. Round to the nearest dollar. 28-Feb The supplies remaining at the end of the month was $840. 28-Feb Accrued wages and salaries worked in February that will be paid 3-4, $1,940. 28-Feb The estimated income taxes for the month is $505 March Transactions 1-Mar Performed car repair seervices and received cash at the time of sale, $4,510 4-Mar Paid wages and salaries for $2,230, part of which was accrued in February 10-Mar Issued stock to new investors, $12,500 15-Mar Made the interest payment on all notes, all is accrued in interest payable. 15-Mar Paid annual income taxes that was accrued in income taxes payable 20-Mar Made a monthly payment on the equipment note, $65. 22-Mar Paid cash for advertising, $145 27-Mar Performed car repair services on account, $4,075 30-Mar Paid dividends to owners, $380 March Adjusting Entries 31-Mar The estimated depreciation on building and equipment is $770. 31-Mar One month of rent has expired, $850. 31-Mar The annual interest rate is 4% on all notes and paid quarterly. Round to the nearest dollar. 31-Mar Accrued wages and salaries worked in March that will be paid 4-4, $1,705. 31-Mar The estimated income taxes for the month is $725Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started