Question

Prepare journal entries, t accounts, and ending trial balance. Jan. 1 - Issued 6,500 shares of no-par common stock for $10 per share. Jan. 1

Prepare journal entries, t accounts, and ending trial balance.

Jan. 1 - Issued 6,500 shares of no-par common stock for $10 per share. Jan. 1 - Purchased a computer equipment for $5,000. Monthly depreciation for the equipment is $250. Jan. 3 Paid $3,000 in rent on the warehouse building for the month of January Jan. 6 - Purchased office supplies for $6,000. Jan. 10 - Performed repairs and maintenance on their machine costing $1,500. Jan. 11 - Purchased inventory on account for $95,000. Jan. 16 - Declared and paid $15,000 in dividends to its shareholders. Jan. 21 - Paid $55,000 to its suppliers for inventory purchased on credit in December 2019 ($45,000) and on January 11, 2020 ($10,000). Jan. 25 - Provided services for which a customer had paid $7,500 in December of 2019 (hint: see the deferred revenue account in the January 1, 2020 trial balance). Jan. 31 - Paid its employees $24,800 for work performed from December 26 January 25. $4,800 was for work performed in December 2019, and 20,000 was for work performed from January 1 January 25, 2020. During January Packing Inc. made credit sales for $225,000. The cost of the goods sold was $123,750 (make one summary entry for the entire month). During January Packing Inc. collected $145,000 in accounts receivable from customers (make one summary entry for the entire month).

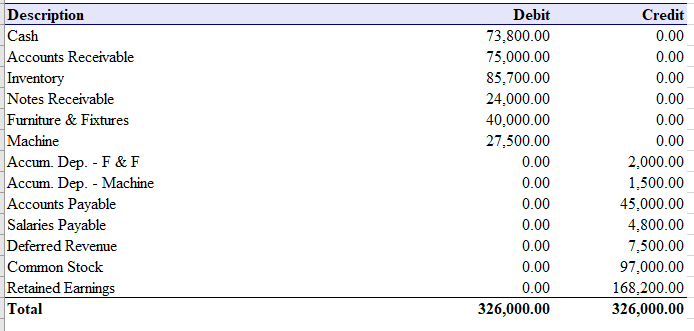

opening trial balance:

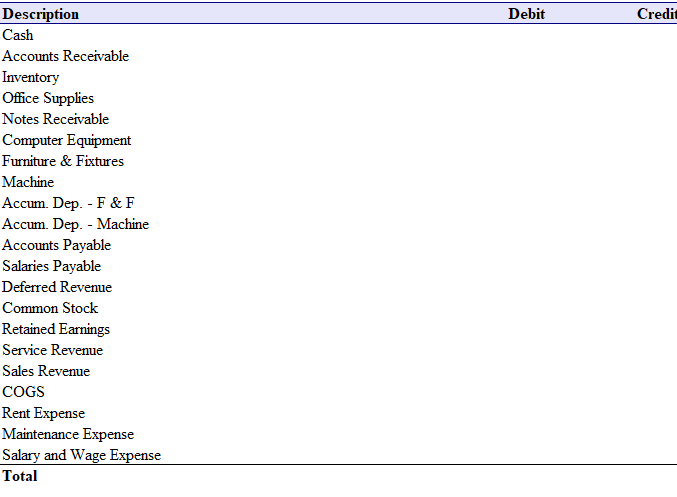

ending trial balance:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started