Question

Prepare Pages 1 and 6 of Wildcat's Form 1120 Prepare a calculation of Wildcat's current earning s of profits (E&P) Prepare Schedule M-3 (Parts II

Prepare Pages 1 and 6 of Wildcat's Form 1120

Prepare a calculation of Wildcat's current earning s of profits (E&P)

Prepare Schedule M-3 (Parts II and III; skip Part I). Although it is not required because total assets are less than $10 million (and, when requested, Schedule M-3 is filed instead of Schedule M-1), preparing Schedules M-3 and M-1 will Gove you experience with both of them.

Prepare the journal entry, in accordance with U.S GAAP, to update WIldcat's income tax expense and adjust the balances in its deferred tax assets and liabilities. Also, prepare a disclosure indicating the amounts of current income tax expense and deferred income tax expense.

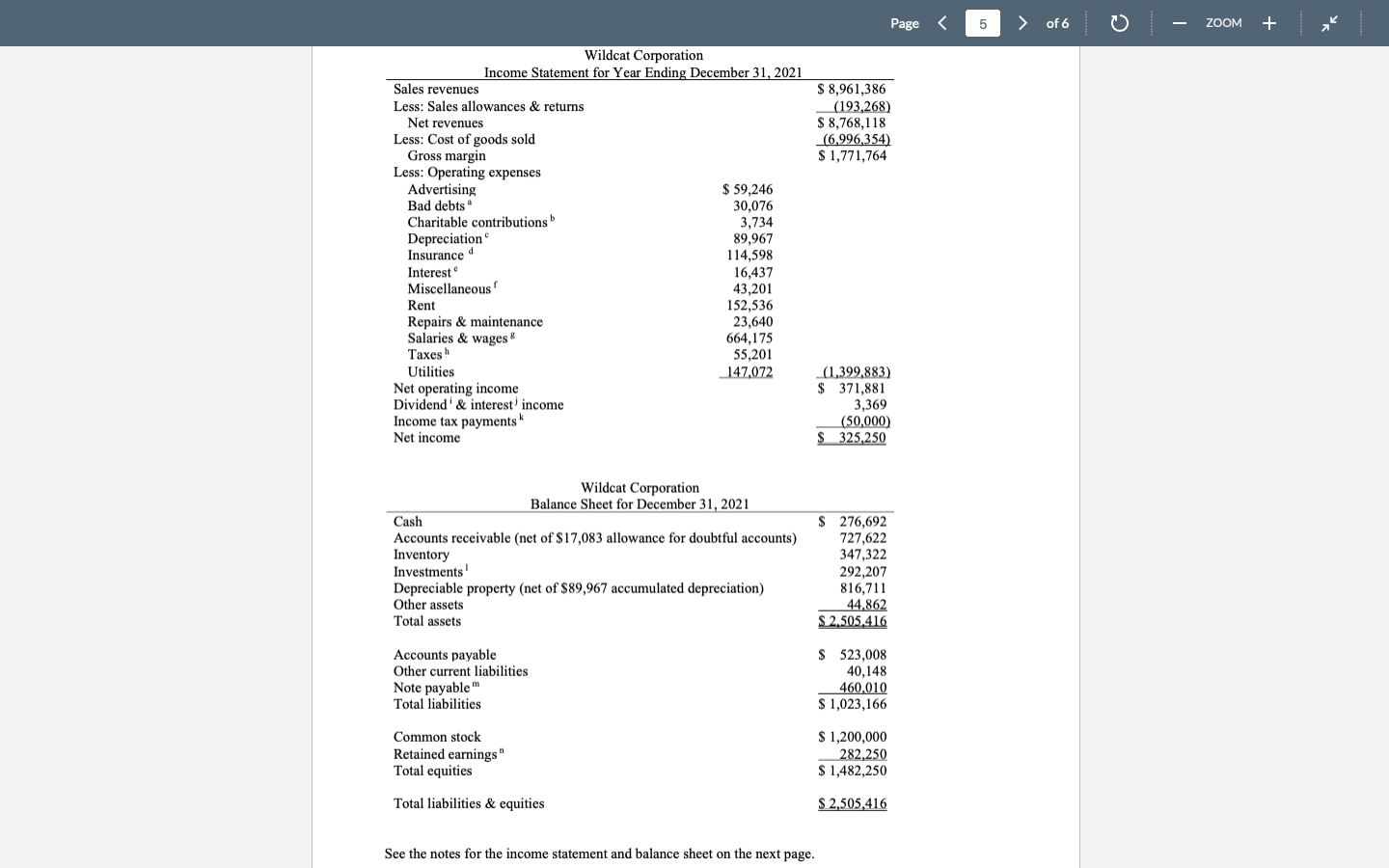

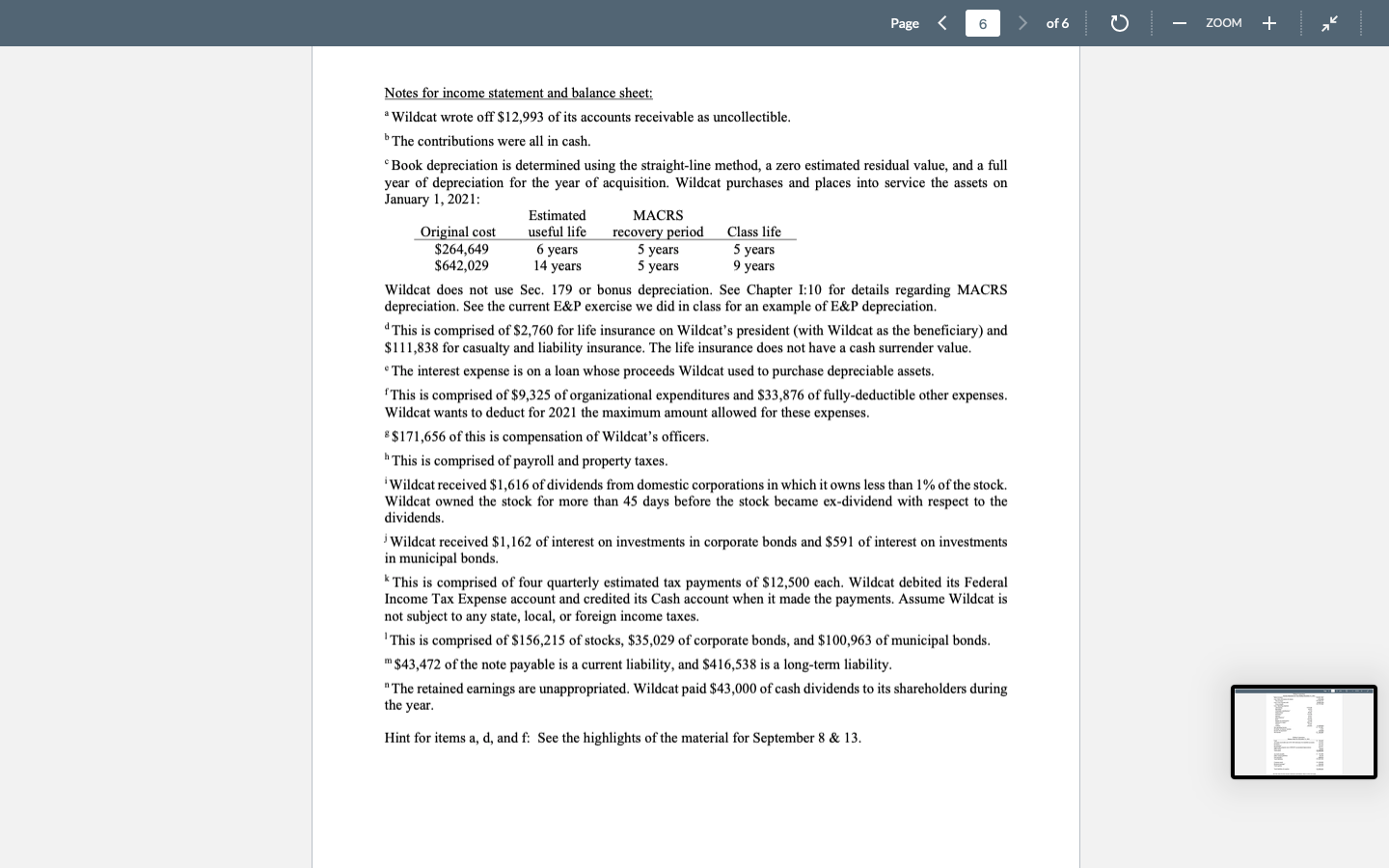

Page 5 > of 6 ZOOM + $ 8,961,386 (193.268) $ 8,768,118 (6.996,354) $ 1,771,764 Wildcat Corporation Income Statement for Year Ending December 31, 2021 Sales revenues Less: Sales allowances & returns Net revenues Less: Cost of goods sold Gross margin Less: Operating expenses Advertising $ 59,246 Bad debts a 30,076 Charitable contributions 3,734 Depreciation 89,967 Insurance 114,598 Interest 16,437 Miscellaneous 43,201 Rent 152,536 Repairs & maintenance 23,640 Salaries & wages 664,175 55,201 Utilities 147,072 Net operating income Dividend' & interest income Income tax payments" Net income Taxes (1,399,883) $ 371,881 3,369 (50,000) $ 325,250 Wildcat Corporation Balance Sheet for December 31, 2021 Cash Accounts receivable (net of $17,083 allowance for doubtful accounts) Inventory Investments Depreciable property (net of $89,967 accumulated depreciation) Other assets Total assets $ 276,692 727,622 347,322 292,207 816,711 44.862 S 2.505,416 Accounts payable Other current liabilities Note payable" Total liabilities $ 523,008 40,148 460,010 $ 1,023,166 Common stock Retained earnings" Total equities $ 1,200,000 282,250 $ 1,482,250 Total liabilities & equities $ 2,505,416 See the notes for the income statement and balance sheet on the next page. Page 6 > of 6 ZOOM + 5 years Notes for income statement and balance sheet: a Wildcat wrote off $12,993 of its accounts receivable as uncollectible. The contributions were all in cash. "Book depreciation is determined using the straight-line method, a zero estimated residual value, and a full year of depreciation for the year of acquisition. Wildcat purchases and places into service the assets on January 1, 2021: Estimated MACRS Original cost useful life recovery period Class life $264,649 6 years 5 years $642,029 14 years 5 years 9 years Wildcat does not use Sec. 179 or bonus depreciation. See Chapter 1:10 for details regarding MACRS depreciation. See the current E&P exercise we did in class for an example of E&P depreciation. This is comprised of $2,760 for life insurance on Wildcat's president (with Wildcat as the beneficiary) and $111,838 for casualty and liability insurance. The life insurance does not have a cash surrender value. The interest expense is on a loan whose proceeds Wildcat used to purchase depreciable assets. This is comprised of $9,325 of organizational expenditures and $33,876 of fully-deductible other expenses. Wildcat wants to deduct for 2021 the maximum amount allowed for these expenses. 8 $171,656 of this is compensation of Wildcat's officers. This is comprised of payroll and property taxes. Wildcat received $1,616 of dividends from domestic corporations in which it owns less than 1% of the stock. Wildcat owned the stock for more than 45 days before the stock became ex-dividend with respect to the dividends. Wildcat received $1,162 of interest on investments in corporate bonds and $591 of interest on investments in municipal bonds. k This is comprised of four quarterly estimated tax payments of $12,500 each. Wildcat debited its Federal Income Tax Expense account and credited its Cash account when it made the payments. Assume Wildcat is not subject to any state, local, or foreign income taxes. This is comprised of $156,215 of stocks, $35,029 of corporate bonds, and $100,963 of municipal bonds. *$43,472 of the note payable is a current liability, and $416,538 is a long-term liability. " The retained earnings are unappropriated. Wildcat paid $43,000 of cash dividends to its shareholders during the year. Hint for items a, d, and f: See the highlights of the material for September 8 & 13. Page 5 > of 6 ZOOM + $ 8,961,386 (193.268) $ 8,768,118 (6.996,354) $ 1,771,764 Wildcat Corporation Income Statement for Year Ending December 31, 2021 Sales revenues Less: Sales allowances & returns Net revenues Less: Cost of goods sold Gross margin Less: Operating expenses Advertising $ 59,246 Bad debts a 30,076 Charitable contributions 3,734 Depreciation 89,967 Insurance 114,598 Interest 16,437 Miscellaneous 43,201 Rent 152,536 Repairs & maintenance 23,640 Salaries & wages 664,175 55,201 Utilities 147,072 Net operating income Dividend' & interest income Income tax payments" Net income Taxes (1,399,883) $ 371,881 3,369 (50,000) $ 325,250 Wildcat Corporation Balance Sheet for December 31, 2021 Cash Accounts receivable (net of $17,083 allowance for doubtful accounts) Inventory Investments Depreciable property (net of $89,967 accumulated depreciation) Other assets Total assets $ 276,692 727,622 347,322 292,207 816,711 44.862 S 2.505,416 Accounts payable Other current liabilities Note payable" Total liabilities $ 523,008 40,148 460,010 $ 1,023,166 Common stock Retained earnings" Total equities $ 1,200,000 282,250 $ 1,482,250 Total liabilities & equities $ 2,505,416 See the notes for the income statement and balance sheet on the next page. Page 6 > of 6 ZOOM + 5 years Notes for income statement and balance sheet: a Wildcat wrote off $12,993 of its accounts receivable as uncollectible. The contributions were all in cash. "Book depreciation is determined using the straight-line method, a zero estimated residual value, and a full year of depreciation for the year of acquisition. Wildcat purchases and places into service the assets on January 1, 2021: Estimated MACRS Original cost useful life recovery period Class life $264,649 6 years 5 years $642,029 14 years 5 years 9 years Wildcat does not use Sec. 179 or bonus depreciation. See Chapter 1:10 for details regarding MACRS depreciation. See the current E&P exercise we did in class for an example of E&P depreciation. This is comprised of $2,760 for life insurance on Wildcat's president (with Wildcat as the beneficiary) and $111,838 for casualty and liability insurance. The life insurance does not have a cash surrender value. The interest expense is on a loan whose proceeds Wildcat used to purchase depreciable assets. This is comprised of $9,325 of organizational expenditures and $33,876 of fully-deductible other expenses. Wildcat wants to deduct for 2021 the maximum amount allowed for these expenses. 8 $171,656 of this is compensation of Wildcat's officers. This is comprised of payroll and property taxes. Wildcat received $1,616 of dividends from domestic corporations in which it owns less than 1% of the stock. Wildcat owned the stock for more than 45 days before the stock became ex-dividend with respect to the dividends. Wildcat received $1,162 of interest on investments in corporate bonds and $591 of interest on investments in municipal bonds. k This is comprised of four quarterly estimated tax payments of $12,500 each. Wildcat debited its Federal Income Tax Expense account and credited its Cash account when it made the payments. Assume Wildcat is not subject to any state, local, or foreign income taxes. This is comprised of $156,215 of stocks, $35,029 of corporate bonds, and $100,963 of municipal bonds. *$43,472 of the note payable is a current liability, and $416,538 is a long-term liability. " The retained earnings are unappropriated. Wildcat paid $43,000 of cash dividends to its shareholders during the year. Hint for items a, d, and f: See the highlights of the material for September 8 & 13Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started