Answered step by step

Verified Expert Solution

Question

1 Approved Answer

prepare partnership account and strment of fanancial positron so QUESTION TWO Nii, Maafio and Eno have been in partnership as accountants for a number of

prepare partnership account and strment of fanancial positron so

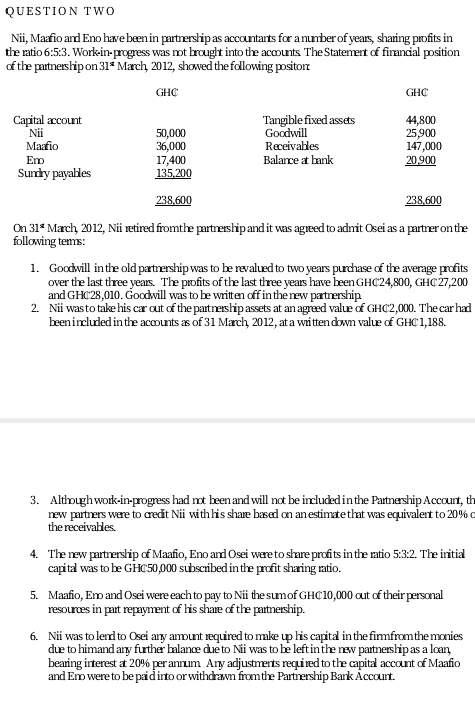

QUESTION TWO Nii, Maafio and Eno have been in partnership as accountants for a number of years, sharing profits in the ratio 6:5:3. Work-in-progress was not brought into the accounts The Statement of financial position of the partnership on 31 March 2012 showed the following positor GHC GHC Capital account Tangible fixed assets 44,800 Nii 50,000 Goodwill 25,900 Maatio 36,000 Receivables 147,000 Em 17,400 Balance at bank 20.900 Sundy payables 135.200 238,600 238,600 On 31* Mach 2012, Nii retired fromthe partnership and it was agreed to admit Osei as a partner on the following tems: 1. Goodwill in the old patrership was to be revalued to two years purchase of the average profits over the last three years. The profits of the last three years have been GHC24,800, GHC 27,200 and GHC28,010. Goodwill was to be writen off in the new partnership 2. Nii was to take his car out of the partnership assets at an agreed value of GHC2,000. The car had been included in the accounts as of 31 March 2012, at a written down value of GHC1,188. 3. Although work-in-progress had not been and will not be included in the Partnership Account, th new partners were to credit Nii with his share based on an estimate that was equivalent to 20% the receivables. 4. The new partnership of Maafio, Eno and Osei were to share profits in the ratio 5:32. The initial capital was to be GHC50,000 subscribed in the profit sharing ratio. 5. Maafio, Emo and Osei were each to pay to Nii the sum of GHC10,000 out of their personal resources in part repayment of his share of the partnership. 6. Nii was to lend to Osei ary amount required to make up his capital in the fimmfrom the monies due to himand any further balance due to Nii was to be left in the new partnership as a loan, bearing interest a 20% per annum Any adjustments required to the capital account of Maafio and Emo were to be paid into or withdrawn from the Partnership Bank AccountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started