Answered step by step

Verified Expert Solution

Question

1 Approved Answer

prepare tax documentation for individuals edition 1 8 solution QUESTION 3 . 7 ( Exempt foreign employment income with deductions ) Cain Sturrock, a 4

prepare tax documentation for individuals edition solution QUESTION

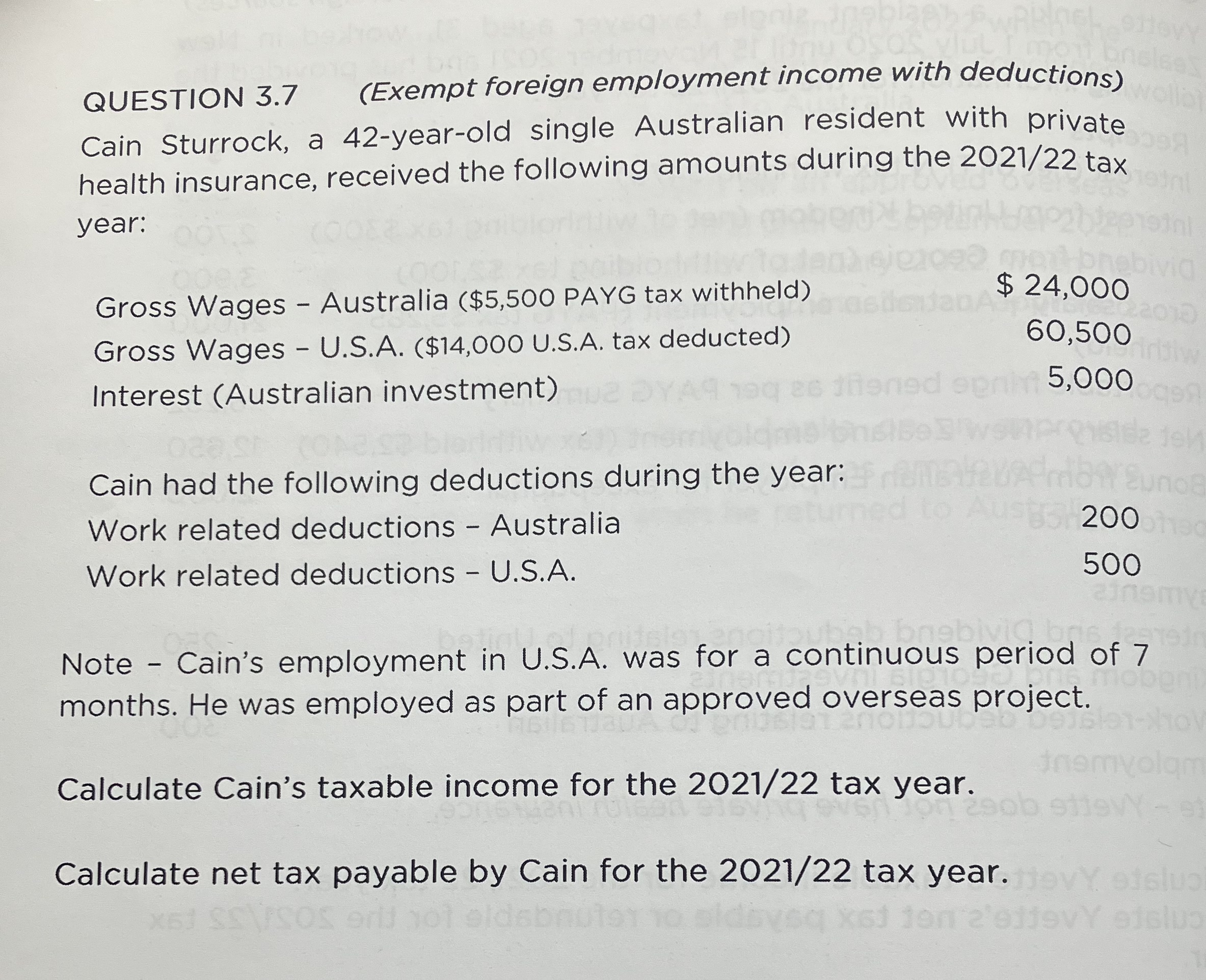

Exempt foreign employment income with deductions

Cain Sturrock, a yearold single Australian resident with private

health insurance, received the following amounts during the tax

year:

Gross Wages Australia $ PAYG tax withheld

Gross Wages USA $ USA tax deducted

Interest Australian investment

Cain had the following deductions during the year:

Work related deductions Australia

Work related deductions USA

Note Cain's employment in USA was for a continuous period of

months. He was employed as part of an approved overseas project.

Calculate Cain's taxable income for the tax year.

Calculate net tax payable by Cain for the tax year. Answer to Q

Note Please show all workinas where necessary and you may use additional space below

Adelitinnal Workinae Iif anulto question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started