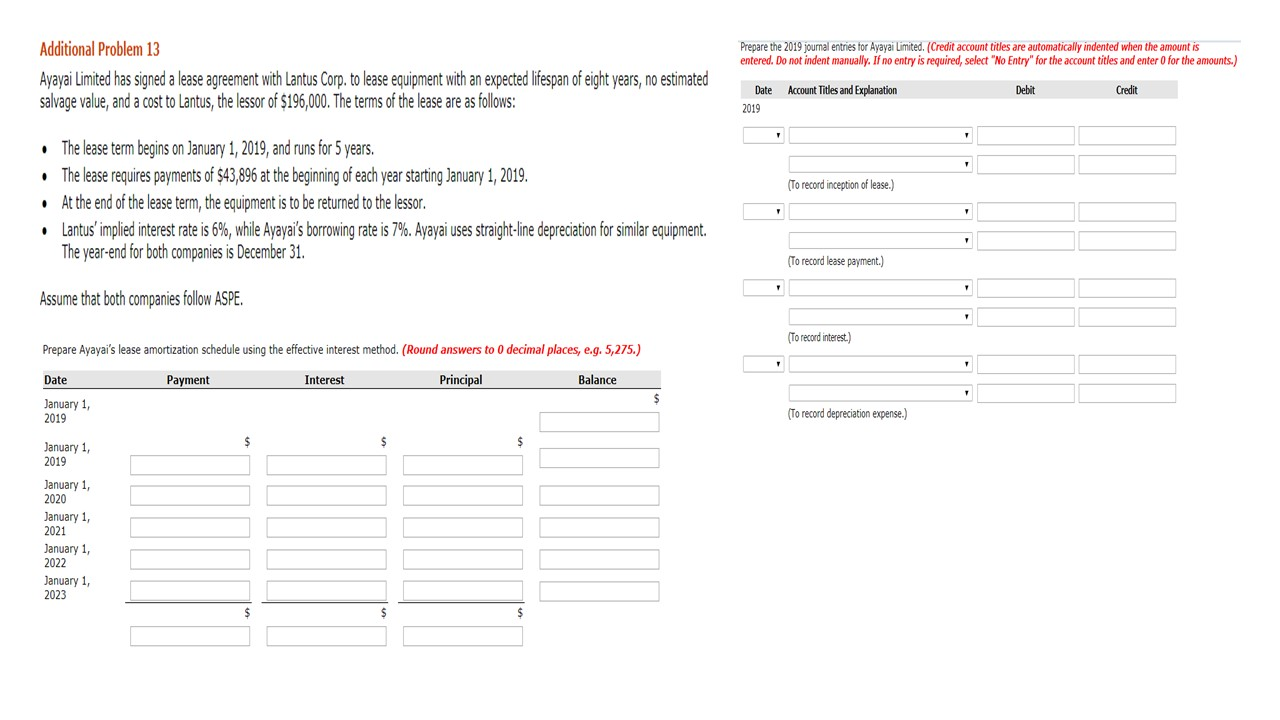

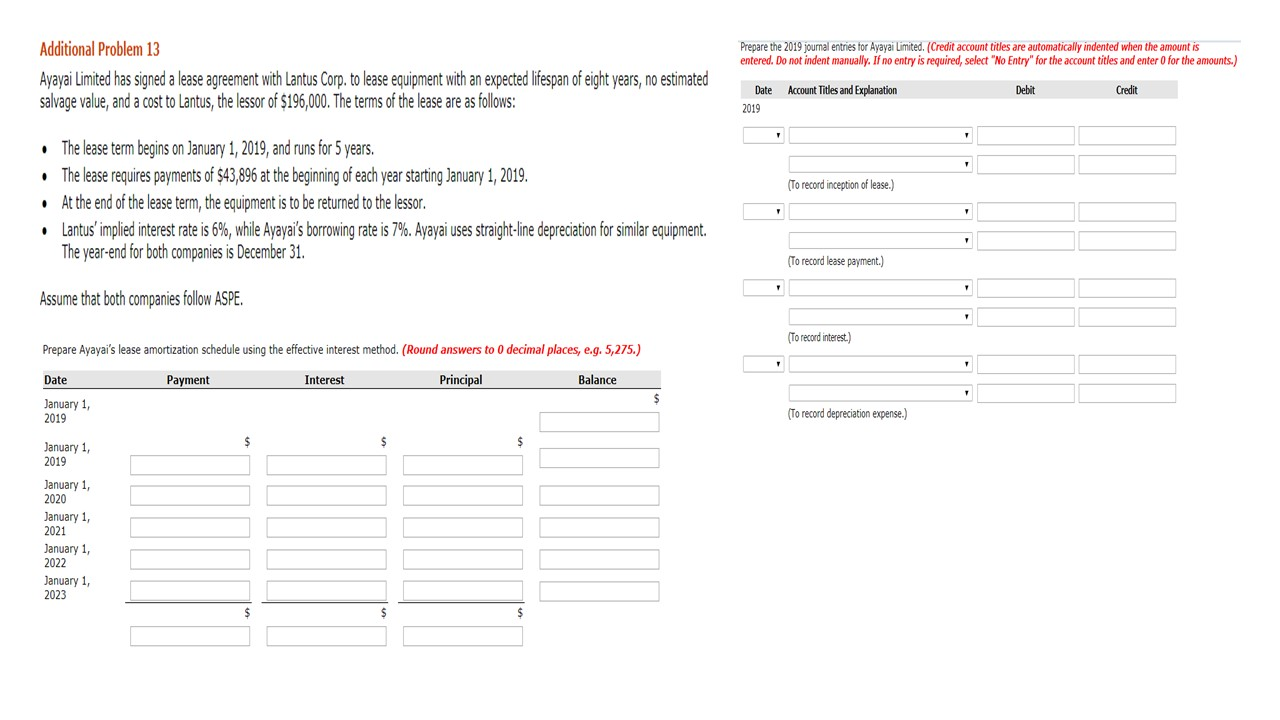

Prepare the 2019 journal entries for Ayayai Limited. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Additional Problem 13 Ayayai Limited has signed a lease agreement with Lantus Corp. to lease equipment with an expected lifespan of eight years, no estimated salvage value, and a cost to Lantus, the lessor of $196,000. The terms of the lease are as follows: Account Titles and Explanation Debit Credit Date 2019 (To record inception of lease.) The lease term begins on January 1, 2019, and runs for 5 years. The lease requires payments of $43,896 at the beginning of each year starting January 1, 2019. At the end of the lease term, the equipment is to be returned to the lessor. Lantus' implied interest rate is 6%, while Ayayai's borrowing rate is 7%. Ayayai uses straight-line depreciation for similar equipment. The year-end for both companies is December 31. (To record lease payment.) Assume that both companies follow ASPE. (To record interest.) Prepare Ayayai's lease amortization schedule using the effective interest method. (Round answers to 0 decimal places, e.g. 5,275.) Date Payment Interest Principal Balance January 1, 2019 (To record depreciation expense.) January 1, 2019 January 1, 2020 January 1, 2021 January 1, 2022 January 1, 2023 Prepare the 2019 journal entries for Ayayai Limited. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Additional Problem 13 Ayayai Limited has signed a lease agreement with Lantus Corp. to lease equipment with an expected lifespan of eight years, no estimated salvage value, and a cost to Lantus, the lessor of $196,000. The terms of the lease are as follows: Account Titles and Explanation Debit Credit Date 2019 (To record inception of lease.) The lease term begins on January 1, 2019, and runs for 5 years. The lease requires payments of $43,896 at the beginning of each year starting January 1, 2019. At the end of the lease term, the equipment is to be returned to the lessor. Lantus' implied interest rate is 6%, while Ayayai's borrowing rate is 7%. Ayayai uses straight-line depreciation for similar equipment. The year-end for both companies is December 31. (To record lease payment.) Assume that both companies follow ASPE. (To record interest.) Prepare Ayayai's lease amortization schedule using the effective interest method. (Round answers to 0 decimal places, e.g. 5,275.) Date Payment Interest Principal Balance January 1, 2019 (To record depreciation expense.) January 1, 2019 January 1, 2020 January 1, 2021 January 1, 2022 January 1, 2023