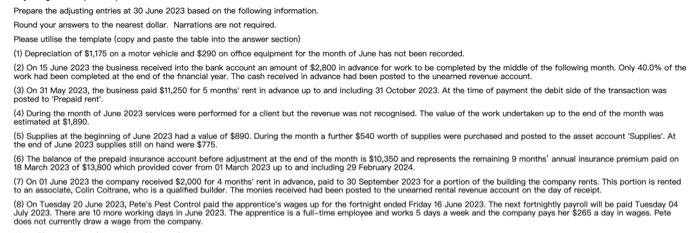

Prepare the adjusting entries at 30 June 2023 based on the following information. Round your answers to the nearest dollar. Narrations are not required. Please utilise the template (copy and paste the table into the answer section) (1) Depreciation of $1,175 on a motor wehicle and $290 on office equipment for the month of June has not been recorded. (2) On 15 June 2023 the business received inte the bank account an amount of $2,800 in advance for work to be completed by the middie of the following month. Only a0.0\% of the work had been completed at the end of the financial year. The cash received in advance had been posted to the uneamed reverue accourt. (3) On 31 May 2023, the businoss paid $11,250 for 5 months' rent in advance up to and including 31 Ootober 2023. At the time of payment the dobit side of the transaction was posted to 'Prepaid rent". (4) During the month of June 2023 services wero performed for a cliont but the revonue was not recognised. The value of the work undertaken up to the end of the month was estimated at $1,890. (5) Supplies at the beginning of June 2023 had a value of \$890. During the month a further $540 worth of supplies were purchased and posted to the asset account 'Supplies'. At the end of June 2023 supplies still on hand were $775. (6) The balance of the prepaid insurance account before adjustment at the end of the month is $10,350 and represents the remaining 9 months' annual insurance premium paid on 18 March 2023 of $13,800 which provided cover from 0t March 2023 up to and including 29 Fobruary 2024. (7) On 01 June 2023 the company received $2.000 for 4 months' rent in advance, paid to 30 september 2023 for a portion of the buliding the compary rents. This portion is rented to an associate, Colin Coltrane, who is a qualified buildber. The monies received had been posted to the unearned rental revenue account on the day of receipt. (8) On Tuesday 20 June 2023, Pote's Pest Control paid the apprentice's wages up for the fortnight ended Fridar t6 June 2023 . The noxt fortnightly payroll will be paid Tuesday 04 July 2023. There are 10 more working days in June 2023. The apprentice is a full-time empleyee and works 5 days a week and the company pays her $265 a day in wages. Pote does not currently draw a wage from the compary