Question

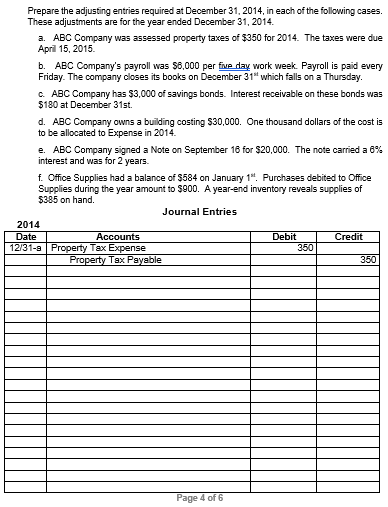

Prepare the adjusting entries required at December 31, 2014, in each of the following cases. These adjustments are for the year ended December 31, 2014.

Prepare the adjusting entries required at December 31, 2014, in each of the following cases. These adjustments are for the year ended December 31, 2014.

a. ABC Company was assessed property taxes of $350 for 2014. The taxes were due April 15, 2015.

b. ABC Companys payroll was $6,000 per five day work week. Payroll is paid every Friday. The company closes its books on December 31st which falls on a Thursday.

c. ABC Company has $3,000 of savings bonds. Interest receivable on these bonds was $180 at December 31st.

d. ABC Company owns a building costing $30,000. One thousand dollars of the cost is to be allocated to Expense in 2014. e. ABC Company signed a Note on September 16 for $20,000. The note carried a 6% interest and was for 2 years.

f. Office Supplies had a balance of $584 on January 1st. Purchases debited to Office Supplies during the year amount to $900. A year-end inventory reveals supplies of $385 on hand.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started