Question

Prepare the budgets for each month in the first quarter of 2104 for the Bullwinkle, Inc. *Slaes Unit Selling Price $12.00 Unit Sales for November,

Prepare the budgets for each month in the first quarter of 2104 for the Bullwinkle, Inc.

*Slaes

Unit Selling Price $12.00

Unit Sales for November, 2013 $112,500.00

Unit Sales for December, 2013 $102,100.00

Expected unit sales for May, 2014 $137,500.00

Expected unit sales for April, 2014 $125,000.00

Expected unit sales for March, 2014 $116,000.00

Expected unit sales for February, 2014 $112,500.00

Expected unit sales for January, 2014 $113,000.00

Bullwinkle, Inc. likes to keep 10% of the next month's unit sales in ending inventory. All sales are on account. 85% of the Accounts Receivalbe are collected in the month of sale, and 15% of the Account Receivable are collected in the mont after sale. Account Receivable on December 31,2013, totaled $183,780.

Desired Ending Direct Materials 3/31/14 12625.0lbs

Metal, Plastic, and Rubber together are $0.75 per pound per unit.

Bullwinkle, Inc. likes to keep 5%of the materials needed ofr the next month in ending inventory. Payment for materials is made within 15 days. 50% is paid in the month of purchase, and 50% is paid in the month after purchase. Accounts Payable on December 31. 2013 totaled $120,595 and were paid in full in January 2014. Beginning Raw Materials on December 31,2013 was 11,295 pounds.

*Direct Labor

Labor requires 2 pounds per unit for completion and is paid at a rate of $8.00 per hour.

*Manufacturing Overhead

Indirect Materials $0.30 per labor hour

Indirect Labor $0.50 per labor hour

Utilities $0.45 per labor hour

Maintenace $0.25 per labor hour

Salaries $42,000 per month

Depreciation $16,800 per month

Property Taxes $2675 per month

insurance $1200 per month

Janitorial $1300 per month

All manufacturing overhead costs are variable except salaries, depreciation, property taxes, insurance and janitorial.

*Selling and Administrative Expenses

Variable selling and Administrative cost per unit is $1.60

Advertising $15,000 a month

Insurance $1,400 a month

Salaries $72,000 a month

Depreciation $2,500 a month

Other fixed cost $3,000 a month

*Other info

Cash balance on December 31,2013, totaled $100,500 but management has decided it would like to maintain a cash balance of at least $800,000 beginning on January 31, 2014. Dividends are paid each month at the rate of $2.50 per share for 5000 shares outstanding. The company has an open line of credit with Exchange Bank. The terms of agreement requires borrowing to be in $1000 increments at 8% interest. The funds borrowed in January 2014 were paid back on February 28, 2014. A $500,000 equipment purchase is planned for February, 2014

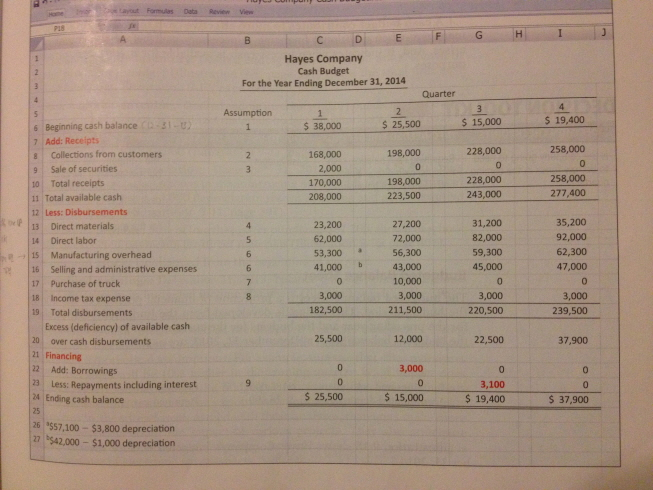

Prepare Cash Budget (Use picture format please.)

| Variable Costs | Jan | Feb | Mar | Total | |||

| Indirect Materials ($.30/hour) | $ 6,777.00 | $ 6,771.00 | $ 7,014.00 | $ 20,562.00 | |||

| Indirect Labor ($.50/hour) | $ 11,295.00 | $ 11,285.00 | $ 11,690.00 | $ 34,270.00 | |||

| Utilities($.45/hour) | $ 10,165.50 | $ 10,156.50 | $ 10,521.00 | $ 30,843.00 | |||

| Mainatenance($.25/hour) | $ 5,647.50 | $ 5,642.50 | $ 5,845.00 | $ 17,135.00 | |||

| Total Variable costs | $ 33,885.00 | $ 33,855.00 | $ 35,070.00 | $ 102,810.00 | |||

| Fixed Costs | |||||||

| Salaries | $ 42,000.00 | $ 42,000.00 | $ 42,000.00 | $ 126,000.00 | |||

| Depreciation | $ 16,800.00 | $ 16,800.00 | $ 16,800.00 | $ 50,400.00 | |||

| Property Taxes | $ 2,675.00 | $ 2,675.00 | $ 2,675.00 | $ 8,025.00 | |||

| Insurance | $ 1,200.00 | $ 1,200.00 | $ 1,200.00 | $ 3,600.00 | |||

| Janitorial | $ 1,300.00 | $ 1,300.00 | $ 1,300.00 | $ 3,900.00 | |||

| Total Fixed Costs | $ 63,975.00 | $ 63,975.00 | $ 63,975.00 | $ 191,925.00 | |||

| Total Manufacturing Overhead | $ 97,860.00 | $ 97,830.00 | $ 99,045.00 | $ 294,735.00 | |||

| Direct Labor hours | 22590 | 22570 | 23380 | $ 68,540.00 | |||

| MO/DL | $ 4.30 | ||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started