Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PREPARE THE CONDENSED BALANCE SHEET FOR CARLA INC AS IT WOULD APPEAR DEC 31 2017 Prepare the condensed balance sheet for Carla Inc. as it

PREPARE THE CONDENSED BALANCE SHEET FOR CARLA INC AS IT WOULD APPEAR DEC 31 2017

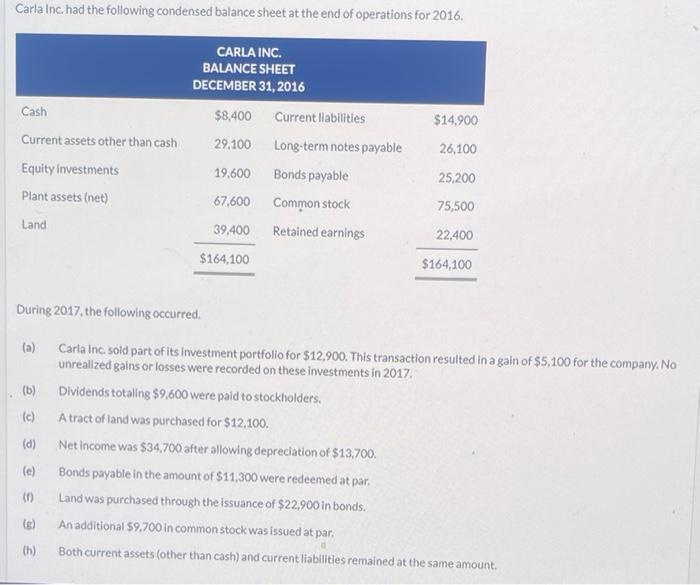

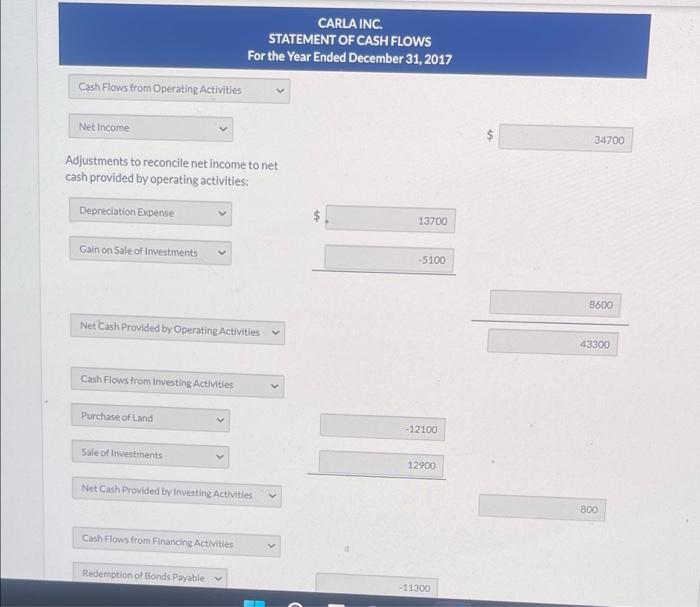

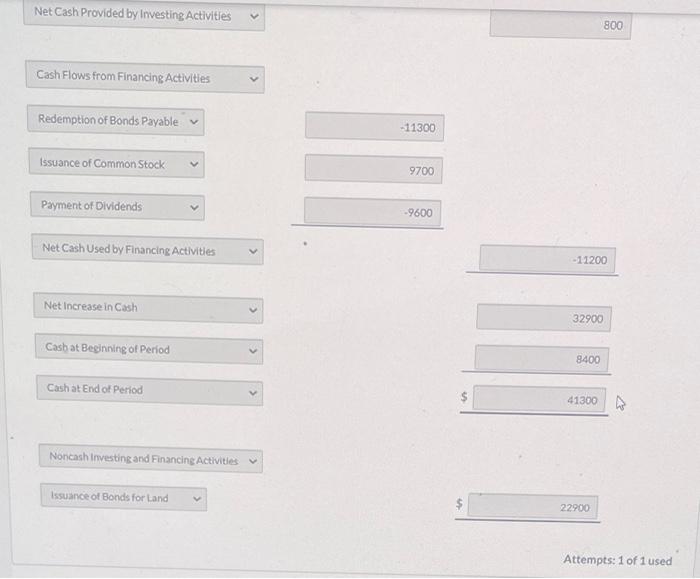

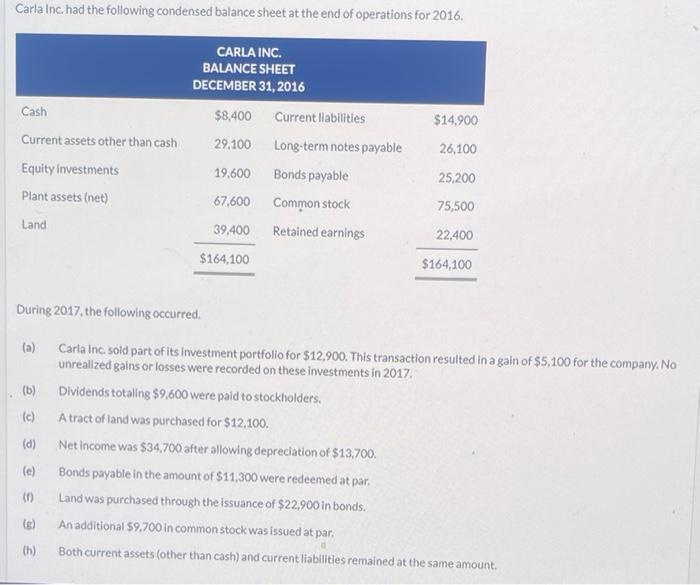

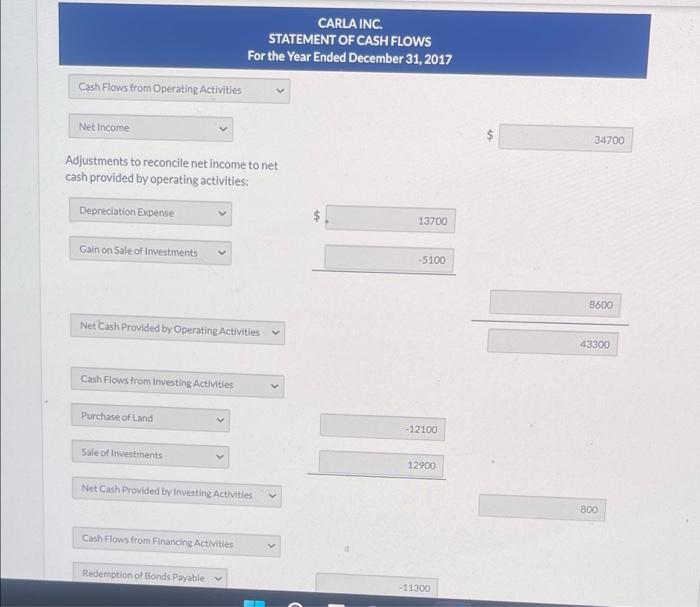

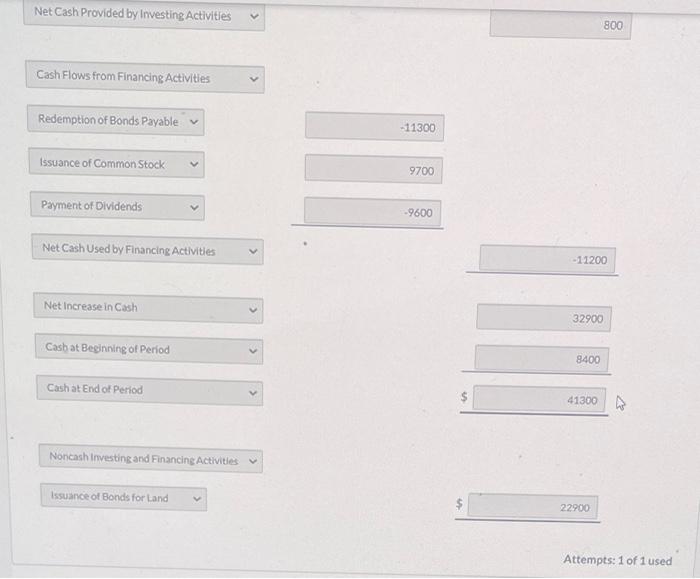

Prepare the condensed balance sheet for Carla Inc. as it would appear at December 31, 2017. December 31, 2017 Assets $ $ Save for Later CARLA INC. BALANCE SHEET Equities Attempts: 0 of 1 used: Submit Answer Prepare the condensed balance sheet for Carla Inc. as it would appear at December 31, 2017. CARLA INC. BALANCE SHEET December 31, 2017 Equities Save for Later Attempts: 0 of 1 used Submit Answer Carla Inc. had the following condensed balance sheet at the end of operations for 2016. CARLA INC. BALANCE SHEET DECEMBER 31, 2016 Cash $8,400 Current liabilities $14,900 Current assets other than cash 29,100 Long-term notes payable 26,100 Equity investments 19,600 Bonds payable 25,200 Plant assets (net) 67,600 Common stock 75,500 Land 39,400 Retained earnings 22,400 $164,100 $164,100 During 2017, the following occurred. (a) Carla Inc. sold part of its investment portfolio for $12.900. This transaction resulted in a gain of $5,100 for the company. No unrealized gains or losses were recorded on these investments in 2017. . (b) Dividends totaling $9,600 were paid to stockholders. (c) A tract of land was purchased for $12,100. (d) Net Income was $34,700 after allowing depreciation of $13,700. (e) Bonds payable in the amount of $11,300 were redeemed at par. (1) Land was purchased through the issuance of $22,900 in bonds. (8) An additional $9,700 in common stock was issued at par. (h) Both current assets (other than cash) and current liabilities remained at the same amount. 3 CARLA INC. STATEMENT OF CASH FLOWS For the Year Ended December 31, 2017 13700 -5100 Cash Flows from Operating Activities Net Income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation Expense Gain on Sale of Investments Net Cash Provided by Operating Activities Cash Flows from Investing Activities Purchase of Land Sale of Investments Net Cash Provided by Investing Activities Cash Flows from Financing Activities Redemption of Bonds Payable -12100 12900 -11300 34700 8600 43300 800 Net Cash Provided by Investing Activities Cash Flows from Financing Activities Redemption of Bonds Payable Issuance of Common Stock Payment of Dividends Net Cash Used by Financing Activities Net Increase in Cash Cash at Beginning of Period Cash at End of Period Noncash Investing and Financing Activities Issuance of Bonds for Land -11300 9700 -9600 800 -11200 32900 8400 41300 22900 Attempts: 1 of 1 used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started