Answered step by step

Verified Expert Solution

Question

1 Approved Answer

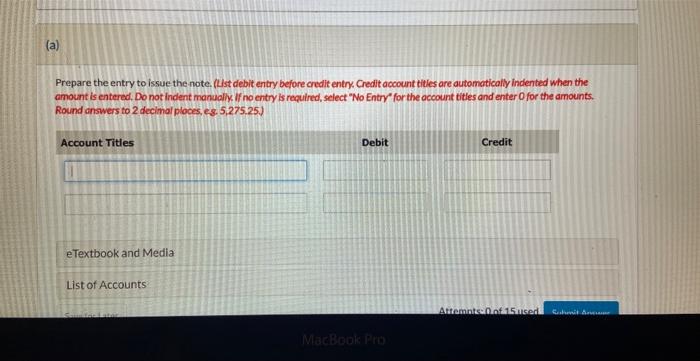

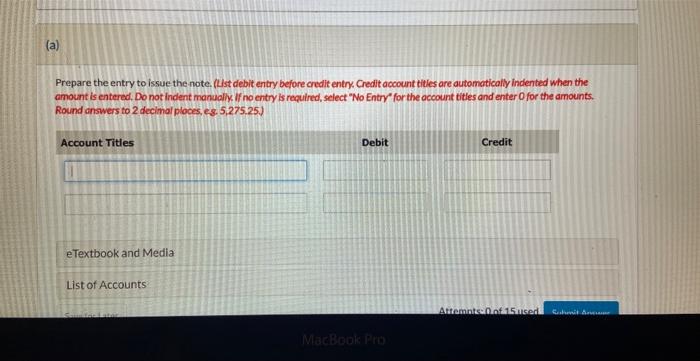

Prepare the entry to issue yhe note Assume that your company issued a $12,600, three-year, zero-interest-bearing note to Ayayai Company, Let's assume further that the

Prepare the entry to issue yhe note

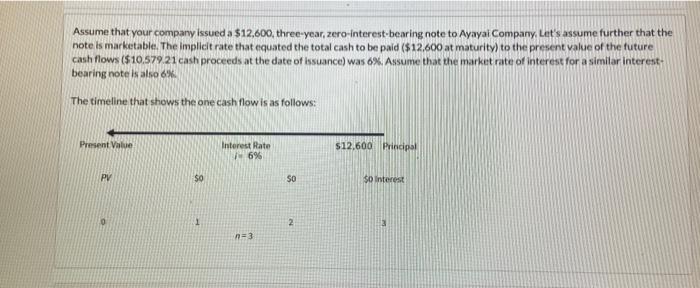

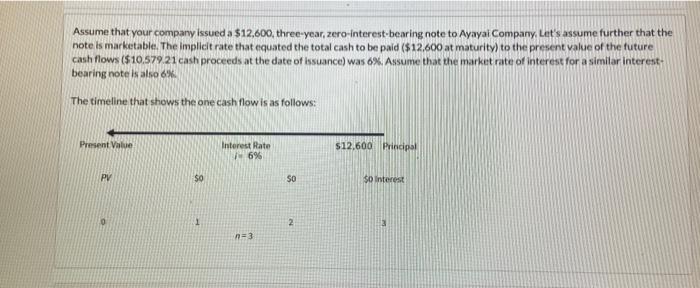

Assume that your company issued a $12,600, three-year, zero-interest-bearing note to Ayayai Company, Let's assume further that the note is marketable. The implicit rate that equated the total cash to be paid ($12.600 at maturity) to the present value of the future cash flows ($10.579.21 cash proceeds at the date of issuance) was 6%. Assume that the market rate of interest for a similar interest. bearing note is also 6% The timeline that shows the one cash flow is as follows: Prepare the entry to issue the note. (List debit entry before credit entry. Credit aocount tities are automatically indented when the amount is entered, Do not indent manalily if no entry is required, select "No Entry" for the occount titles and enter 0 for the amounts. Round answers to 2 decimal ploces, es.5.275.25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started