Question

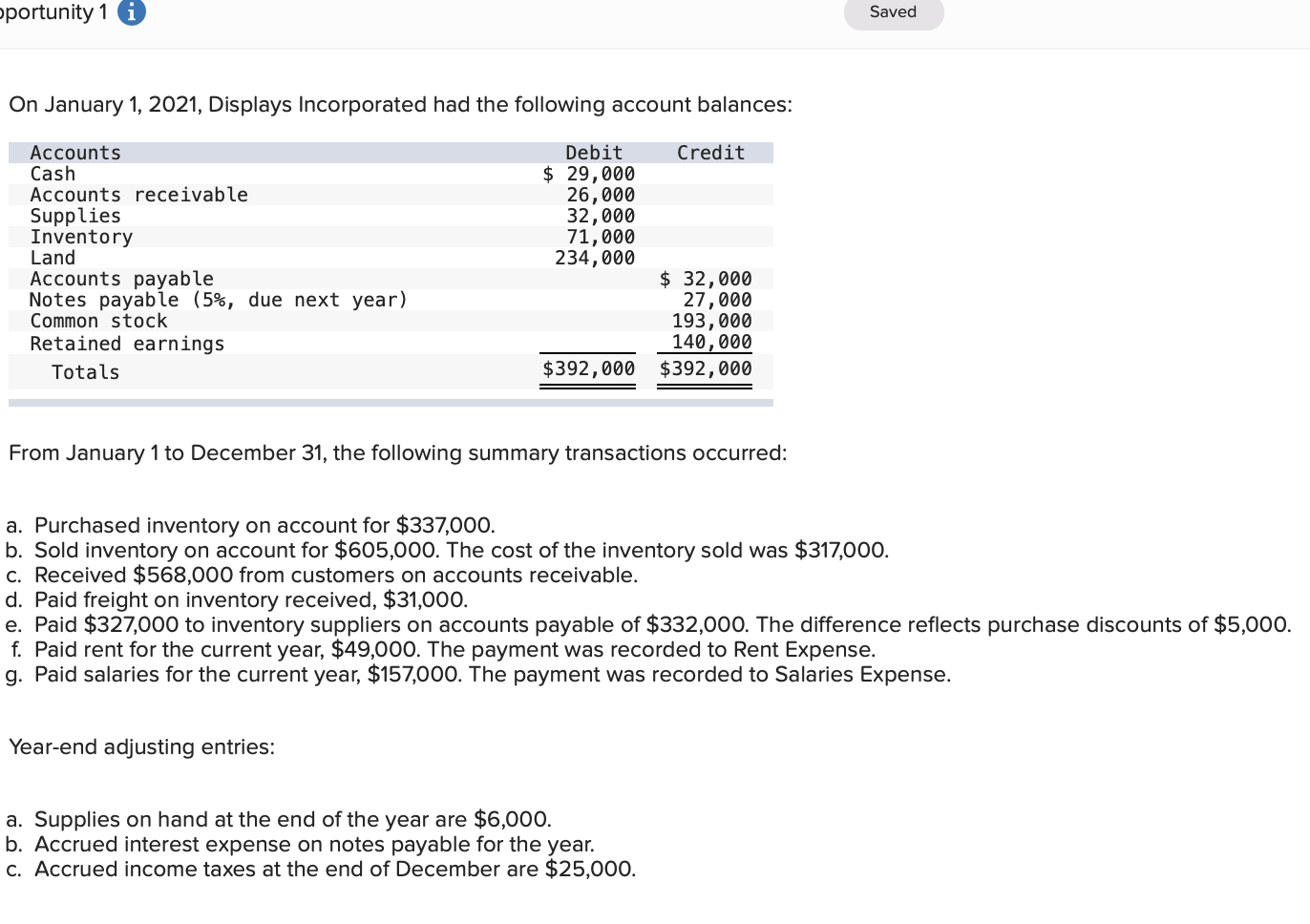

Prepare the following 13 journal entries for transactions. 1. Jan 2 Purchased inventory on account $337,000 2. Jan 2 Sold inventory on account for $605,000.

Prepare the following 13 journal entries for transactions.

Prepare the following 13 journal entries for transactions.

1. Jan 2 Purchased inventory on account $337,000

2. Jan 2 Sold inventory on account for $605,000.

3. Jan 2 The cost of the inventory sold was $317,000.

4. Jan 2 Received $568,000 from customers on accounts receivable.

5. Jan 2 Paid freight on inventory received, $31,000.

6. Jan 2 Paid $327,000 to inventory suppliers on accounts payable of $332,000. The difference reflects purchase discounts of $5,000.

7. Jan 2 Paid rent for the current year, $49,000. The payment was recorded to Rent Expense.

8. Jan 2 Paid salaries for the current year, $157,000. The payment was recorded to Salaries Expense.

9. Dec 31 Supplies on hand at the end of the year are $6,000. Record the adjusting entry for supplies.

10. Dec 31 Record the adjusting entry for accrued interest expense on notes payable.

11. Dec 31 Accrued income taxes at the end of December are $25,000. Record the adjusting entry for income taxes.

12. Dec 31 Record the closing entry for revenue accounts.

13. Dec 31 Record the closing entry for expense accounts.

oportunity 1 Saved On January 1, 2021, Displays Incorporated had the following account balances: Credit Accounts Cash Accounts receivable Supplies Inventory Land Accounts payable Notes payable (5%, due next year) Common stock Retained earnings Totals Debit $ 29,000 26,000 32,000 71,000 234,000 $ 32,000 27,000 193,000 140,000 $392,000 $392,000 From January 1 to December 31, the following summary transactions occurred: a. Purchased inventory on account for $337,000. b. Sold inventory on account for $605,000. The cost of the inventory sold was $317,000. C. Received $568,000 from customers on accounts receivable. d. Paid freight on inventory received, $31,000. e. Paid $327,000 to inventory suppliers on accounts payable of $332,000. The difference reflects purchase discounts of $5,000. f. Paid rent for the current year, $49,000. The payment was recorded to Rent Expense. g. Paid salaries for the current year, $157,000. The payment was recorded to Salaries Expense. Year-end adjusting entries: a. Supplies on hand at the end of the year are $6,000. b. Accrued interest expense on notes payable for the year. C. Accrued income taxes at the end of December are $25,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started