Answered step by step

Verified Expert Solution

Question

1 Approved Answer

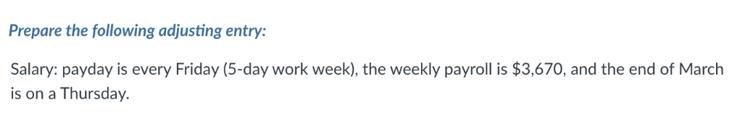

Prepare the following adjusting entry: Salary: payday is every Friday (5-day work week), the weekly payroll is $3,670, and the end of March is

![]()

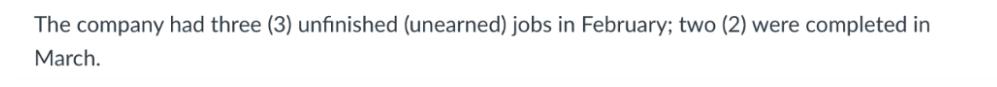

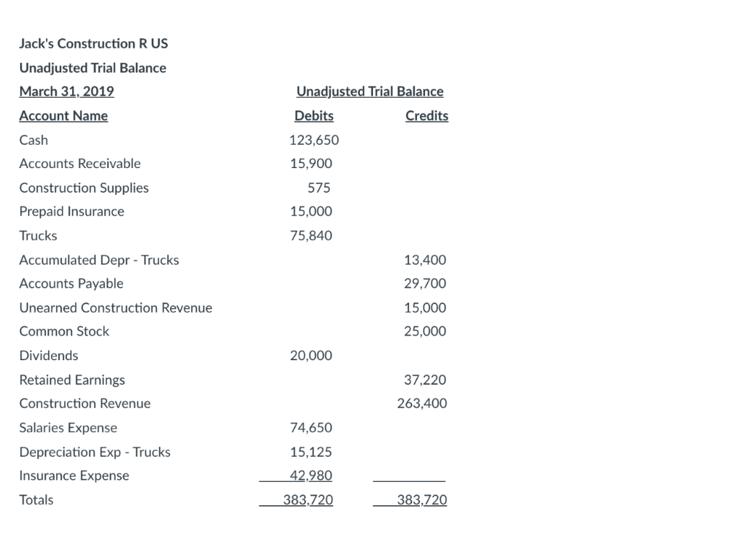

Prepare the following adjusting entry: Salary: payday is every Friday (5-day work week), the weekly payroll is $3,670, and the end of March is on a Thursday. The company purchased a 3-month insurance policy; one month has expired in March. The company had three (3) unfinished (unearned) jobs in February; two (2) were completed in March. Jack's Construction R US Unadjusted Trial Balance March 31, 2019 Account Name Cash Accounts Receivable Construction Supplies Prepaid Insurance Trucks Accumulated Depr - Trucks Accounts Payable Unearned Construction Revenue Common Stock Dividends Retained Earnings Construction Revenue Salaries Expense Depreciation Exp - Trucks Insurance Expense Totals Unadjusted Trial Balance Credits Debits 123,650 15,900 575 15,000 75,840 20,000 74,650 15,125 42.980 383,720 13,400 29,700 15,000 25,000 37,220 263,400 383,720 Prepare an Adjusted Trial Balance for Jack's Construction R US as of March 31, 2019.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided images we need to calculate the adjusting entries for salaries insurance and earned revenue for the company Jacks Construction R US as of March 31 2019 and then prepare an adjust...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started