Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the following financial statements for Bozeman Ski Shop, Inc. for the year ending 12/31/2020; a Multi-step Income Statement, the Statement of Stockholders' Equity, and

Prepare the following financial statements for Bozeman Ski Shop, Inc. for the year ending 12/31/2020; a Multi-step Income Statement, the Statement of Stockholders' Equity, and a Classified Balance Sheet, using the accrual basis of accounting.

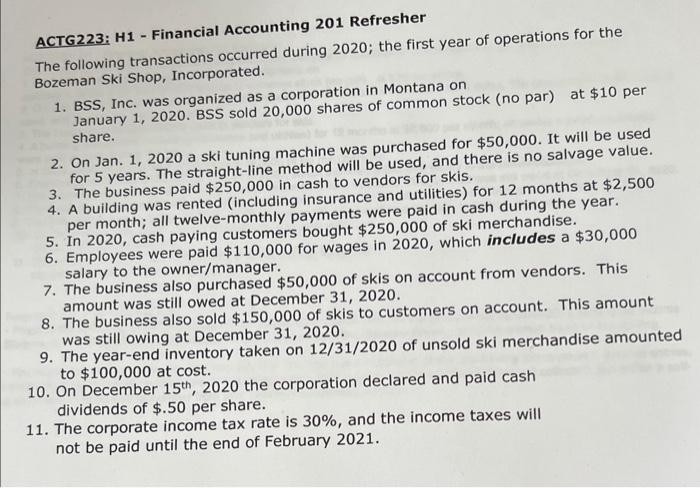

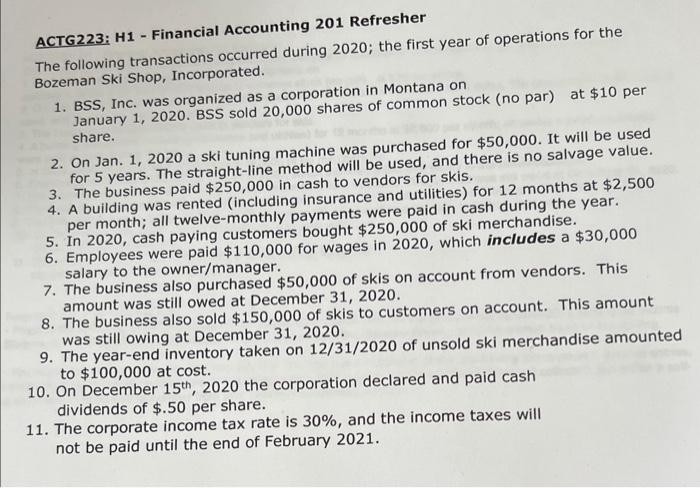

ACTG223: H1 - Financial Accounting 201 Refresher The following transactions occurred during 2020; the first year of operations for the Bozeman Ski Shop, Incorporated. 1. BSS, Inc. was organized as a corporation in Montana on January 1,2020 . BSS sold 20,000 shares of common stock (no par) at $10 per share. 2. On Jan. 1,2020 a ski tuning machine was purchased for $50,000. It will be used for 5 years. The straight-line method will be used, and there is no salvage value. 3. The business paid $250,000 in cash to vendors for skis. 4. A building was rented (including insurance and utilities) for 12 months at $2,500 per month; all twelve-monthly payments were paid in cash during the year. 5. In 2020 , cash paying customers bought $250,000 of ski merchandise. 6. Employees were paid $110,000 for wages in 2020, which includes a $30,000 salary to the owner/manager. 7. The business also purchased $50,000 of skis on account from vendors. This amount was still owed at December 31,2020. 8. The business also sold $150,000 of skis to customers on account. This amount was still owing at December 31,2020. 9. The year-end inventory taken on 12/31/2020 of unsold ski merchandise amounted to $100,000 at cost. 10. On December 15th,2020 the corporation declared and paid cash dividends of $.50 per share. 11. The corporate income tax rate is 30%, and the income taxes will not be paid until the end of February 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started